Concept explainers

Financial statements

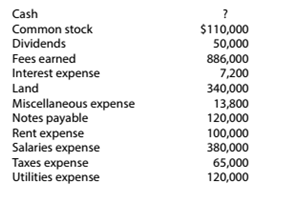

Padget Home Services began its operations on January 1, 20Y7 (see Problem 2-3). After its second year of operations, the following amounts were taken from the accounting records of Padget Home Services, Inc., as of December 31, 20Y8.

Instuctions

Prepare a

Balance sheet- It is a financial statement that records the company's assets, liabilities and stockholder's equity at a point in time. The balance sheet also known as statement of financial condition is expressed in the accounting equation as:

The balance sheet is prepared using accounting equation in vertical form. Also, the balance on assets side must be equal to sum of balances of liabilities and stockholder's equity.

To prepare the balance sheet of company P for the year ended December 31, 20Y8.

Answer to Problem 2.4.3P

The balance sheet of Company P reports total assets of $500000 is equal to the sum of total liabilities of $120000 and stockholder's equity of $380000.

Explanation of Solution

Computation of balance sheet of company P for the year ended December 31, 20Y8:

Computation of purchase of land during year ended December 31, 20Y8:

Computation of issue of notes payable during year ended December 31, 20Y8:

Computation of retained earnings balance for the year ended December 31, 20Y8:

Computation of issue of common stock during year ended December 31, 20Y8:

Computation of Cash balance of company P for the year ended December 31, 20Y8:

Computation of Net Income

Want to see more full solutions like this?

Chapter 2 Solutions

Survey of Accounting (Accounting I)

Additional Business Textbook Solutions

Marketing: An Introduction (13th Edition)

Horngren's Accounting (12th Edition)

Fundamentals of Management (10th Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Intermediate Accounting (2nd Edition)

- do not use aiWhich of the following is a nominal account?A. CashB. Accounts PayableC. Sales RevenueD. Equipmentarrow_forwardWhich of the following is a nominal account?A. CashB. Accounts PayableC. Sales RevenueD. Equipment need anarrow_forwardWhich of the following is a nominal account?A. CashB. Accounts PayableC. Sales RevenueD. Equipmentneed helparrow_forward

- Which of the following is a nominal account?A. CashB. Accounts PayableC. Sales RevenueD. Equipmentarrow_forwardPlease help me solve this general accounting question using the right accounting principles.arrow_forwardI need assistance with this general accounting question using appropriate principles.arrow_forward

- I need assistance with this general accounting question using appropriate principles.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forwardI am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning