Financial Accounting

9th Edition

ISBN: 9781259738692

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 2.5E

Determining Financial Statement Effects of Several Transactions

Nike. Inc., with headquarters in Beaverton. Oregon, is one of the world’s leading manufacturers of athletic shoes and sports apparel. The following activities occurred during a recent year. The amounts are rounded to millions.

- a. Purchased additional buildings for $172 and equipment for $270: paid $432 in cash and signed a longterm note for the rest.

- b. Issued 100 shares of $2 par value common stock for $345 cash.

- c. Declared $145 in dividends to be paid in the following year.

- d. Purchased additional short-term investments for $7,616 cash.

- e. Several Nike investors sold their own stock to other investors on the stock exchange for $84.

- f. Sold $4,313 in short-term investments for $4,313 in cash.

Required:

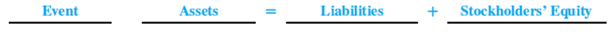

- 1. For each of the events (a) through (f). perform transaction analysis and indicate the account, amount, and direction of the effect on the

accounting equation . Check that the accounting equation remains in balance after each transaction. Use the following headings:

- 2. Explain your response to event (e).

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Calculate the annual depreciation

The gain or loss on sale is

MCQ

Chapter 2 Solutions

Financial Accounting

Ch. 2 - Prob. 1QCh. 2 - Define the following: a. Asset b. Current asset c....Ch. 2 - Explain what the following accounting terms mean:...Ch. 2 - Why are accounting assumptions necessary?Ch. 2 - For accounting purposes, what is an account?...Ch. 2 - What is the fundamental accounting model?Ch. 2 - Prob. 7QCh. 2 - Explain what debit and credit mean.Ch. 2 - Prob. 9QCh. 2 - Prob. 10Q

Ch. 2 - Prob. 11QCh. 2 - Prob. 12QCh. 2 - How is the current ratio computed and interpreted?Ch. 2 - Prob. 14QCh. 2 - Prob. 1MCQCh. 2 - Which of the following is not an asset? a....Ch. 2 - Total liabilities on a balance sheet at the end of...Ch. 2 - The dual effects concept can best be described as...Ch. 2 - The T-account is a tool commonly used for...Ch. 2 - Prob. 6MCQCh. 2 - The Cash T-account has a beginning balance of...Ch. 2 - Prob. 8MCQCh. 2 - At the end of a recent year, The Gap, Inc.,...Ch. 2 - Prob. 10MCQCh. 2 - Matching Definitions with Terms Match each...Ch. 2 - Matching Definitions with Terms Match each...Ch. 2 - Identifying Events as Accounting Transactions...Ch. 2 - Classifying Accounts on a Balance Sheet The...Ch. 2 - Determining Financial Statement Effects of Several...Ch. 2 - Prob. 2.6MECh. 2 - Prob. 2.7MECh. 2 - Prob. 2.8MECh. 2 - Prob. 2.9MECh. 2 - Prob. 2.10MECh. 2 - Prob. 2.11MECh. 2 - Computing and Interpreting the Current Ratio...Ch. 2 - Identifying Transactions as Investing or Financing...Ch. 2 - Matching Definitions with Terms Match each...Ch. 2 - Identifying Account Titles The following are...Ch. 2 - Classifying Accounts and Their Usual Balances As...Ch. 2 - Determining Financial Statement Effects of Several...Ch. 2 - Determining Financial Statement Effects of Several...Ch. 2 - Recording Investing and Financing Activities Refer...Ch. 2 - Prob. 2.7ECh. 2 - Recording Investing and Financing Activities...Ch. 2 - Analyzing the Effects of Transactions In...Ch. 2 - Analyzing the Effects of Transactions In...Ch. 2 - Prob. 2.11ECh. 2 - Inferring Investing and Financing Transactions and...Ch. 2 - Recording Journal Entries Nathanson Corporation...Ch. 2 - Prob. 2.14ECh. 2 - Analyzing the Effects of Transactions Using...Ch. 2 - Prob. 2.16ECh. 2 - Prob. 2.17ECh. 2 - Prob. 2.18ECh. 2 - Inferring Typical Investing and Financing...Ch. 2 - Prob. 2.20ECh. 2 - Identifying the Investing and Financing Activities...Ch. 2 - Prob. 2.22ECh. 2 - Identifying Accounts on a Classified Balance Sheet...Ch. 2 - Determining Financial Statement Effects of Various...Ch. 2 - Prob. 2.3PCh. 2 - Prob. 2.4PCh. 2 - Prob. 2.5PCh. 2 - Prob. 2.6PCh. 2 - Prob. 2.1APCh. 2 - Determining Financial Statement Effects of Various...Ch. 2 - Recording Transactions in T-Accounts, Preparing...Ch. 2 - Prob. 2.4APCh. 2 - Accounting for the Establishment of a New Business...Ch. 2 - Prob. 2.1CPCh. 2 - Prob. 2.2CPCh. 2 - Prob. 2.3CPCh. 2 - Prob. 2.4CPCh. 2 - Prob. 2.5CPCh. 2 - Prob. 2.6CPCh. 2 - Prob. 2.7CPCh. 2 - Prob. 2.8CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A cosmetic manufacturer provides the following production data for the year: Work-in-process (WIP) inventory, January 1: 15 units Units started during the year: 30,000 units Units completed and transferred out: 22,500 units WIP Inventory, December 31: 7,500 units Direct materials cost: $360,000 Direct labor cost: $700,000 Manufacturing overhead: $400,000 The units in the ending WIP inventory were 70% complete for materials and 50% complete for conversion costs. What is the cost per equivalent unit for materials? a) $14.50 b) $13.85 c) $12.00 d) $12.97arrow_forwardGeneral accountingarrow_forwardNeed help with this general accounting questionarrow_forward

- Newcombe & Associates, Inc. is considering the introduction of a new product. Production of the new product requires an investment of $140,000 in equipment that has a five-year life. The equipment has no salvage value at the end of five years and will be depreciated on a straight-line basis. Newcombe's required return is 15%, and the tax rate is 34%. The firm has made the following forecasts: Base Case Lower Bound Upper Bound Unit Sales 2,000 1,800 2,200 Price Per Unit $55 $50 $60 Variable Costs Per Unit $22 $21 $23 Fixed Costs Per Year $10,000 $9,500 $10,500 Suppose that sales for the project under consideration by Newcombe increases from 2,000 units to 2,200 units per year. Compute the DOL for the project at sales of 2,000 units. Use both the definition of the DOL and its algebraic equivalent. Assume Newcome pays no taxes on this project. Show all workarrow_forwardCalculate the debt Equity ?arrow_forwardWhat is the arithmetic average annual return per year ? General accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY