Concept explainers

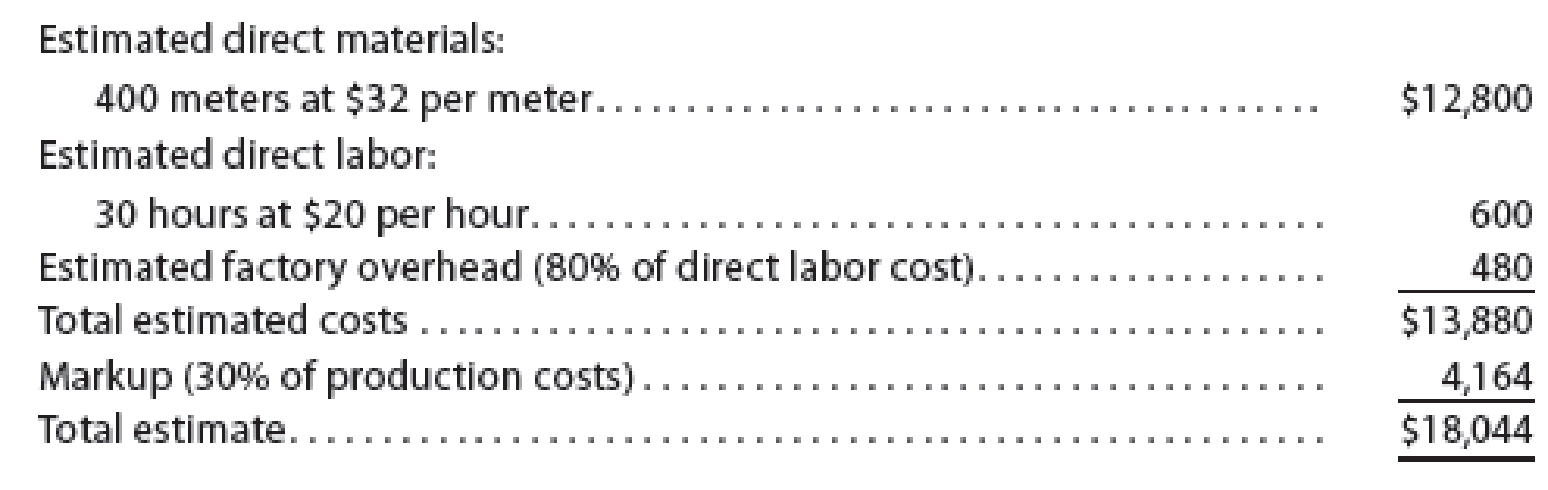

Stretch and Trim Carpet Company sells and installs commercial carpeting for office buildings. Stretch and Trim Carpet Company uses a job order cost system. When a prospective customer asks for a price quote on a job, the estimated cost data are inserted on an unnumbered job cost sheet. If the offer is accepted, a number is assigned to the job, and the costs incurred are recorded in the usual manner on the job cost sheet. After the job is completed, reasons for the variances between the estimated and actual costs are noted on the sheet. The data are then available to management in evaluating the efficiency of operations and in preparing quotes on future jobs. On May 9, Stretch and Trim gave Lunden Consulting an estimate of $18,044 to carpet the consulting firm’s newly leased office. The estimate was based on the following data:

On May 10, Lunden Consulting signed a purchase contract, and the carpet was delivered and installed on May 15.

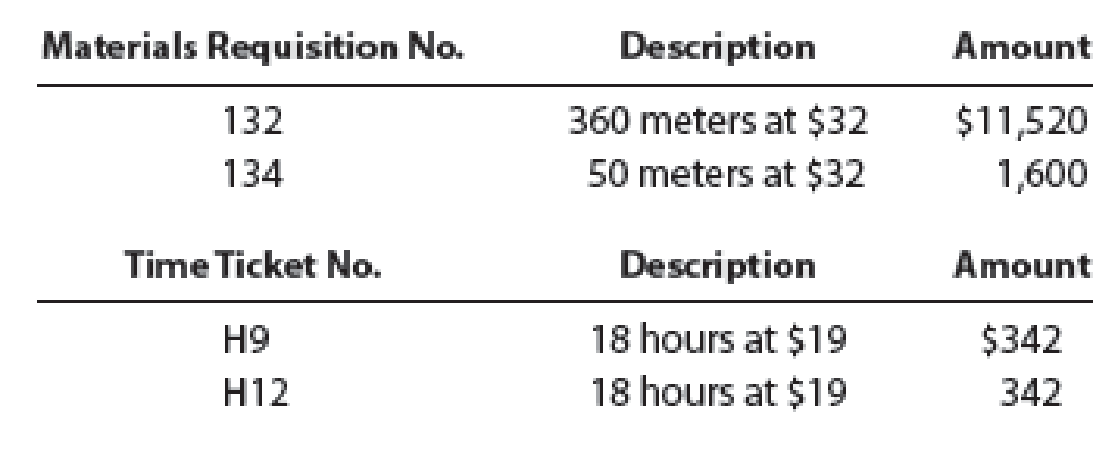

The related materials requisitions and time tickets are summarized as follows:

Instructions

- 1. Complete that portion of the job cost sheet that would be prepared when the estimate is given to the customer. (Round factory

overhead applied to the nearest dollar.) - 2. Record the costs incurred, and prepare a job cost sheet. Comment on the reasons for the variances between actual costs and estimated costs. For this purpose, assume that the additional meters of material used in the job were spoiled, the factory overhead rate has proven to be satisfactory, and an inexperienced employee performed the work.

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

Managerial Accounting

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College