ACCT GOV.+NFP ENTITIES LOOSELEAF W/CONN.

18th Edition

ISBN: 9781260949766

Author: RECK

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 22EP

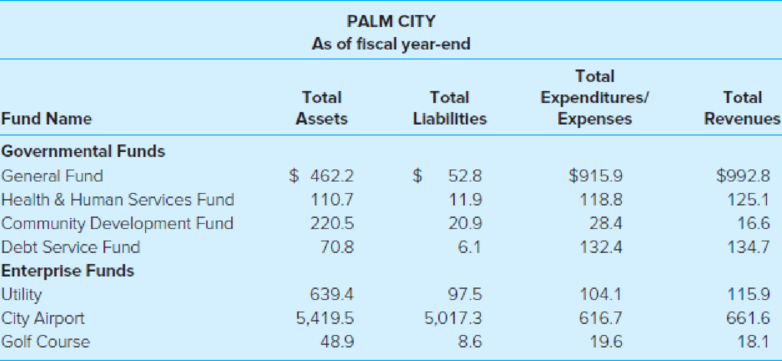

Major Funds. (LO2-4) At the end of the fiscal year, Palm City was trying to determine which of its funds would be required to be reported as major funds in accordance with GASB standards. Palm City has provided the information for all of its governmental and enterprise funds that is needed to determine major fund classification in accordance with GASB standards. Identify for the city which of its funds should be classified as major and explain how you determined that the fund would be considered major under GASB standards.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Hi experts please provide answer this general accounting question

MCQ

What is the correct option? ? General Accounting question

Chapter 2 Solutions

ACCT GOV.+NFP ENTITIES LOOSELEAF W/CONN.

Ch. 2 - Prob. 1QCh. 2 - Prob. 2QCh. 2 - Prob. 3QCh. 2 - Explain the modified accrual basis of accounting....Ch. 2 - Prob. 5QCh. 2 - What is the primary reason government entities use...Ch. 2 - What is meant by the terms deferred outflows of...Ch. 2 - How do expenses and expenditures differ?Ch. 2 - Prob. 9QCh. 2 - Prob. 10Q

Ch. 2 - Accounting and Reporting Principles. (LO2-3) The...Ch. 2 - Prob. 12CCh. 2 - Which of the following statements is true...Ch. 2 - Prob. 16.2EPCh. 2 - Prob. 16.3EPCh. 2 - The measurement focus and basis of accounting that...Ch. 2 - Which of the following amounts that are identified...Ch. 2 - Prob. 16.6EPCh. 2 - Prob. 16.7EPCh. 2 - Under the modified accrual basis of accounting a....Ch. 2 - Prob. 16.9EPCh. 2 - A certain city reports the following year-end...Ch. 2 - Prob. 16.11EPCh. 2 - Prob. 16.12EPCh. 2 - Prob. 16.13EPCh. 2 - Prob. 16.14EPCh. 2 - Which of the following fund(s) will generally be...Ch. 2 - Prob. 17EPCh. 2 - Prob. 18EPCh. 2 - Matching Funds with Transactions. (LO2-3) Choose...Ch. 2 - Fund Balance Classifications. (LO2-3) Section A...Ch. 2 - Prob. 21EPCh. 2 - Major Funds. (LO2-4) At the end of the fiscal...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

What is Fund Accounting?; Author: Aplos;https://www.youtube.com/watch?v=W5D5Dr0j9j4;License: Standard Youtube License