Concept explainers

Refer to the following financial statements for Crosby Corporation:

a. Prepare a statement of cash flows for the Crosby Corporation using the general procedures indicated in Table 2-10.

b. Describe the general relationship between net income and net cash flows from operating activities for the firm.

c. Has the buildup in plant and equipment been financed in a satisfactory manner? Briefly discuss.

d. Compute the book value per common share for both 20X1 and 20X2 for the Crosby Corporation.

e. If the market value of a share of common stock is 3.3 times book value for 20X1, what is the firm’s P/E ratio for 20X2?

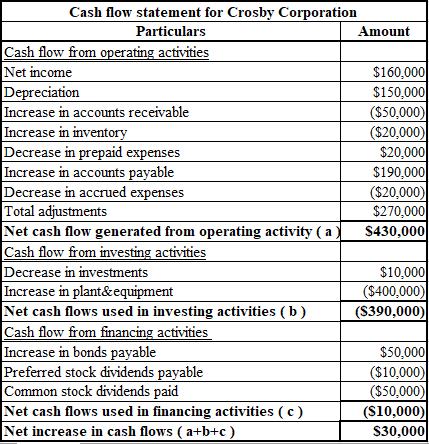

a.

To prepare: The cash flow statement for Crosby Corporation for the year ending 31st December, 20X2.

Introduction:

Cash Flow Statement (CFS):

The CFS is a core financial statement of a firm that shows the way cash gets affected by any change in any item of the balance sheet and income statement. It also shows the cash position of the company.

Answer to Problem 28P

The cash flow statement for Crosby Corporation for the year ending 31st December, 20X2 is as follows.

Hence, the net increase in cash flow is $30,000.

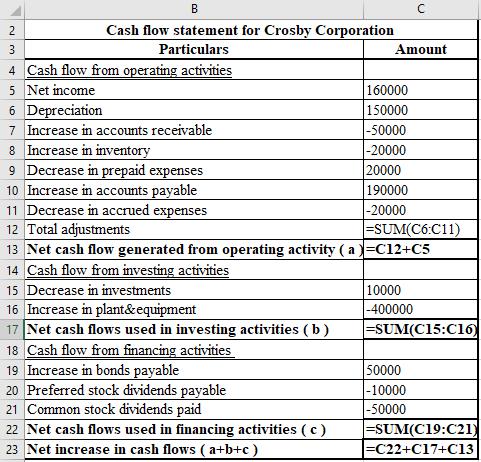

Explanation of Solution

The formulae and calculations used for the preparation of the CFS for Crosby Corporation are shown below.

(b)

To explain:The relationship between net income as well as net cash flows from activities of operating nature.

Introduction:

Cash Flow Statement (CFS):

The CFS is a core financial statement of a firm that shows the way cash gets affected by any change in any item of the balance sheet and income statement. It also shows the cash position of the company.

Answer to Problem 28P

There exists a direct relationship between net income and cash flow from operating activities. If the net income increases, cash flow from operating activities also increases. In the given problem, the net cash flows from activities of operating nature is much more than the net income.

Explanation of Solution

Cash flow from operating activities, in the given problem, exceeds net income as depreciation of $319,000 is added back and there is an increase of $248,000 in accounts payable, which leads to an increase in the cash flow. This provides an understanding of the CFS to the readers, users and the analysts with regard to the cash flows from the corporation’s routine operations.

(c)

To explain:Whether the financing of the addition in plant and equipment has been done satisfactorily or not.

Introduction:

Plant & Equipment:

The fixed assets used by a company for manufacturing or providing services are termed as plant and equipment. These assets are for long-term, and thus, have a life of more than a year. They are depreciable and tangible in nature.

Answer to Problem 28P

The additions in Crosby Corporation’s plant & equipment have largely been financed through accounts payable, which is a short-term source. Such type of financing is not a preferred by any company as short-term sources should only be used for short-term needs.

Explanation of Solution

The financing of the gross buildup in Crosby Corporation’s plant & equipment of $690,000, of which the net buildup is of $371,000, has largely been done by accounts payables worth $248,000, which is a short-term source.

Such type of sourcing is mostly preferred for short-term needs and not long-term assets. If the firm continues to use short-term sources of funds for financing non-current assets rather than choosing options such as long-term debts, the funds might get dried up quickly.

(d)

To calculate: The book value for each share of Crosby corporation for the years 20X1 and 20X2.

Introduction:

Book value per share:

It is a metric used by investors to know whether the price of the share is undervalued or overvalued by comparing it to the market value per share. If a company’s book value per share is lower than the market value per share, the stock is overvalued and, if the book value per share is higher than the market value, it is undervalued.

Answer to Problem 28P

The book value per share of Crosby Corporation for the year 20X1 is $8.58 and that for the year 20X2 is $9.42.

Explanation of Solution

The calculation of the book value per share for the year 20X1 is as follows.

Hence, the book value for each share in the year 20X1 is $8.58.

The calculation of the book value per share for the year 20X2 is as follows.

Hence, the book value for each share in the year 20X2 is $9.42.

(e)

To calculate:The P/E ratio of the firm in the year 20X2, the market value per share being 3.3 times its book value.

Introduction:

Market value per share

Market value per share is the current value of each share of a company assigned by the market. It is computed by dividing the total market value of the company by the number of its outstanding shares.

Earnings per share (EPS):

It is the profit earned by shareholders on each share. A higher EPS indicates a higher value of the company because investors are ready to pay a higher price for one share of the company.

P/E ratio:

Price earnings ratio is calculated by dividing a company’s current share price by its EPS. It helps value the present as well as future profitability of a company.

Answer to Problem 28P

The P/E ratio of Crosby Corporation for the year 20X2 is 24.87.

Explanation of Solution

Explanation:

The calculation of P/E ratio:

Hence, the P/E ratio is 24.87.

Working Note:

The calculation of the market value of each share:

Want to see more full solutions like this?

Chapter 2 Solutions

FOUND.OF FINANCIAL MANAGEMENT-ACCESS

- Problem Three (15 marks) You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5. The required rate of return for NEWER stock is 14% compounded annually. What is NEWER’s stock price? The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8. The required rate of return for OLDER stock is 16% compounded annually. What is OLDER’s stock price? Now assume that…arrow_forwardProblem Three (15 marks) You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5. The required rate of return for NEWER stock is 14% compounded annually. What is NEWER’s stock price? The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8. The required rate of return for OLDER stock is 16% compounded annually. What is OLDER’s stock price? Now assume that…arrow_forwardProblem Three (15 marks) You are an analyst in charge of valuing common stocks. You have been asked to value two stocks. The first stock NEWER Inc. just paid a dividend of $6.00. The dividend is expected to increase by 60%, 45%, 30% and 15% per year, respectively, in the next four years. Thereafter, the dividend will increase by 4% per year in perpetuity. Calculate NEWER’s expected dividend for t = 1, 2, 3, 4 and 5. The required rate of return for NEWER stock is 14% compounded annually. What is NEWER’s stock price? The second stock is OLDER Inc. OLDER Inc. will pay its first dividend of $10.00 three (3) years from today. The dividend will increase by 30% per year for the following four (4) years after its first dividend payment. Thereafter, the dividend will increase by 3% per year in perpetuity. Calculate OLDER’s expected dividend for t = 1, 2, 3, 4, 5, 6, 7 and 8. The required rate of return for OLDER stock is 16% compounded annually. What is OLDER’s stock price? Now…arrow_forward

- You are considering a 10-year, $1,000 par value bond. Its coupon rate is 11%, and interest is paid semiannually. Bond valuation Years to maturity 10 Par value of bond $1,000.00 Coupon rate 11.00% Frequency interest paid per year 2 Effective annual rate 8.78% Calculation of periodic rate: Formulas Nominal annual rate #N/A Periodic rate #N/A Calculation of bond price: Formulas Number of periods #N/A Interest rate per period 0.00% Coupon payment per period #N/A Par value of bond $1,000.00 Price of bond #N/Aarrow_forwardHow much do investor psychology and market sentiment play into stock price movements? Do these emotional reactions having a bigger impact on short-term swings, or do they also shape long-term trends in a meaningful way?arrow_forwardExplain The business of predatory tax return preparation, including: How they deceive the working poor,The marketing tactics the preparers use, and Other than paying high fees, what negative impact can the use of these unqualified and unregulated preparers have on the taxpayer?arrow_forward

- Explain the changes in tax return preparation you would like to see in Alabama, based on what has been successful in other states.arrow_forwardExplain the understanding (or misunderstanding) of the working poor with tax return preparation within one page report.arrow_forwardExplain the regulations or requirements for tax return preparers in Alabama.arrow_forward

- question 1. Toodles Inc. had sales of $1,840,000. Cost of goods sold, administrative and selling expenses, and depreciation expenses were $1,180,000, $185,000 and $365,000 respectively. In addition, the company had an interest expense of $280,000 and a tax rate of 35 percent. (Ignore any tax loss carry-back or carry-forward provisions.)Arrange the financial information for Toodles Inc. in an income statement and compute its OCF?Question 2 Anti-Pandemic Pharma Co. Ltd. reports the following information in its income statement: Sales = $5,250,000;Costs = $2, 173,000;Other expenses = $187,400; Depreciation expense = $79,000; Interest expense= $53,555; Taxes = $76,000; Dividends = $69,000. $136,700 worth of new shares were also issued during the year and long-term debt worth $65,300 was redeemed.a) Compute the cash flow from assetsb) Compute the net change in working capitalQuestion 3Footfall Manufacturing Ltd. reports the following financial information at the end of the current year:…arrow_forwardAccrued Interest PayableCompute the interest for December accrued on each of the following notes payable owed by Riff-Raff'n Yell Inc., on December 31: Day of Calendar: 1 Lender: New Age Principal: $10,000 Interest Rate: 5% Term (Days) 120 Day of Calendar: 8 Lender: Wyvern Tavern Principal: $8,000 Interest Rate: 6% Term (Days) 90 Day of Calendar: 17 Lender: Cedar Tree Principal: $15,000 Interest Rate: 4% Term (Days) 90 Note: Use 360 days for calculations and round to the nearest dollar. Riff-Raff'n Yell, Inc. Lender (in alphabetical order) Accrued Interest Cedar Tree Answer 1 New Age Answer 2 Wyvern Tavern Answer 3arrow_forwardQuestion Footfall afacturing pers The following fancial information at the end of the current years Inventory turnover ratio Fixed accetturnover ratio bot to assets ratia set profit ang ross profit margin the given information to fill at the templates for income statement and balance sheet geb In Statement of Footfall Manufacturing Ltd. for the year ending RELEASED BY THE CL MOME2003, FEBRUARY 9, 3005 Sales December 31, 20 Cast of other expec Earnings befo Camings afterarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:CengagePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:CengagePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College