Concept explainers

Basic Concepts

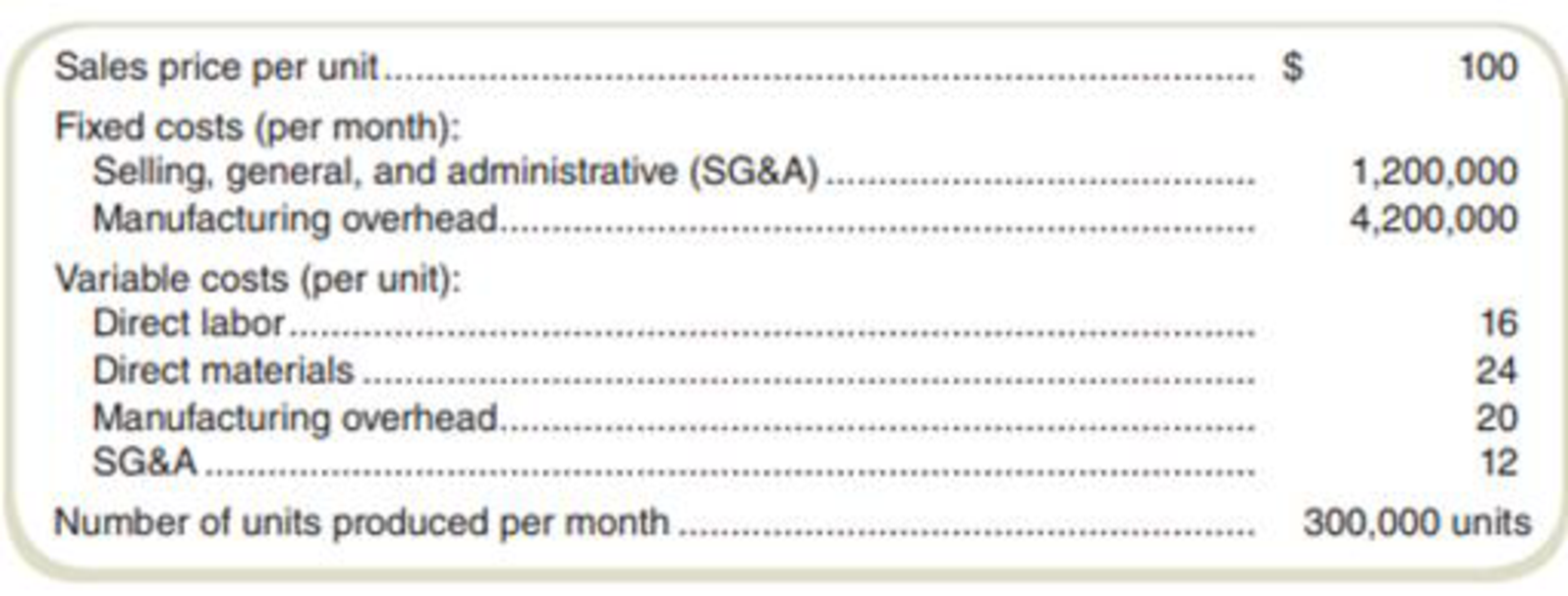

Intercontinental, Inc., provides you with the following data for its single product:

Required

Give the amounts for each of the following:

- a. Prime cost per unit.

- b. Contribution margin per unit.

- c. Gross margin per unit.

- d. Conversion cost per unit.

- e. Variable cost per unit.

- f. Full absorption cost per unit.

- g. Variable production cost per unit.

- h. Full cost per unit.

- i. Suppose the number of units increases to 400,000 units per month, which is within the relevant range. Which of amounts (a) through (h) will change? For each that will change, give the new amount for a volume of 400,000 units.

a.

Calculate the prime cost per unit.

Answer to Problem 30E

The prime cost per unit is $40.

Explanation of Solution

Prime cost per unit:

The cost including materials cost per unit, labor cost per unit and outsource cost per unit refers to the prime cost per unit.

Calculate the prime cost per unit:

Thus, prime cost per unit is $40.

b.

Calculate the contribution margin per unit.

Answer to Problem 30E

The contribution margin per unit is $28.

Explanation of Solution

Contribution margin per unit:

The contribution margin per unit refers to the difference between sales price per unit and the variable cost per unit. The contribution margin as a percentage of sales is referred to as the contribution margin ratio (CM ratio).

Calculate the contribution margin per unit:

Thus, contribution margin per unit is $28.

Working note 1:

Compute the variable cost per unit:

| Particulars | Amount |

| Variable costs (per test): | |

| Direct labor | $16 |

| Direct material | $24 |

| Manufacturing overhead | $20 |

| SG&A | $12 |

| Total variable production cost per unit | $72 |

Table: (1)

Thus, the total variable production cost per unit is $72.

c.

Calculate the gross margin per unit.

Answer to Problem 30E

The gross margin per unit is $26.

Explanation of Solution

Gross margin per unit:

The gross margin per unit is the difference of selling price per unit and the absorption cost per unit.

Calculate the gross margin per unit:

Thus, the gross margin per unit is $26.

Calculate the full absorption cost per unit:

Thus, full absorption cost per unit is $74.

Working note 2:

Compute the fixed manufacturing overhead per unit:

Thus, fixed manufacturing overhead per unit is $14.

d.

Calculate the conversion cost per unit.

Answer to Problem 30E

The conversion cost per unit is $50.

Explanation of Solution

Conversion cost per unit:

The conversion cost per unit refers to the total unit cost of labor, outsourcing and production overhead.

Calculate the conversion cost per unit:

Thus, conversion cost per unit is $50.

Working note 3:

Calculate the production overhead per unit:

Working note 4:

Calculate the fixed production overhead per unit:

e.

Calculate the variable cost per unit.

Answer to Problem 30E

The variable cost per unit is $72.

Explanation of Solution

Variable cost per unit:

The variable cost per unit refers to the unit variable cost of product including the variable manufacturing costs.

Compute the variable cost per unit:

| Particulars | Amount |

| Variable costs (per test): | |

| Direct labor | $16 |

| Direct material | $24 |

| Manufacturing overhead | $20 |

| SG&A | $12 |

| Total variable production cost per unit | $72 |

Table: (2)

Thus, variable cost per unit is $72.

f.

Calculate the full absorption cost per unit.

Answer to Problem 30E

Full absorption cost per unit is $74.

Explanation of Solution

Full absorption cost per unit:

the full absorption cost per unit refers to the total unit cost including the fixed manufacturing overhead and variable cost per unit.

Calculate the full absorption cost per unit:

Thus, full absorption cost per unit is $74.

Working note 5:

Compute the variable production cost per unit:

| Particulars | Amount |

| Variable costs (per test): | |

| Direct labor | $16 |

| Direct materials | $24 |

| Manufacturing overhead | $20 |

| Total variable production cost per unit | $60 |

Table: (8)

Thus, the total variable production cost per unit is $60.

g.

Calculate variable production cost per unit.

Answer to Problem 30E

Variable production cost per unit is $60.

Explanation of Solution

Calculate the variable production cost per unit:

| Particulars | Amount |

| Variable costs (per test): | |

| Direct labor | $16 |

| Direct materials | $24 |

| Manufacturing overhead | $20 |

| Total variable production cost per unit | $60 |

Table: (8)

Thus, the total variable production cost per unit is $60.

h.

Calculate the full cost per unit.

Answer to Problem 30E

The full cost per unit is $90.

Explanation of Solution

Full cost per unit:

The full cost per unit refers to the total cost of the product including the fixed and variable cost per unit.

Compute the total cost per unit:

Thus, total cost per unit is $90.

Working note 6:

Compute the total fixed cost:

| Particulars | Amount |

| Fixed costs (per month): | |

| Selling, general, and administrative | $1,200,000 |

| Manufacturing overheads | $4,200,000 |

| Total fixed costs | $5,400,000 |

Table: (6)

Working note 7:

Compute the fixed cost per unit:

i.

Calculate the change required in parts (a) through (h). Given that the new amount for a volume is 400,000 units.

Answer to Problem 30E

- I. The gross margin per unit is $17.5.

- II. Conversion cost per unit is $46.5.

- III. Full absorption cost per unit is $70.5.

- IV. Total cost per unit is $85.5.

Explanation of Solution

I.

Calculate the change in gross margin because of decrease in units to 400,000:

Thus, the gross margin per unit is $17.5.

Calculate the change in full absorption because of decrease in units400,000:

Working note 8:

Compute the fixed manufacturing overhead per unit:

II.

Calculate the change in conversion cost because of decrease in units 400,000:

Thus, conversion cost per unit is $46.5.

Working note 9:

Compute the fixed manufacturing overhead per unit:

Thus, fixed manufacturing overhead per unit is $10.5.

III.

Calculate the change in full absorption cost because of increase in units to 400,000:

Thus, full absorption cost per unit is $70.5.

IV.

Calculate the change in full cost because of increase in units to 400,000:

Thus, total cost per unit is $85.5.

Working note 10:

Compute the fixed cost per unit:

Want to see more full solutions like this?

Chapter 2 Solutions

FUNDAMENTALS OF...(LL)-W/ACCESS>IP<

- Laws can be classified into several categories: criminal law versus civil law, substantive law versus procedural law, public versus private law, and law versus equity. Discuss one of these categories and the distinctions between the two types of laws.arrow_forwardDo fast answer of this accounting questionsarrow_forwardFinancial Accounting Question please answerarrow_forward

- Can you please give me correct answer the general accounting question?arrow_forwardLambert Manufacturing estimates the following manufacturing costs... Please answer the general accounting questionarrow_forwardWhat journal entry will Mason Builders record on these general accounting question?arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College