Concept explainers

Nature of transactions

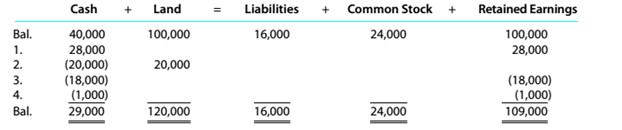

Cheryl Alder operates her own catering service. Summary financial data for March are presented in the following equation form. Each line, designated by a number, indicates the effect of a transaction on the

a. Describe each transaction.

h. What is the net decrease in cash during the month?

c. What is the net increase in retained earnings during the month?

d. What is the net income for the month?

e. How much of the net income for the month was retained in the business?

f. What are the net

g. ‘1iat arc the net cash flows fn)m investing activities?

h. What are the net cash flows from financing activities?

(a)

Balance sheet:

It is a financial statement that records the assets, liabilities and stockholder's equity of the company at a point in time. The balance sheet also known as statement of financial condition is expressed in the accounting equation as:

The balance sheet is prepared using accounting equation in vertical form. Also, the balance on assets side must be equal to sum of balances of liabilities and stockholder's equity

The effect of each transaction in balance sheet of person A during the given period.

Answer to Problem 2.11E

The effect of each transaction is mentioned below:

- Here, there is an increase in cash by $28000 along with an increase in retained earnings by$28000 which means that this increase is due to payment received from customers or fees earned.

- In this transaction, there is an increase in land under assets by $20000 along with a decrease in cash under assets by $20000 which means that land is purchased for which cash decreased during the given period.

- Here, there is decrease in cash under assets as well as decrease in retained earnings under stockholders' equity by $18000 which means that operating expenses have been paid during the given period.

- In this transaction, there is decrease in cash under assets as well as decrease in retained earnings under stockholders' equity by $1000 which means that dividends have been paid during the given period.

Explanation of Solution

The effect of each transaction is explained below:

- When there is an increase in cash, it means that the person A has received cash of $28000 as fees earned it will increase assets in the form of cash and increase retained earnings under stockholder's equity by $28000. The effect of this transaction on statement of cash flows will be an increase in cash flow from operating activities by $28000.

- When there is decrease in cash along with an increase in land value of same amount it means that the person A has purchased land of $20000, which will be recorded in balance sheet as a deduction from cash under assets and added to land as an asset. In the statement of cash flows it will be recorded as a deduction under cash flow from investing activities.

- When there is decrease in cash and retained earnings of same amount it means that person A has paid operating expenses of $18000 which will reduce balance sheet balance under assets since cash is paid and retained earnings will also reduce. In the statement of cash flows, it will be recorded as a deduction under cash flow from operating expenses and in income statement it will be treated as an expense.

- When there is decrease in cash and retained earnings of same amount it means person A paid dividends of $1000, which will be reduced from assets under cash for dividends paid and from retained earnings under stockholder's equity with $1000. Also, it will be recorded in the statement of cash flows under cash flow from financing activities as a deduction of $1000.

(b)

Statement of cash flows:

It is a financial statement that provides details of changes in cash that is cash generated or used during a period. The analysis of this statement is divided into three sections:

- Operating activities- It is used to assess the cash flows from operating activities of the business.

- Investing activities- It is used to report the cash flows from purchase and sale of long-term investments.

- Financing activities- It is used to show changes in cash from borrowings and contributed equity capital of the company.

The net decrease in cash during the month.

Answer to Problem 2.11E

The statement of cash flows shows that there is a net decrease in cash during the month which is $11000

Explanation of Solution

Computation of Statement of cash flows of company P for the year ended 31, 20Y8:

(c)

Retained Earnings:

It is related to net income and represents accumulated profits after paying out dividends to stockholders of the company. It is calculated as:

To compute:

Net increase in retained earnings during the month.

Answer to Problem 2.11E

The net increase in retained earnings during the month is $9000

Explanation of Solution

Computation of net increase in retained earnings:

Computation of net income with income statement for the month:

(d)

Income statement:

This statement shows the financial performance of the company over a specific time-period. It is used to measure the profitability of the company by recording revenues and expenses during a period.

To prepare:

The income statement of company A for the month.

Answer to Problem 2.11E

The income statement of company A shows net income of $10000 for the month.

Explanation of Solution

Computation of income statement of company A for the month:

(e)

Retained Earnings:

It is related to net income and represents accumulated profits after paying out dividends to stockholders of the company. It is calculated as:

To compute:

Net income retained for the month by person A.

Answer to Problem 2.11E

The net income retained for the month in the business is $9000.

Explanation of Solution

Computation of retained earnings for the month:

Computation of net income with income statement:

(f)

Statement of cash flows:

It is a financial statement that provides details of changes in cash that is cash generated or used during a period. The analysis of this statement is divided into three sections:

- Operating activities- It is used to assess the cash flows from operating activities of the business.

- Investing activities- It is used to report the cash flows from purchase and sale of long-term investments.

- Financing activities- It is used to show changes in cash from borrowings and contributed equity capital of the company.

To compute:

Net cash from operating activities for the month.

Answer to Problem 2.11E

The net cash flows from operating activities of company A for the month is $10000.

Explanation of Solution

Computation of net cash flows from operating activities of company A for the month:

(g)

Statement of cash flows:

It is a financial statement that provides details of changes in cash that is cash generated or used during a period. The analysis of this statement is divided into three sections:

- Operating activities- It is used to assess the cash flows from operating activities of the business.

- Investing activities- It is used to report the cash flows from purchase and sale of long-term investments.

- Financing activities- It is used to show changes in cash from borrowings and contributed equity capital of the company.

To compute:

Cash flow from investing activities for the month.

Answer to Problem 2.11E

The cash flow from investing activities for the month is $20000.

Explanation of Solution

Computation of cash flow from investing activities for the month:

(h)

Statement of cash flows:

It is a financial statement that provides details of changes in cash that is cash generated or used during a period. The analysis of this statement is divided into three sections:

- Operating activities- It is used to assess the cash flows from operating activities of the business.

- Investing activities- It is used to report the cash flows from purchase and sale of long-term investments.

- Financing activities- It is used to show changes in cash from borrowings and contributed equity capital of the company.

To compute:

Cash flow from financing activities for the month.

Answer to Problem 2.11E

The net cash flow from financing activities for the month is $1000.

Explanation of Solution

Computation of cash flows from financing activities for the month:

Want to see more full solutions like this?

Chapter 2 Solutions

Survey of Accounting (Accounting I)

Additional Business Textbook Solutions

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Marketing: An Introduction (13th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Intermediate Accounting (2nd Edition)

Financial Accounting, Student Value Edition (5th Edition)

- I am looking for the correct answer to this financial accounting question with appropriate explanations.arrow_forwardGive correct answer Global Fitness LLC reported a debt-to-equity ratio of 1.5 times at the end of 2024. If the firm's total assets at year-end were $36.8 million, how much of their assets are financed with equity?arrow_forwardCan you help me solve this financial accounting problem using the correct accounting process?arrow_forward

- Global Fitness LLC reported a debt-to-equity ratio of 1.5 times at the end of 2024. If the firm's total assets at year-end were $36.8 million, how much of their assets are financed with equity?a. $14.72 millionb. $22.08 millionc. $9.2 milliond. $55.2 million i need helparrow_forwardPlease provide the accurate answer to this financial accounting problem using valid techniques.arrow_forwardCan you help me solve this general accounting problem with the correct methodology?arrow_forward

- Global Fitness LLC reported a debt-to-equity ratio of 1.5 times at the end of 2024. If the firm's total assets at year-end were $36.8 million, how much of their assets are financed with equity?a. $14.72 millionb. $22.08 millionc. $9.2 milliond. $55.2 million helparrow_forwardPlease help me solve this financial accounting problem with the correct financial process.arrow_forwardPlease provide answer accurate of this Financial Accounting Question without any problemarrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning  College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage