Concept explainers

Basic Concepts

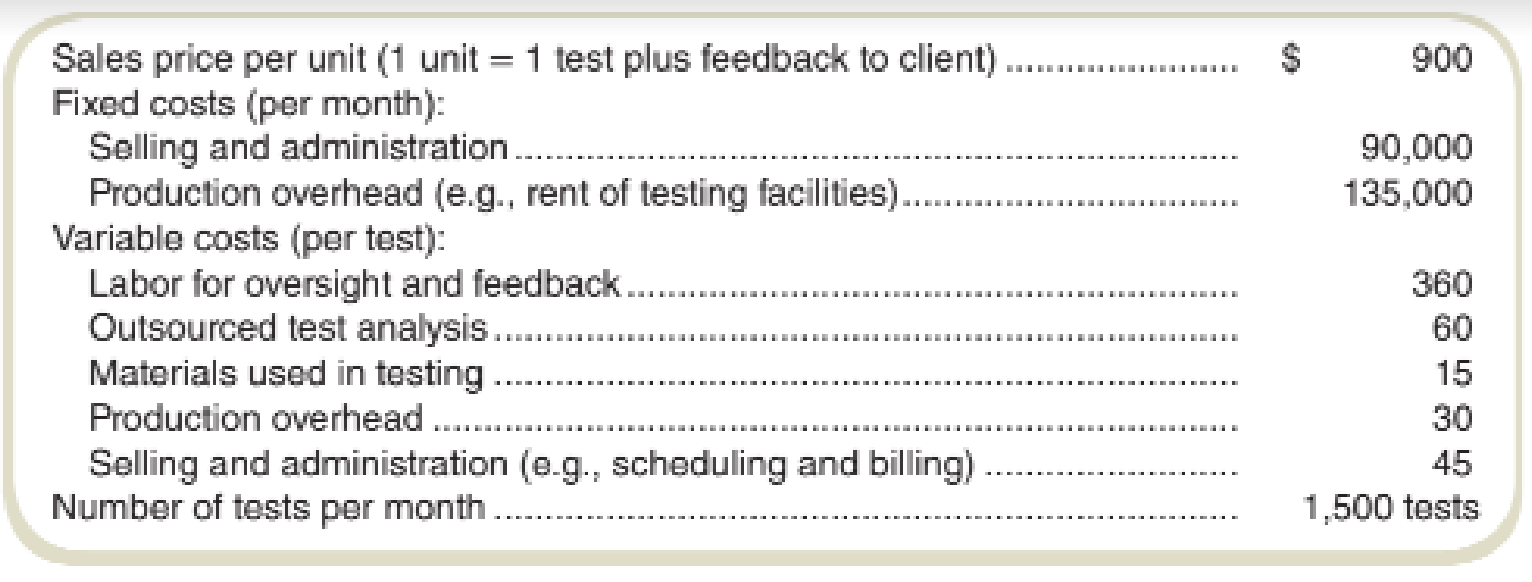

The following data apply to the provision of psychological testing services:

Required

Give the amount for each of the following (one unit = one test):

- a. Variable production cost per unit.

- b. Variable cost per unit.

- c. Full cost per unit.

- d. Full absorption cost per unit.

- e. Prime cost per unit.

- f. Conversion cost per unit.

- g. Contribution margin per unit.

- h. Gross margin per unit.

- i. Suppose the number of units decreases to 1,250 tests per month, which is within the relevant range. Which parts of (a) through (h) will change? For each amount that will change, give the new amount for a volume of 1,250 tests.

a.

Calculate the variable production cost per unit.

Answer to Problem 34E

The total variable production cost per unit is $465.

Explanation of Solution

Production cost per unit:

The production cost per unit refers to the unit cost of production including direct materials, direct labor and manufacturing overheads.

Compute the variable production cost per unit:

| Particulars | Amount |

| Variable costs (per test): | |

| Labor for oversight and feedback | $360 |

| Outsourced test analysis. | $60 |

| Materials used in testing | $15 |

| Production overhead | $30 |

| Total variable production cost per unit | $465 |

Table: (2)

Thus, the total variable production cost per unit is $465.

b.

Calculate the variable cost per unit.

Answer to Problem 34E

The variable cost per unit is $510.

Explanation of Solution

Variable cost per unit:

The variable cost per unit refers to the unit variable cost of product including the variable manufacturing costs.

Compute the variable cost per unit:

| Particulars | Amount |

| Variable costs (per test): | |

| Labor for oversight and feedback | $360 |

| Outsourced test analysis. | $60 |

| Materials used in testing | $15 |

| Production overhead | $30 |

| Selling and administration (e.g., scheduling and billing) | 45 |

| Total variable cost | $510 |

Table: (4)

Thus, the total variable cost per unit is $510.

c.

Calculate the full cost per unit.

Answer to Problem 34E

The full cost per unit is $660.

Explanation of Solution

Full cost per unit:

The full cost per unit refers to the total cost of the product including the fixed and variable cost per unit.

Compute the full cost per unit:

Thus, total cost per unit is $660.

Working note 1:

Compute the total fixed cost:

| Particulars | Amount |

| Fixed costs (per month): | |

| Selling and administration | $90,000 |

| Production overhead (e.g., rent of testing facilities) | $135,000 |

| Total fixed costs | $225,000 |

Table: (6)

Working note 2:

Compute the fixed cost per unit:

Working note 3:

Compute the variable cost per unit:

| Particulars | Amount |

| Variable costs (per test): | |

| Labor for oversight and feedback | $360 |

| Outsourced test analysis. | $60 |

| Materials used in testing | $15 |

| Production overhead | $30 |

| Selling and administration (e.g., scheduling and billing) | 45 |

| Total variable cost | $510 |

Table: (7)

d.

Calculate the full absorption cost per unit.

Answer to Problem 34E

The full absorption cost per unit is $555.

Explanation of Solution

Full absorption cost per unit:

the full absorption cost per unit refers to the total unit cost including the fixed manufacturing overhead and variable cost per unit.

Calculate the full absorption cost per unit:

Thus, full absorption cost per unit is $555.

Working note 4:

Compute the fixed manufacturing overhead per unit:

Working note 5:

Compute the variable production cost per unit:

| Particulars | Amount |

| Variable costs (per test): | |

| Labor for oversight and feedback | $360 |

| Outsourced test analysis. | $60 |

| Materials used in testing | $15 |

| Production overhead | $30 |

| Total variable production cost per unit | $465 |

Table: (8)

e.

Calculate the prime cost per unit.

Answer to Problem 34E

The prime cost per unit is $435.

Explanation of Solution

Prime cost per unit:

The cost including materials cost per unit, labor cost per unit and outsource cost per unit refers to the prime cost per unit.

Calculate the prime cost per unit:

Thus, prime cost per unit is $435.

f.

Calculate Conversion cost per unit.

Answer to Problem 34E

The Conversion cost per unit is $540.

Explanation of Solution

Conversion cost per unit:

The conversion cost per unit refers to the total unit cost of labor, outsourcing and production overhead.

Calculate the Conversion cost per unit:

Thus, conversion cost per unit is $540.

Working note 6:

Calculate the production overhead per unit:

Working note 7:

Calculate the fixed production overhead per unit:

g.

Calculate Contribution margin per unit.

Answer to Problem 34E

The Contribution margin per unit is $390.

Explanation of Solution

Contribution margin per unit:

The contribution margin per unit refers to the difference between sales price per unit and the variable cost per unit. The contribution margin as a percentage of sales is referred to as the contribution margin ratio (CM ratio).

Calculate the contribution margin per unit:

Thus, contribution margin per unit is $390.

h.

Calculate gross margin per unit.

Answer to Problem 34E

The gross margin per unit is $345.

Explanation of Solution

Gross margin per unit:

The gross margin per unit is the difference of selling price per unit and the absorption cost per unit.

Calculate the gross margin per unit:

Thus, the gross margin per unit is $345.

i.

Calculate the change required in parts (a) through (h). given that the new amount for a volume of 1,250 units.

Answer to Problem 34E

- I. Total cost per unit is $690.

- II. Full absorption cost per unit is $573.

- III. Conversion cost per unit is $558.

- IV. The gross margin per unit is $327.

Explanation of Solution

I.

Calculate the change in fixed cost because of decrease in units to 1,250:

Compute the total cost per unit:

Thus, total cost per unit is $690.

Working note 8:

Compute the fixed cost per unit:

II.

Calculate the change in full absorption because of decrease in units to 1,250:

Thus, full absorption cost per unit is $573.

Working note 9:

Compute the fixed manufacturing overhead per unit:

Thus, fixed manufacturing overhead per unit is $108.

III.

Calculate the change in conversion cost because of decrease in units to 1,250:

Thus, conversion cost per unit is $558.

Working note 10:

Calculate the production overhead per unit:

IV.

Calculate the change in gross margin because of decrease in units to 1,250:

Thus, the gross margin per unit is $327.

Want to see more full solutions like this?

Chapter 2 Solutions

FUNDAMENTALS OF...(LL)-W/ACCESS>CUSTOM<

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College