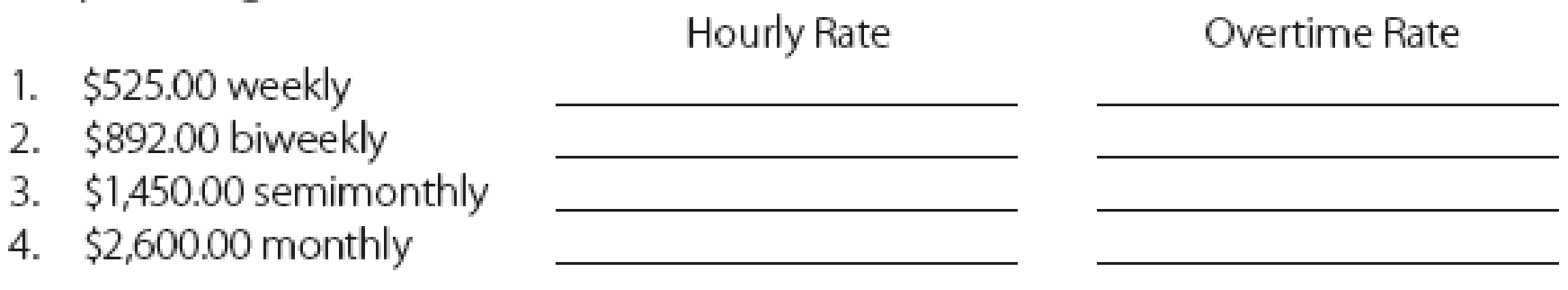

Compute the hourly and overtime rates for a standard 40-hour workweek for the following amounts:

1

Calculate the hourly rate and overtime rate for earnings $525 weekly.

Explanation of Solution

Regular earnings: Generally, employees in a firm work in pre-determined hours (40 hours) and get paid accordingly. The amount of earnings that is calculated based on predetermined hours is called as regular earnings of an employee.

Overtime Earnings: If an employee works more than the stipulated working hours (more than 40 hours) of the employment then, the employee is mandated to get paid one and a half times more than the normal working pay. This one and half times can be termed as overtime premium or earnings.

Calculate hourly rate.

Calculate the overtime rate.

Hence, the hourly rate and overtime rate for earnings $525 weekly is $13.13 and $19.70 respectively.

2.

Calculate the hourly rate and overtime rate for earnings $892 biweekly.

Explanation of Solution

Calculate hourly wage rate.

Step 1: Calculate regular earnings for a week.

Step 2: Calculate hourly rate.

Calculate the overtime rate.

Hence, the hourly rate and overtime rate for earnings $892 biweekly is $11.15 and $16.73 respectively.

3.

Calculate the hourly rate and overtime rate for earnings $1,450 semimonthly.

Explanation of Solution

Calculate hourly wage rate.

Step 1: Calculate regular earnings for a week.

Step 2: Calculate hourly rate.

Calculate the overtime rate.

Hence, the hourly rate and overtime rate for earnings $1,450 semimonthly is $16.73 and $25.10 respectively.

4.

Calculate the hourly rate and overtime rate for earnings $2,600 monthly.

Explanation of Solution

Calculate hourly wage rate.

Step 1: Calculate regular earnings for a week.

Step 2: Calculate hourly rate.

Calculate the overtime rate.

Hence, the hourly rate and overtime rate for earnings $2,600 monthly is $15 and $22.50 respectively.

Want to see more full solutions like this?

Chapter 2 Solutions

Payroll Accounting

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College