Concept explainers

Refer to the following financial statements for Crosby Corporation:

a. Prepare a statement of cash flows for the Crosby Corporation using the general procedures indicated in Table 2-10.

b. Describe the general relationship between net income and net cash flows from operating activities for the firm.

c. Has the buildup in plant and equipment been financed in a satisfactory manner? Briefly discuss.

d. Compute the book value per common share for both 20X1 and 20X2 for the Crosby Corporation.

e. If the market value of a share of common stock is 3.3 times book value for 20X1, what is the firm’s P/E ratio for 20X2?

a.

To prepare: The cash flow statement for Crosby Corporation for the year ending 31st December, 20X2.

Introduction:

Cash Flow Statement (CFS):

The CFS is a core financial statement of a firm that shows the way cash gets affected by any change in any item of the balance sheet and income statement. It also shows the cash position of the company.

Answer to Problem 28P

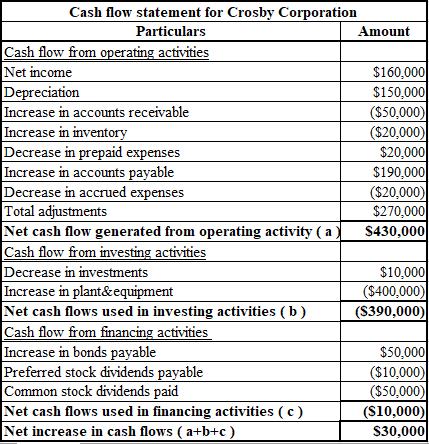

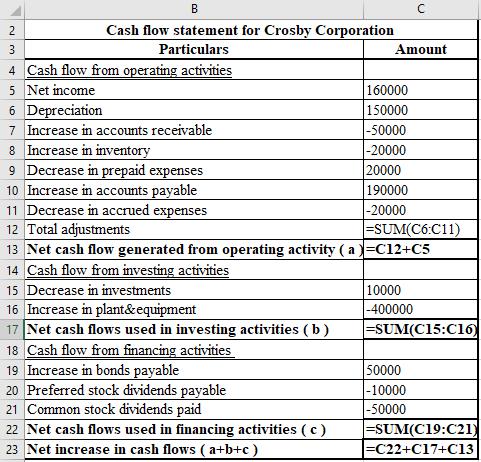

The cash flow statement for Crosby Corporation for the year ending 31st December, 20X2 is as follows.

Hence, the net increase in cash flow is $30,000.

Explanation of Solution

The formulae and calculations used for the preparation of the CFS for Crosby Corporation are shown below.

(b)

To explain:The relationship between net income as well as net cash flows from activities of operating nature.

Introduction:

Cash Flow Statement (CFS):

The CFS is a core financial statement of a firm that shows the way cash gets affected by any change in any item of the balance sheet and income statement. It also shows the cash position of the company.

Answer to Problem 28P

There exists a direct relationship between net income and cash flow from operating activities. If the net income increases, cash flow from operating activities also increases. In the given problem, the net cash flows from activities of operating nature is much more than the net income.

Explanation of Solution

Cash flow from operating activities, in the given problem, exceeds net income as depreciation of $319,000 is added back and there is an increase of $248,000 in accounts payable, which leads to an increase in the cash flow. This provides an understanding of the CFS to the readers, users and the analysts with regard to the cash flows from the corporation’s routine operations.

(c)

To explain:Whether the financing of the addition in plant and equipment has been done satisfactorily or not.

Introduction:

Plant & Equipment:

The fixed assets used by a company for manufacturing or providing services are termed as plant and equipment. These assets are for long-term, and thus, have a life of more than a year. They are depreciable and tangible in nature.

Answer to Problem 28P

The additions in Crosby Corporation’s plant & equipment have largely been financed through accounts payable, which is a short-term source. Such type of financing is not a preferred by any company as short-term sources should only be used for short-term needs.

Explanation of Solution

The financing of the gross buildup in Crosby Corporation’s plant & equipment of $690,000, of which the net buildup is of $371,000, has largely been done by accounts payables worth $248,000, which is a short-term source.

Such type of sourcing is mostly preferred for short-term needs and not long-term assets. If the firm continues to use short-term sources of funds for financing non-current assets rather than choosing options such as long-term debts, the funds might get dried up quickly.

(d)

To calculate: The book value for each share of Crosby corporation for the years 20X1 and 20X2.

Introduction:

Book value per share:

It is a metric used by investors to know whether the price of the share is undervalued or overvalued by comparing it to the market value per share. If a company’s book value per share is lower than the market value per share, the stock is overvalued and, if the book value per share is higher than the market value, it is undervalued.

Answer to Problem 28P

The book value per share of Crosby Corporation for the year 20X1 is $8.58 and that for the year 20X2 is $9.42.

Explanation of Solution

The calculation of the book value per share for the year 20X1 is as follows.

Hence, the book value for each share in the year 20X1 is $8.58.

The calculation of the book value per share for the year 20X2 is as follows.

Hence, the book value for each share in the year 20X2 is $9.42.

(e)

To calculate:The P/E ratio of the firm in the year 20X2, the market value per share being 3.3 times its book value.

Introduction:

Market value per share

Market value per share is the current value of each share of a company assigned by the market. It is computed by dividing the total market value of the company by the number of its outstanding shares.

Earnings per share (EPS):

It is the profit earned by shareholders on each share. A higher EPS indicates a higher value of the company because investors are ready to pay a higher price for one share of the company.

P/E ratio:

Price earnings ratio is calculated by dividing a company’s current share price by its EPS. It helps value the present as well as future profitability of a company.

Answer to Problem 28P

The P/E ratio of Crosby Corporation for the year 20X2 is 24.87.

Explanation of Solution

Explanation:

The calculation of P/E ratio:

Hence, the P/E ratio is 24.87.

Working Note:

The calculation of the market value of each share:

Want to see more full solutions like this?

Chapter 2 Solutions

EBK FOUNDATIONS OF FINANCIAL MANAGEMENT

- What are some of Airbnb Legal Issues? How have Airbnb Resolved these Legal issues?WHat happened in the legal problem with Airbnb and Italy?arrow_forwardWhat are AIrbnb's Legal Foundations? What are Airbnb's Business Ethics? What are Airbnb's Corporate Social Responsibility?arrow_forwardDiscuss in detail the differences between the Primary Markets versus the Secondary Markets, The Money Market versus the Capital Market AND the Spot Market versus the Futures Market. Additionally, discuss the various Interest Rate Determinants listed in your textbook (such as default-risk premium.....).arrow_forward

- How can the book value still serve as a useful metric for investors despite the dominance of market value?arrow_forwardHow do you think companies can practically ensure that stakeholder interests are genuinely considered, while still prioritizing the financial goal of maximizing shareholder equity? Do you think there’s a way to measure and track this balance effectively?arrow_forward$5,000 received each year for five years on the first day of each year if your investments pay 6 percent compounded annually. $5,000 received each quarter for five years on the first day of each quarter if your investments pay 6 percent compounded quarterly. Can you show me either by hand or using a financial calculator please.arrow_forward

- Can you solve these questions on a financial calculator: $5,000 received each year for five years on the last day of each year if your investments pay 6 percent compounded annually. $5,000 received each quarter for five years on the last day of each quarter if your investments pay 6 percent compounded quarterly.arrow_forwardNow suppose Elijah offers a discount on subsequent rooms for each house, such that he charges $40 for his frist room, $35 for his second, and $25 for each room thereafter. Assume 30% of his clients have only one room cleaned, 25% have two rooms cleaned, 30% have three rooms cleaned, and the remaining 15% have four rooms cleaned. How many houses will he have to clean before breaking even? If taxes are 25% of profits, how many rooms will he have to clean before making $15,000 profit? Answer the question by making a CVP worksheet similar to the depreciation sheets. Make sure it works well, uses cell references and functions/formulas when appropriate, and looks nice.arrow_forward1. Answer the following and cite references. • what is the whole overview of Green Markets (Regional or Sectoral Stock Markets)? • what is the green energy equities, green bonds, and green financing and how is this related in Green Markets (Regional or Sectoral Stock Markets)? Give a detailed explanation of each of them.arrow_forward

- Could you help explain “How an exploratory case study could be goodness of work that is pleasing to the Lord?”arrow_forwardWhat are the case study types and could you help explain and make an applicable example.What are the 4 primary case study designs/structures (formats)?arrow_forwardThe Fortune Company is considering a new investment. Financial projections for the investment are tabulated below. The corporate tax rate is 24 percent. Assume all sales revenue is received in cash, all operating costs and income taxes are paid in cash, and all cash flows occur at the end of the year. All net working capital is recovered at the end of the project. Year 0 Year 1 Year 2 Year 3 Year 4 Investment $ 28,000 Sales revenue $ 14,500 $ 15,000 $ 15,500 $ 12,500 Operating costs 3,100 3,200 3,300 2,500 Depreciation 7,000 7,000 7,000 7,000 Net working capital spending 340 390 440 340 ?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:CengagePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:CengagePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College