FUNDAME.OF COST ACCT. W/CONNECT

6th Edition

ISBN: 9781264508341

Author: LANEN

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 39E

Prepare Statements for a Service Company

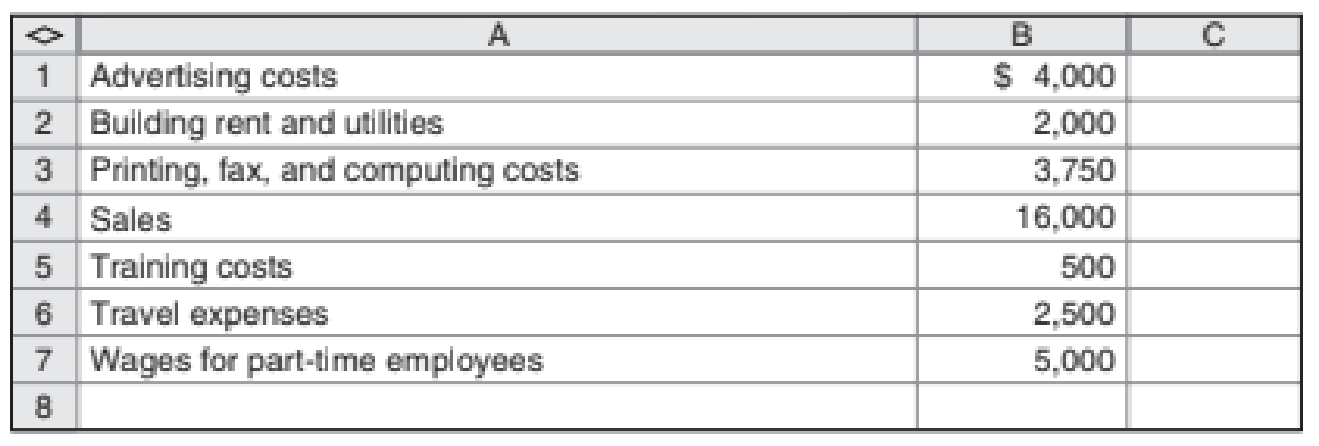

Where2 Services is a small service firm that advises high school students on college opportunities. Joseph Kapp, the founder and president, has collected the following information for March:

Required

Prepare an income statement for March for Where2 Services.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

In its March 31, 2021, financial statements, Tennyson Enterprises Inc. reported a beginning accounts receivable balance of $425,000 and an ending accounts receivable balance of $510,000. Tennyson reported sales for the year ended March 31, 2021, of $5,320,000. All sales are on credit. Required: Calculate the amount of cash Tennyson Enterprises Inc. collected from customers during fiscal 2021.

Accounting question

Financial Accounting question.

Chapter 2 Solutions

FUNDAME.OF COST ACCT. W/CONNECT

Ch. 2 - What is the difference in meaning between the...Ch. 2 - What is the difference between product costs and...Ch. 2 - What is the difference between outlay cost and...Ch. 2 - Prob. 4RQCh. 2 - Is cost-of-goods sold an expense?Ch. 2 - Is cost-of-goods a product cost or a period cost?Ch. 2 - What are the similarities between the Direct...Ch. 2 - What are the three categories of product cost in a...Ch. 2 - Prob. 9RQCh. 2 - Prob. 10RQ

Ch. 2 - What do the terms step costs and semivariable...Ch. 2 - What do the terms variable costs and fixed costs...Ch. 2 - How does a value income statement differ from a...Ch. 2 - Why is a value income statement useful to...Ch. 2 - Materials and labor are always direct costs, and...Ch. 2 - Prob. 16CADQCh. 2 - In evaluating product profitability, we can ignore...Ch. 2 - Prob. 18CADQCh. 2 - The friend in question 2-18 decides that she does...Ch. 2 - Consider a digital music service such as those...Ch. 2 - Consider a ride-sharing service such as Uber or...Ch. 2 - Pick a unit of a hospital (for example, intensive...Ch. 2 - The dean of Midstate University Business School is...Ch. 2 - Prob. 24CADQCh. 2 - Prob. 25CADQCh. 2 - Basic Concepts For each of the following...Ch. 2 - Basic Concepts For each of the following costs...Ch. 2 - Basic Concepts For each of the following costs...Ch. 2 - Basic Concepts Place the number of the appropriate...Ch. 2 - Basic Concepts Intercontinental, Inc., provides...Ch. 2 - Prob. 31ECh. 2 - For each of the following costs incurred in a...Ch. 2 - Basic Concepts For each of the following costs...Ch. 2 - Basic Concepts The following data apply to the...Ch. 2 - Cost AllocationEthical Issues In one of its...Ch. 2 - Cost AllocationEthical Issues Star Buck, a coffee...Ch. 2 - Prepare Statements for a Manufacturing Company The...Ch. 2 - Prepare Statements for a Service Company Chucks...Ch. 2 - Prepare Statements for a Service Company Where2...Ch. 2 - Prepare Statements for a Service Company The...Ch. 2 - Prepare Statements for a Service Company Lead!...Ch. 2 - Prepare Statements for a Manufacturing Company The...Ch. 2 - Basic Concepts The following data refer to one...Ch. 2 - Basic Concepts The following data refers to one...Ch. 2 - Prepare Statements for a Merchandising Company The...Ch. 2 - Prepare Statements for a Merchandising Company...Ch. 2 - Cost Behavior and Forecasting Dayton, Inc....Ch. 2 - Sophia’s Restaurant served 5,000 meals last...Ch. 2 - Prob. 49ECh. 2 - Components of Full Costs Madrid Corporation has...Ch. 2 - Prob. 51ECh. 2 - Components of Full Costs Larcker Manufacturings...Ch. 2 - Prob. 53ECh. 2 - Gross Margin and Contribution Margin Income...Ch. 2 - Gross Margin and Contribution Margin Income...Ch. 2 - Value Income Statement Ralphs Restaurant has the...Ch. 2 - Value Income Statement DeLuxe Limo Service has the...Ch. 2 - Cost Concepts The following information comes from...Ch. 2 - Cost Concepts The controller at Lawrence...Ch. 2 - Cost Concepts Columbia Products produced and sold...Ch. 2 - Prepare Statements for a Manufacturing Company...Ch. 2 - Prepare Statements for a Manufacturing Company...Ch. 2 - Prepare Statements for a Manufacturing Company The...Ch. 2 - Cost Allocation with Cost Flow Diagram Coastal...Ch. 2 - Cost Allocation with Cost Flow Diagram Wayne...Ch. 2 - Cost Allocation with Cost Flow Diagram The library...Ch. 2 - Greenfield Consultants conducts analyses of public...Ch. 2 - Consider the Business Application, “Indirect Costs...Ch. 2 - Find the Unknown Information After a computer...Ch. 2 - Find the Unknown Information Just before class...Ch. 2 - Cost Allocation and Regulated Prices The City of...Ch. 2 - Koufax Materials Corporation produces plastic...Ch. 2 - Reconstruct Financial Statements San Ysidro...Ch. 2 - Westlake, Inc., produces metal fittings for the...Ch. 2 - Finding Unknowns Marys Mugs produces and sells...Ch. 2 - Finding Unknowns BST Partners has developed a new...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Bright Prints, Inc. is considering the purchase of a 3D printing machine, which it will make available to customers at a per-print charge. The machine has an initial cost of $9,000, an estimated useful life of six years, and an estimated salvage value of $3,000. The estimated annual revenue and expenses related to the operation of the machine are as follows: • Revenue: $15,000 • Expenses other than depreciation: $10,500 All revenue will be received in cash, and expenses other than depreciation will be paid in cash. Depreciation will be computed using the straight-line method. Compute the expected annual increase in Bright Prints' net income.arrow_forwardPlease provide correct answer the financial accountingarrow_forwardLabor rate?arrow_forward

- Blue Wave Enterprises had revenues of $420,000, expenses of $275,000, and dividends of $60,000. When Income Summary is closed to Retained Earnings, What is the amount of the debit or credit to Retained Earnings? A. credit of $145,000 B. debit of $145,000 C. credit of $85,000 D. debit of $85,000arrow_forwardMCQarrow_forwardAccurate answer this financial accountingarrow_forward

- In 2019, a company reported sales revenue of $180 and net income of $18. The company had current assets of $30 and long-term assets of $90 at the beginning of the year. By the end of the year, its current assets increased to $38, while long-term assets grew to $110. Compute the Asset Turnover Ratio as of 12/31/19.arrow_forwardWant to this question answer general accountingarrow_forwardWhat is Hamilton's gross profit percentage?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning  College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License