ADV.FIN.ACCT. CONNECT+PROCTORIO PLUS

12th Edition

ISBN: 9781266379017

Author: Christensen

Publisher: INTER MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 2.5E

Acquisition Price

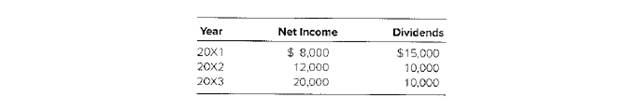

Phillips Company bought 40 percent ownership in Jones Bag Company on January 1, 20X1, at underlying book value. During the period of January 1, 20X1. through December 31. 20X3, themarket value of Phillips’ investment in Jones’ stock increased by $2,000 each year. In 20X1, 20X2, and 20X3, Jones Bag reported the following:

The balance in Phillips Company’s investment account on December 31, 20X3, was $54,000.

Required

In each of the following independent cases, determine the amount that Phillips paid for its investment in Jones Bag stock assuming that Phillips accounted for its investment by (a) carrying the investment it fair value, or (b) using the equity method.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Write down as many descriptions describing rock and roll that you can.

From these descriptions can you come up with s denition of rock and roll?

What performers do you recognize?

What performers don’t you recognize?

What can you say about musical inuence on these current rock musicians?

Try to break these inuences into genres and relate them to the rock musicians. What does

Mick Jagger say about country artists?

What does pioneering mean?

What kind of ensembles w

Recently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: What impact would the write-down of inventory have had on Abercrombie's expenses, Gross margin, and Net income?

Recently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: What impact would the write-down of inventory have had on Abercrombie's assets, Liabilities, and Equity?

Chapter 2 Solutions

ADV.FIN.ACCT. CONNECT+PROCTORIO PLUS

Ch. 2 - What types of investments in common stock normally...Ch. 2 - Prob. 2.2QCh. 2 - Describe an investor’s treatment of an investment...Ch. 2 - How is the receipt of a dividend recorded under...Ch. 2 - How does carrying securities at fair value...Ch. 2 - Prob. 2.6QCh. 2 - Prob. 2.7QCh. 2 - Prob. 2.8QCh. 2 - Prob. 2.9QCh. 2 - Prob. 2.10Q

Ch. 2 - How are a subsidiary’s dividend declarations...Ch. 2 - Prob. 2.12QCh. 2 - Give a definition of consolidated retained...Ch. 2 - Prob. 2.14QCh. 2 - Prob. 2.15QCh. 2 - Prob. 2.16AQCh. 2 - When is equity method reporting considered...Ch. 2 - How does the fully adjusted equity method differ...Ch. 2 - What is the modified equity method? When might a...Ch. 2 - Choice of Accounting Method Slanted Building...Ch. 2 - Prob. 2.2CCh. 2 - Prob. 2.3CCh. 2 - Prob. 2.4CCh. 2 - Prob. 2.5CCh. 2 - Prob. 2.6CCh. 2 - Prob. 2.1.1ECh. 2 - Multiple-Choice Questions on Accounting for Equity...Ch. 2 - Prob. 2.1.3ECh. 2 - Prob. 2.1.4ECh. 2 - Multiple-Choice Questions on Intercorporate...Ch. 2 - Prob. 2.2.2ECh. 2 - Prob. 2.3.1ECh. 2 - Prob. 2.3.2ECh. 2 - Prob. 2.3.3ECh. 2 - Prob. 2.4ECh. 2 - Acquisition Price Phillips Company bought 40...Ch. 2 - Prob. 2.6ECh. 2 - Prob. 2.7ECh. 2 - Carrying an investment at Fair Value versus Equity...Ch. 2 - Carrying an Investment at Fair Value versus Equity...Ch. 2 - Prob. 2.10ECh. 2 - Prob. 2.11ECh. 2 - Prob. 2.12ECh. 2 - Prob. 2.13ECh. 2 - Income Reporting Grandview Company purchased 40...Ch. 2 - Investee with Preferred Stock Outstanding Reden...Ch. 2 - Prob. 2.16AECh. 2 - Prob. 2.17AECh. 2 - Changes ¡n the Number of Shares Held Idle...Ch. 2 - Investments Carried at Fair Value and Equity...Ch. 2 - Carried at Fair Value Journal Entries Marlow...Ch. 2 - Consolidated Worksheet at End of the First Year of...Ch. 2 - Consolidated Worksheet at End of the Second Year...Ch. 2 - Prob. 2.23PCh. 2 - Prob. 2.24PCh. 2 - Prob. 2.25APCh. 2 - Equity-Method income Statement Wealthy...Ch. 2 - Prob. 2.27BPCh. 2 - Prob. 2.28BP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

The ACCOUNTING EQUATION For BEGINNERS; Author: Accounting Stuff;https://www.youtube.com/watch?v=56xscQ4viWE;License: Standard Youtube License