Hide-It (HI), a family-owned business based in Tombstone, Arizona, builds custom homes with special features, such as hidden rooms and hidden wall safes. Hide-It has been an audit client for three years.

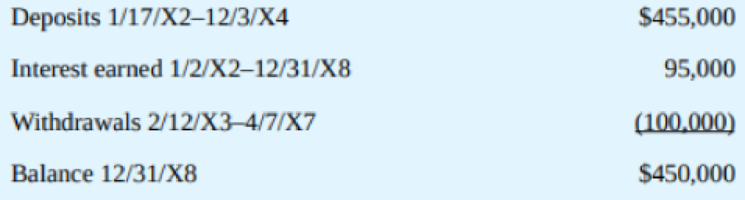

You are about to sign off on a “clean” opinion on HI’s current annual financial statements when Art Hyde, the VP-Finance, calls to tell you that the Arizona Department of Revenue has seized control of a Hide-It bank account that includes about $450,000 of company funds; the account is not currently recorded in the accounting system and you had been unaware of it. In response to your questions about the origin of the funds, Art assures you that the funds, though not recorded as revenue, had been obtained legitimately. He explains that all of the money came from separately billed but unrecorded change orders to items in contracts completed before you became HI’s auditor, and before he or any members of current management became involved with the company. You subsequently determine that there is insufficient evidence to allow you to reconstruct the nature of these cash transactions, although the following analysis is available from the Arizona Department of Revenue:

Art also informs you that HI has agreed to pay a combined tax and penalty of 12 percent on the total funds deposited within 120 days as required by a recently enacted rule that provides amnesty for tax evaders. Furthermore, he states that negotiations with the Internal Revenue Service are in process.

Required:

- a. The professional standards define errors as unintentional misstatements or omissions of amounts or disclosures in the financial statements. Is the situation described an error?

- b. The professional standards state that fraud relates to intentional misstatements or omissions of amounts or disclosures in the financial statements. Misstatements due to fraud may occur due to either (1) fraudulent financial reporting or (2) misappropriation of assets. Does the situation appear to be fraud? If so, is it fraudulent financial reporting, misappropriation of assets, or both?

- c. The professional standards outline certain auditor responsibilities relating to identifying client noncompliance with laws and distinguish between laws with a “direct effect” on the financial statements and other laws. Does the situation herein relate to noncompliance with laws as discussed within the auditing standards? If so, is the noncompliance related to a law with a direct effect on the financial statements or another law.

- d. Should the CPA firm resign in this situation? If the decision is not clear-cut, what additional information would you desire before deciding?

Trending nowThis is a popular solution!

Chapter 2 Solutions

GEN COMBO LL PRINCIPLES OF AUDITING & OTHER ASSURANCE SERVICES; CONNECT AC

- Nino Moscardi, president of Greater Providence Deposit & Trust (GPD&T), received an anonymous note in his mail stating that a bank employee was making bogus loans. Moscardi asked the bank’s internal auditors to investigate the transactions detailed in the note. The investigation led to James Guisti, manager of a North Providence branch office and a trusted 14-year employee who had once worked as one of the bank’s internal auditors. Guisti was charged with embezzling $1.83 million from the bank using 67 phony loans taken out over a three-year period. Court documents revealed that the bogus loans were 90-day notes requiring no collateral and ranging in amount from $10,000 to $63,500. Guisti originated the loans; when each one matured, he would take out a new loan, or rewrite the old one, to pay the principal and interest due. Some loans had been rewritten five or six times. The 67 loans were taken out by Guisti in five names, including his wife’s maiden name, his father’s name,…arrow_forwardThe following paragraphs describe fraudulent accounting committed by the company Gateway. After reading the paragraphs, list the journal entries you think would have used to do what is described here. You will have to make an educated guess as to what journal entries the company would use to cover up the fraud. On September 21, 2000, Gateway's sales representative sent an e-mail to the consumer leasing company confirming that the consumer leasing company would issue a purchase order for $16.5 million of PCs, for which it would receive a 5% discount, that the consumer leasing company would be billed by September 30, 2000 and would take the PCs by October 31, 2000.arrow_forwardAn employee of JHT Holdings, Inc., a trucking company, was responsible for resolving roadway accident claims under $25,000. the employee created fake accident claims and wrote settlement checks of between $5,000 and $25,000 to friends or acquaintances acting as phony victims. One friend recruited subordinates at his place of work to cash some of the checks. Beyond this, the JHT employee also recruited lawyers, whom he paid to represent both the trucking company and the fake victims in the bogus accidents. When the lawyers cash the checks they allegedly split the money with the corporate JHT employee. This fraud went undetected for two years Answer the following true or false questions concerning the fraud. Frauds that are perpetrated with multiple parties in different positions of control make detecting fraud more difficult. Claims should be authorized and verified before payment is made. The employee made sure each claim had a phony victim. Corrupt lawyers were bought into the fraud…arrow_forward

- During the preparation of the bank reconciliation for Apache Grading Co., Sarah Ferrari, the assistant controller, discovered that Rocky Spring Bank incorrectly recorded a $610 check written by Apache Grading Co. as $160. Sarah has decided not to notify the bank but wait for the bank to detect the error. Sarah plans to record the $450 error as Other Income if the bank fails to detect the error within the next three months. Discuss whether Sarah is behaving in a professional manner.arrow_forwardAn employee of JHT Holdings, Inc., a trucking company, was responsible for resolving roadway accident claims under $25,000. The employee created fake accident claims and wrote settlement checks of between $5,000 and $25,000 to friends or acquaintances acting as phony “victims.” One friend recruited subordinates at his place of work to cash some of the checks. Beyond this, the JHT employee also recruited lawyers, whom hepaid to represent both the trucking company and the fake victims in the bogus accident settlements. When the lawyers cashed the checks, they allegedly split the money with the corrupt JHT employee. This fraud went undetected for two years.Why would it take so long to discover such a fraud?arrow_forwardOn February 15, 2022, Kate Collins, owner of Kate’s Cards, asks you to investigate the cash han- dling activities in her business. She believes that a new employee might be stealing funds. “I have no proof,” she says, “but I’m fairly certain that the January 31, 2022, undeposited receipts amounted to more than $12,000, although the January 31 bank reconciliation prepared by the cashier (who works in the treasurer’s department) shows only $7,238.40. Also, the January bank reconciliation doesn’t show several checks that have been outstanding for a long time. The cashier told me that these checks needn’t appear on the reconciliation because he had notified the bank to stop payment on them and he had made the necessary adjustment on the books. Does that sound reasonable to you?” At your request, Kate shows you the following (unaudited) January 31, 2022, bank reconciliation prepared by the cashier: KATE’S CARDS Bank Reconciliation January 31, 2022 Ending balance from bank statement . . . $…arrow_forward

- Dave Czarnecki is the managing partner of Czarnecki and Hogan, a medium-sized local CPA firm located outside of Chicago. Over lunch, he is surprised when his friend Juarez Foley asks him, “Doesn’t it bother you that your clients don’t look forward to seeing their auditors each year?” Dave responds, “Well, auditing is only one of several services we provide. Most of our work for clients does not involve financial statement audits, and our audit clients seem to like interacting with us.” Identify ways in which a financial statement audit adds value for clients. List services other than audits that Czarnecki and Hogan likely provides. Assume Czarnecki and Hogan has hired you as a consultant to identify ways in which they can expand their practice. Identify at least one additional service that you believe the firm should provide and explain why you believe this represents a growth opportunity for CPA firms.arrow_forwardRay, the owner of a small entity, asked Holmes, CPA, to conduct an audit of the entity’s records. Ray told Holmes that the audit was to be completed in time to submit audited financial statements to a bank as part of a loan application. Holmes immediately accepted the engagement and agreed to provide an auditors’ report within three weeks. Ray agreed to pay Holmes a fixed fee plus a bonus if the loan was granted.Holmes hired two accounting students to conduct the audit and spent several hours telling them exactly what to do. Holmes told the students not to spend time reviewing the controls but instead to concentrate on proving the mathematical accuracy of the ledger accounts and on summarizing the data in the accounting records that support Ray’s financial statements. The students followed Holmes’ instructions and, after two weeks, gave Holmes the financial statements, which did not include footnotes. Holmes studied the statements and prepared an unmodified auditors’ report. The…arrow_forwardJacqueline Mensah, manager of Expert Building Company, is a valued and trusted employee. She has been with the company from its start two years ago. Because of the demand of her job, he has not taken a vacation since she began working. She is in charge of recording collections on account, making the daily bank deposits, and reconciling the bank statement. Late last year, clients began complaining to you, the Managing Director, about incorrect statements. As Managing Director, you want to investigate this matter. Jacqueline tells you there is nothing to worry about. The problem is due to the slow mail: customers payments and statement are crossing in the mail. Because clients were not complaining last year, you doubt the mail is the primary reason for the problem. Required: What might be some of the reasons for the delay? What should be done to make sure the problems are avoided in the future?arrow_forward

- You are an audit manager in Smith & Co, a firm of Chartered Certified Accountants. You have recently been made responsible for reviewing invoices raised to clients and for monitoring your firm’s credit control procedures. Several matters came to light during your most recent review of client invoice files: Norman Co, a large private company, has not paid an invoice from Smith & Co dated 5 June 2007 for work in respect of the financial statement audit for the year ended 28 February 2007. A file note dated 30 November 2007 states that Norman Co is suffering poor cash flows and is unable to pay the balance. This is the only piece of information in the file you are reviewing relating to the invoice. You are aware that the final audit work for the year ended 28 February 2008, which has not yet been invoiced, is nearly complete and the audit report is due to be issued imminently. Wallace Co, a private company whose business is the manufacture of industrial machinery, has paid all…arrow_forwardAn auditor signed the financial statements of a small business that was up for sale. In them, he confirmed that the amount of an outstanding bank loan was $100,000. In fact the loan was for $150,000. During the auditing process the accountant had asked the business for a letter from the bank, confirming the loan amount. He received the letter, typed on plain paper without letterhead, signed by the bank manager, stating that the loan was $100,000. Someone purchased the business, relying on the financial statements. When the error was discovered, the new owner sued the auditor for professional negligence. The auditor defended by saying he really believed the loan amount to be $100,000, and had checked with the bank. Applying the relevant principles of the tort of negligence, provide an explanation to the following questions: a) Was the fact that the auditor truly believed the loan amount to be $100,000 relevant to the question of negligence? b) What test would be applied to determine if…arrow_forwardTaylor, a CPA, has been engaged to audit the financial statements of University Books, Incorporated. University Books maintains a large cash fund exclusively for the purpose of buying used books from students for cash. The cash fund is active all year because the nearby university offers a large variety of courses with varying starting and completion dates throughout the year. Receipts are prepared for each purchase. Reimbursement vouchers periodically are submitted to replenish the fund. Required:Construct an internal control questionnaire to be used in evaluating the internal control over University Books’ repurchasing process using the revolving cash fund. The internal control questionnaire should elicit a yes or no response to each question. Do not discuss the internal controls over books that are purchased from publishers.arrow_forward

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning