a)

The computation of magnitude of operating leverage utilizing contribution margin approach of each firm

a)

Explanation of Solution

The formula to calculate the magnitudes of operating leverage are as follows:

Calculate the magnitude of operating leverage of B Company and Z Company:

Hence, the operating leverage of B Company and Z Company are 2.50 times and 5 times.

b)

Determine the change in net income in amount and change in percentage of net income

Given information:

The sales increased by 10% for both Company B and Company Z and selling price remain unchanged.

b)

Explanation of Solution

The formula to compute the percentage change in net income:

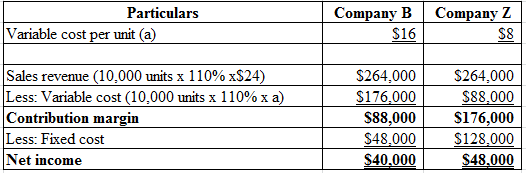

Compute the change in net income in dollars:

Table (1)

Calculate the percentage change in net income of Company B and Company Z:

Hence, the percentage change of net income of Company B and Company Z is 25% and 50%

c)

Determine the change in net income in amount and change in percentage of net income.

Given information:

The sales decreased by 10% for both Company B and Company Z and selling price remain unchanged.

c)

Explanation of Solution

The formula to calculate the percentage change in net income:

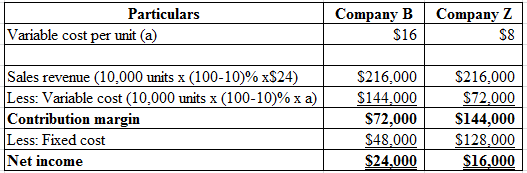

Compute the change in net income in dollars:

Table (2)

Calculate the percentage change in net income of Company B and Company Z:

Hence, the percentage change of net income of Company B and Company Z is −25% and −50%

d)

Write a memo regarding the analyses and advice by Person X.

d)

Explanation of Solution

To,

Person AH

From,

Person X

Subject:

Analysis and recommendation regarding the investment

Date: 12/22/2018

The rewards and risk of both the companies are different even though they have same amount of sales and net income. From the analysis of Person X the operating leverage is 2 for Company B and 5 for Company Z.

The analytical data indicates that income of Company Z is more volatile than Company B.

Investment in Company Z will be the better choice in an economy boom situation. Otherwise, Company B is considering better. An aggressive investor can choice Company Z and a conservative investor can go for Company B.

Want to see more full solutions like this?

Chapter 2 Solutions

Fundamental Managerial Accounting Concepts with Access

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education