College Accounting

13th Edition

ISBN: 9781337280563

Author: Scott, Cathy J.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 2PB

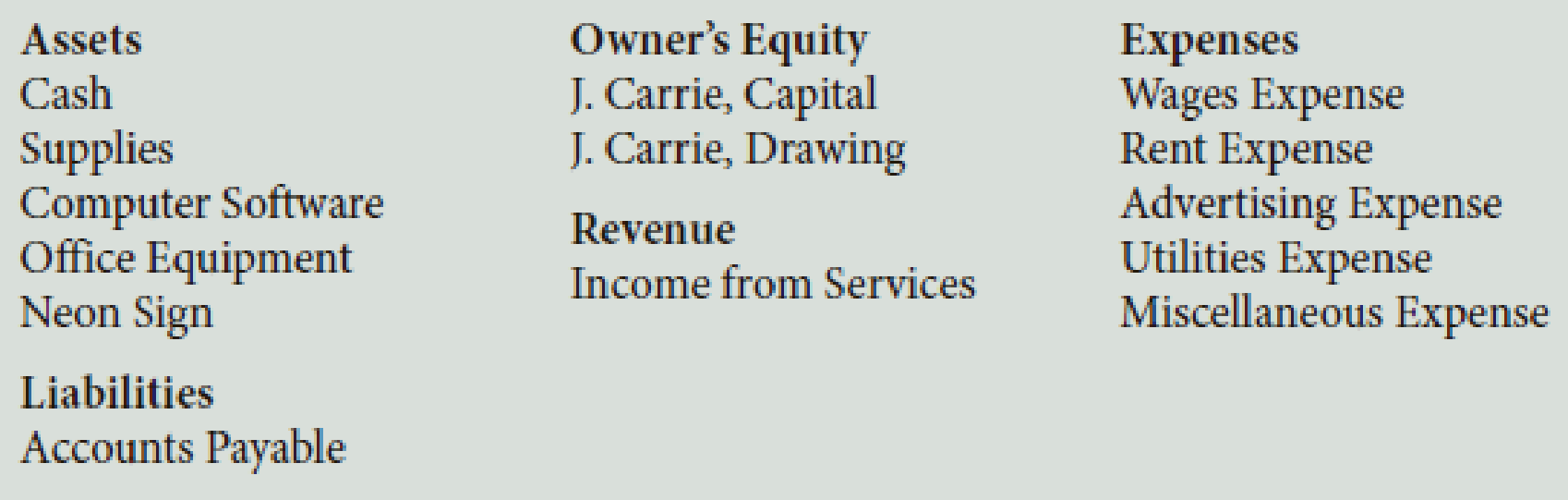

J. Carrie established Carrie’s Photo Tours during June of this year. The accountant prepared the following chart of accounts:

The following transactions occurred during the month of June:

- a. Carrie deposited $30,000 cash in a bank account in the name of the business.

- b. Bought office equipment for cash, $1,850, Ck. No. 1001

- c. Bought computer software from Morey’s Computer Center, $640, paying $350 in cash and placing the balance on account, Ck. No. 1002.

- d. Paid current month’s rent, $950, Ck. No. 1003.

- e. Sold services for cash, $1,575.

- f. Bought a neon sign from The Sign Company, $1,335, paying $435 in cash and placing the balance on account, Ck. No. 1004.

- g. Received bill from The Gossiper for advertising, $445.

- h. Bought supplies on account from City Supply, $460.

- i. Received and paid the electric bill, $380, Ck. No. 1005.

- j. Paid on account to The Gossiper, $245, Ck. No. 1006.

- k. Sold services for cash, $3,474.

- l. Paid wages to an employee, $930, Ck. No. 1007.

- m. Carrie invested his personal computer with a fair market value of $1,000 in the business.

- n. Carrie withdrew cash for personal use, $800, Ck. No. 1008.

- o. Received and paid the bill for city business license, $75, Ck. No. 1009.

Required

- 1. Record the owner’s name in the Capital and Drawing T accounts.

- 2. Correctly place the plus and minus signs for each T account and label the debit and credit sides of the accounts.

- 3. Record the transactions in the T accounts. Write the letter of each entry to identify the transaction.

- 4. Foot the T accounts and show the balances.

- 5. Prepare a

trial balance , with a three-line heading, dated June 30, 20--.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Quick answer of this accounting questions

Don't use ai given answer accounting questions

Need help with this question solution general accounting

Chapter 2 Solutions

College Accounting

Ch. 2 - Determine the balance of the following T account:

...Ch. 2 - Which of the following statements is correct? a....Ch. 2 - Prob. 3QYCh. 2 - R. Nelson invests his personal computer, with a...Ch. 2 - When preparing a trial balance, which of the...Ch. 2 - What would be the net income for Floress Catering?...Ch. 2 - On which financial statement(s) would R. Flores,...Ch. 2 - What is the amount of ending capital shown on the...Ch. 2 - Floress Catering purchased equipment that cost...Ch. 2 - Prob. 1DQ

Ch. 2 - Explain why the term debit doesnt always mean...Ch. 2 - Prob. 3DQCh. 2 - How are the three financial statements shown in...Ch. 2 - Prob. 5DQCh. 2 - List two reasons why the debits and credits in the...Ch. 2 - Prob. 7DQCh. 2 - What do we mean when we say that capital, drawing,...Ch. 2 - On a sheet of paper, draw the fundamental...Ch. 2 - List the classification of each of the following...Ch. 2 - R. Dalberg operates Dalbergs Tours. The company...Ch. 2 - During the first month of operation, Graham...Ch. 2 - Speedy Sewing Services, owned by T. Nguyen, hired...Ch. 2 - During the first month of operations, Landish...Ch. 2 - The following errors were made in journalizing...Ch. 2 - Would the following errors cause the trial balance...Ch. 2 - During December of this year, G. Elden established...Ch. 2 - B. Kelso established Computer Wizards during...Ch. 2 - S. Myers, a speech therapist, opened a clinic in...Ch. 2 - On May 1, B. Bangle opened Self-Wash Laundry. His...Ch. 2 - The financial statements for Daniels Custom...Ch. 2 - During February of this year, H. Rose established...Ch. 2 - J. Carrie established Carries Photo Tours during...Ch. 2 - D. Johnston, a physical therapist, opened...Ch. 2 - On July 1, K. Resser opened Ressers Business...Ch. 2 - The financial statements for Baker Custom Catering...Ch. 2 - Prob. 1ACh. 2 - A fellow accounting student has difficulty...Ch. 2 - What Would You Do? A new bookkeeper cant find the...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (5th Edition)

A typical discounted price of a AAA battery is 0.75. It is designed to provide 1.5 volts and 1.0 amps for about...

Engineering Economy (17th Edition)

Mary Williams, owner of Williams Products, is evaluating whether to introduce a new product line. After thinkin...

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

How is activity-based costing useful for pricing decisions?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2023, Pharoah Ltd. had 702,000 common shares outstanding. During 2023, it had the following transactions that affected the common share account: Feb. 1 Issued 160,000 shares Mar. 1 Issued a 10% stock dividend May 1 Acquired 181,000 common shares and retired them June 1 Issued a 3-for-1 stock split Oct. 1 Issued 78,000 shares ♡ The company's year end is December 31Determine the weighted average number of shares outstanding as at December 31, 2023. (Round answer to O decimal places, eg. 5,275.) Weighted average number of shares outstandingarrow_forwardOn January 1, 2023, Pharoah Ltd. had 702,000 common shares outstanding. During 2023, it had the following transactions that affected the common share account: Feb. 1 Issued 160,000 shares Mar. 1 Issued a 10% stock dividend May 1 Acquired 181,000 common shares and retired them June 1 Issued a 3-for-1 stock split Oct. 1 Issued 78,000 shares ♡ The company's year end is December 31 Assume that Pharoah earned net income of $3,441,340 during 2023. In addition, it had 90,000 of 10%, $100 par, non-convertible, non-cumulative preferred shares outstanding for the entire year. Because of liquidity limitations, however, the company did not declare and pay a preferred dividend in 2023. Calculate earnings per share for 2023, using the weighted average number of shares determined above. (Round answer to 2 decimal places, e.g. 15.25.) Earnings per sharearrow_forwardI want to correct answer general accounting questionarrow_forward

- Discuss the following questions below 1. Definition and scope of IAS 38 2. Recognition of criteria of intangible assets 3. Meaurement basis for intangible assets 4. Amortization methods and their implications for financial reportingarrow_forwardPlease solve this problem general accounting questionarrow_forwardWaiting for your solution general accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY