Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 3PB

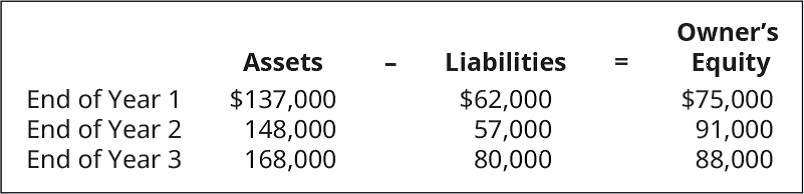

The following information is from a new business. Comment on the year-to-year changes in the accounts and possible sources and uses funds (how were the funds obtained and used).

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Tyson manufacturing company produces and sells 120,000 units of a single product. Variable costs total $340,000 and fixed costs total $480,000. If each unit is sold for $12, what markup percentage is the company using?

hello tutor please help me

How much is hunts owner equity?

Chapter 2 Solutions

Principles of Accounting Volume 1

Ch. 2 - Which of these statements is not one of the...Ch. 2 - Stakeholders are less likely to include which of...Ch. 2 - Identify the correct components of the income...Ch. 2 - The balance sheet lists which of the following? A....Ch. 2 - Assume a company has a $350 credit (not cash)...Ch. 2 - Which of the following statements is true? A....Ch. 2 - Owners have no personal liability under which...Ch. 2 - The accounting equation is expressed as ________....Ch. 2 - Which of the following decreases owners equity? A....Ch. 2 - Exchanges of assets for assets have what effect on...

Ch. 2 - All of the following increase owners equity except...Ch. 2 - Which of the following is not an element of the...Ch. 2 - Which of the following is the correct order of...Ch. 2 - The three heading lines of financial statements...Ch. 2 - Which financial statement shows the financial...Ch. 2 - Which financial statement shows the financial...Ch. 2 - Working capital is an indication of the firms...Ch. 2 - Identify the four financial statements and...Ch. 2 - Define the term stakeholders. Identify two...Ch. 2 - Identify one similarity and one difference between...Ch. 2 - Identify one similarity and one difference between...Ch. 2 - Explain the concept of equity, and identify some...Ch. 2 - Explain the difference between current and...Ch. 2 - Identify/discuss one similarity and one difference...Ch. 2 - Name the three types of legal business structure....Ch. 2 - What is the accounting equation? List two examples...Ch. 2 - Identify the order in which the four financial...Ch. 2 - Explain how the following items affect equity:...Ch. 2 - Explain the purpose of the statement of cash flows...Ch. 2 - For each independent situation below, calculate...Ch. 2 - For each independent situation below, calculate...Ch. 2 - For each independent situation below, calculate...Ch. 2 - For each independent situation below, place an (X)...Ch. 2 - For each of the following items, identify whether...Ch. 2 - For the items listed below, indicate how the item...Ch. 2 - Forest Company had the following transactions...Ch. 2 - Here are facts for the Hudson Roofing Company for...Ch. 2 - Prepare an income statement using the following...Ch. 2 - Prepare a statement of owners equity using the...Ch. 2 - Prepare a balance sheet using the following...Ch. 2 - For each independent situation below, calculate...Ch. 2 - For each independent situation below, calculate...Ch. 2 - For each independent situation below, calculate...Ch. 2 - For each of the following independent situations,...Ch. 2 - For each of the following items, identify whether...Ch. 2 - For the items listed below, indicate how the item...Ch. 2 - Gumbo Company had the following transactions...Ch. 2 - Here are facts for Haileys Collision Service for...Ch. 2 - Prepare an income statement using the following...Ch. 2 - Prepare a statement of owners equity using the...Ch. 2 - Prepare a balance sheet using the following...Ch. 2 - The following information is taken from the...Ch. 2 - Each situation below relates to an independent...Ch. 2 - The following information is from a new business....Ch. 2 - Each of the following situations relates to a...Ch. 2 - For each of the following independent...Ch. 2 - Olivias Apple Orchard had the following...Ch. 2 - Using the information in PA6, determine the amount...Ch. 2 - The following ten transactions occurred during the...Ch. 2 - The following information is taken from the...Ch. 2 - Each situation below relates to an independent...Ch. 2 - The following information is from a new business....Ch. 2 - Each of the following situations relates to a...Ch. 2 - For each of the following independent...Ch. 2 - Mateos Maple Syrup had the following transactions...Ch. 2 - Using the information in PB6, determine the amount...Ch. 2 - Choose three stakeholders (or stakeholder groups)...Ch. 2 - Assume you purchased ten shares of Roku during the...Ch. 2 - A trademark is an intangible asset that has value...Ch. 2 - For each of the following ten independent...Ch. 2 - The following historical information is from...

Additional Business Textbook Solutions

Find more solutions based on key concepts

LIFO, Conversion to FIFO. Inventory transactions tor Jack Franklin stores are summarized in the following table...

Intermediate Accounting (2nd Edition)

E2-13 Identifying increases and decreases in accounts and normal balances

Learning Objective 2

Insert the mis...

Horngren's Accounting (12th Edition)

•• B.4. Consider the following linear programming problem:

Operations Management

11-9. Identify a company with a product that interests you. Consider ways the company could use customer relati...

Business Essentials (12th Edition) (What's New in Intro to Business)

S6-2 Determining inventory costing methods

Ward Hard ware does not expect costs to change dramatically and want...

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

The unlevered cost of capital. Introduction: The rate of return that every company wants to earn on its assets ...

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- provide correct answer is?arrow_forward3 pointsarrow_forwardCrescent Manufacturing produces a single product. Last year, the company had a net operating income of $102,400 using absorption costing and $94,100 using variable costing. The fixed manufacturing overhead cost was $5 per unit. There were no beginning inventories. If 32,000 units were produced last year, then sales last year were_. (a) 21,750 units (b) 29,820 units (c) 30,440 units (d) 35,600 unitsarrow_forward

- I don't need ai answer general accounting questionarrow_forwardSelby Industries has a standard requirement of 4 direct labor hours for each unit produced and pays $12 per hour. During the last month, the company produced 1,200 units of its product and paid a total of $60,480 in direct labor wages. The labor efficiency variance was $720 favorable. What was the direct labor rate variance?arrow_forwardTyson manufacturing company produces and sells 120,000 units of a single product. Variable costs total $340,000 and fixed costs total $480,000. If each unit is sold for $12, what markup percentage is the company using? Right Answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning  Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License