Concept explainers

Consolidated Worksheet at End of the First Year of Ownership (Equity Method)

Peanut Company acquired 100 percent of Snoopy Company’s outstanding common stock for

$300,000 on January 1, 20X8, when the book value of Snoopy’s net assets was equal to $300,000.

Peanut uses the equity method to account for investments.

Required

a. Prepare the

b. Prepare a consolidation worksheet for 20X8 in good form.

a.

Introduction:

The consolidated balance sheet and the worksheets are the computed tools that are used to calculate the retained earnings and the dividend produced by the subsidiaries towards its parent company.

To prepare: A journal entry by equity method for the investment in S company in the year

Answer to Problem 2.21P

The journal entry so passed gives a debit of investment and credit the cash with the same amount.

Explanation of Solution

| Particular | Debit | Credit |

| Equity method entry on books | ||

| Investment in S co. | ||

| Cash | ||

| (Record P co. share of the S co. income) | ||

| Cash | ||

| Investment in the S co. | ||

| (Record P co. share in S co. dividend) | ||

| Investment in S | 75000 | |

| Income from S | 75000 | |

| (To record P share in S income ) |

b.

Concept introduction

The consolidated balance sheet and the worksheets are the computed tools that are used to calculate the retained earnings and the dividend produced by the subsidiaries towards its parent company.

To prepare: The consolidated worksheet for the final values

Explanation of Solution

| Book value calculation | |||||

| Total book value | = | Common stock | + | Retained earnings | |

| Book value | |||||

| Net income | |||||

| Dividend | |||||

| Ending book value |

| Income statement | P | S | Dr. | Cr. | consolidated |

| Sales | |||||

| Less Cogs | |||||

| Depreciation Exp | |||||

| Sel. Exp | |||||

| Income | |||||

| Net income |

| Statement of Retain Earning | P | S | Dr. | Cr. | Consolidated |

| Opening balance | |||||

| Net income | |||||

| Less dividend declared | |||||

| End balance |

| Income statement | P co | S co | Eliminated DR | Eliminated CR | consolidated |

| Cash | |||||

| Accounts received | |||||

| Inventory | |||||

| Investment in S co | |||||

| Land | |||||

| Building and equipment | |||||

| Less accumulated depreciation | |||||

| Total assets | |||||

| Account payable | |||||

| Bonds | |||||

| Common stocks | |||||

| Retained earnings | |||||

| Total liabilities |

Want to see more full solutions like this?

Chapter 2 Solutions

ADV.FIN.ACCT.LL W/CONNECT+PROCTORIO PLUS

- Owe Subject: acountingarrow_forwardRequired information On January 1, 20X2, Power Company acquired 80 percent of Strong Company's outstanding stock for cash. The fair value of the noncontrolling interest was equal to a proportionate share of the book value of Strong Company's net assets at the date of acquisition. Selected balance sheet data at December 31, 20X2 are as follows: Total Assets Liabilities Common Stock Retained Earnings Total Liabilities & Stockholders' Equity Multiple Choice O $35,200 Based on the preceding information, what amount should be reported as noncontrolling interest in net assets in Power Company's December 31, 20X2, consolidated balance sheet? $48,200 $76,800 Power $ 564,000 O $112,800 180,000 150,000 234,000 $ 564,000 Strong $ 216,000 65,000 80,000 96,000 $ 241,000arrow_forwardInstructions At a total cost of $6,950,000, Herrera Corporation acquired 229,500 shares of Tran Corp. common stock as a long-term investment. Herrera Corporation uses the equity method of accounting for this investment. Tran Corp. has 850,000 shares of common stock outstanding, including the shares acquired by Herrera Corporation. Required: A. Journalize the entries by Herrera Corporation on December 31 to record the following information (refer to the Chart of Accounts for exact wording of account titles): 1. Tran Corp. reports net income of $974,000 for the current period. 2. A cash dividend of $0.28 per common share is paid by Tran Corp. during the current period. B. Why is the equity method appropriate for the Tran Corp. investment?arrow_forward

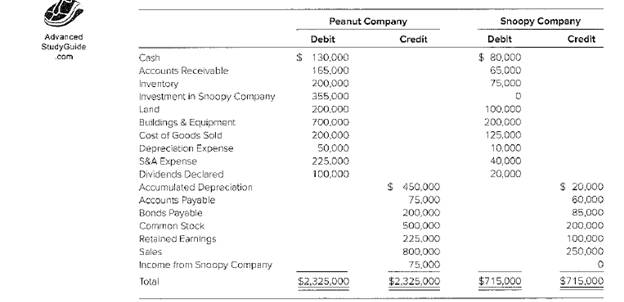

- Peanut Company acquired 100 percent of Snoopy Company’s outstanding common stock for $300,000 on January 1, 20X8, when the book value of Snoopy’s net assets was equal to $300,000. Peanut uses the equity method to account for investments. Trial balance data for Peanut and Snoopy as of December 31, 20X8, are as follows: Peanut Company Snoopy Company Debit Credit Debit Credit Cash $ 130,000 $ 80,000 Accounts Receivable 165,000 65,000 Inventory 200,000 75,000 Investment in Snoopy Company 355,000 0 Land 200,000 100,000 Buildings and Equipment 700,000 200,000 Cost of Goods Sold 200,000 125,000 Depreciation Expense 50,000 10,000 Selling and Administrative Expense 225,000 40,000 Dividends Declared 100,000 20,000 Accumulated Depreciation $ 450,000 $ 20,000 Accounts Payable 75,000 60,000 Bonds Payable 200,000 85,000 Common Stock 500,000 200,000 Retained Earnings 225,000 100,000 Sales 800,000…arrow_forwardPeanut Company acquired 90 percent of Snoopy Company’s outstanding common stock for $270,000 on January 1, 20X8, when the book value of Snoopy’s net assets was equal to $300,000. Peanut uses the equity method to account for investments. Trial balance data for Peanut and Snoopy as of December 31, 20X8, follow: Peanut Company Snoopy Company Debit Credit Debit Credit Cash $ 158,000 $ 80,000 Accounts Receivable 165,000 65,000 Inventory 200,000 75,000 Investment in Snoopy Company 319,500 0 Land 200,000 100,000 Buildings and Equipment 700,000 200,000 Cost of Goods Sold 200,000 125,000 Depreciation Expense 50,000 10,000 Selling & Administrative Expense 225,000 40,000 Dividends Declared 100,000 20,000 Accumulated Depreciation $ 450,000 $ 20,000 Accounts Payable 75,000 60,000 Bonds Payable 200,000 85,000 Common Stock 500,000 200,000 Retained Earnings 225,000 100,000 Sales 800,000 250,000…arrow_forwardPeanut Company acquired 90 percent of Snoopy Company’s outstanding common stock for $270,000 on January 1, 20X8, when the book value of Snoopy’s net assets was equal to $300,000. Peanut uses the equity method to account for investments. Trial balance data for Peanut and Snoopy as of December 31, 20X8, follow: Peanut Company Snoopy Company Debit Credit Debit Credit Cash $ 158,000 $ 80,000 Accounts Receivable 165,000 65,000 Inventory 200,000 75,000 Investment in Snoopy Company 319,500 0 Land 200,000 100,000 Buildings and Equipment 700,000 200,000 Cost of Goods Sold 200,000 125,000 Depreciation Expense 50,000 10,000 Selling & Administrative Expense 225,000 40,000 Dividends Declared 100,000 20,000 Accumulated Depreciation $ 450,000 $ 20,000 Accounts Payable 75,000 60,000 Bonds Payable 200,000 85,000 Common Stock 500,000 200,000 Retained Earnings 225,000 100,000 Sales 800,000 250,000…arrow_forward

- Subject :- Accountingarrow_forwardPeanut Company acquired 90 percent of Snoopy Company's outstanding common stock for $287,100 on January 1, 20X8, when the book value of Snoopy's net assets was equal to $319,000. Peanut uses the equity method to account for investments. Trial balance data for Peanut and Snoopy as of December 31, 20X8, follow: Peanut Company Snoopy Company Cash Accounts Receivable Inventory Debit $ 163,000 Credit 173,000 209,000 Debit $ 87,000 67,000 93,000 Credit Investment in Snoopy Company Land Buildings and Equipment. 342,000 205,000 714,000 93,000 192,000 Cost of Goods Sold 193,000 113,000 Depreciation Expense 42,000 10,000 selling & Administrative Expense 205,000 Dividends Declared 99,000 Accumulated Depreciation $ 443,000 Accounts Payable Bonds Payable Common Stock Retained Earnings Sales Income from Snoopy Company Total 32,000 22,000 $ 20,000 72,000 57,000 200,000 75,000 493,000 199,000 279,300 120,000 783,000 238,000 74,700 0 $ 2,345,000 $ 2,345,000 $ 709,000 $ 709,000 Required: a. Prepare any…arrow_forward4 Peanut Company acquired 80 percent of Snoopy Company's outstanding common stock for $300,000 on January 1, 20X8, when the book value of Snoopy's net assets was equal to $375,000. Peanut uses the eguity method to account for Investments. The following trial balance summarizes the financial position and operations for Peanut and Snoopy as of December 31, 20X9: Peanut Company Snoopy Company Credit Debit Credit Debit $ 272,000 $ 77,000 82, 000 Cash Accounts Receivable 200, eee Inventory 193,e00 319,800 216,e00 706,000 118,000 Investment in Snoopy Company Land 81,000 Buildings and Equipment 199, 000 155,000 13,000 54, 250 34,000 Cost of Goods Sold 375,000 Depreciation Expense Selling & Administrative Expense Dividends Declared 47,000 221,000 224,e00 $ 487,000 $ 39,e00 Accumulated Depreciation Accounts Payable Bonds Payable 55,000 39,e00 137,000 79,250 Common Stock Retained Earnings 491,000 682,400 187,e00 158,eee 319, e00 Sales 844,000 Income from Snoopy Company 77,400 Total $2,773,800…arrow_forward

- i need the answer quicklyarrow_forwardAlmond acquires 80% of the share capital of Cashew on 1 August 20X6 and is preparing its group financial statements for the year ended 31 December 20X6. How will Cashew's results be included in the consolidated statement of financial position at 31 December 20X6? a. 80% of Cashew's assets and liabilities, time apportioned for the 4 months from 1 August 20X6 to 31 December 20X6 b. 80% of Cashew's assets and liabilities at 31 December 20X6 C. 100% of Cashew's assets and liabilities at 31 December 20X6 С. d. 100% of Cashew's assets and liabilities, time apportioned for the 4 months from 1 August 20X6 to 31 December 20X6arrow_forwardP Inc. purchased 81% of the voting shares of S Inc for $696,143 cash on January 1, year 2. P recorded Investment in S at cost. The Balance Sheet of P Inc. & S Inc. for year 5 showed the following balances P Inc. S Inc. Investment $696,143 $90,653 What is the amount for Investment on Consolidated Balance Sheet of P Inc. for year5?arrow_forward