Identifying the Investing and Financing Activities Affecting

Starwood Hotels & Resorts Worldwide. Inc., is one of the world's largest hotel and leisure companies. with more than 1,200 properties in 100 countries. Starwood owns, operates, and franchises hotels, resorts, and residences with the following brands: St. Regis®, The Luxury Collection®, W®, Westin®, Le Méridien®, Sheraton®, Four Points® by Sheraton, Aloft® , and Element®. Information adapted from the company's recent annual statement of cash flows indicates the following investing and financing activities during that year (simplified, in millions of dollars):

| a. | Additional borrowing from banks | $1,290 |

| b. | Purchase of investments | 1 |

| c. | Sale of assets and investments (assume sold at cost) | 806 |

| d. | issuance of stock | 70 |

| e. | Purchases of property, plant, and equipment | 327 |

| f | Payment of debt principal | 108 |

| g- | Dividends paid | 735 |

| h. | Receipt of principal payment on a note receivable | 5 |

Required:

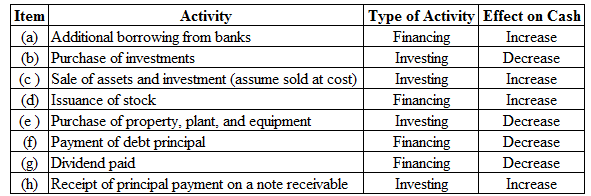

For activities (a) through (h), indicate whether the activity is investing (I) or financing (F) and the direction of the effects on cash flows (+ for increases cash; − for decreases cash).

Identify the activities (a) through (h) indicate whether the activity is investing or financing and the direction of the effects on cash flows whether ‘+’ increase in cash or‘‒’decrease in cash.

Answer to Problem 2.21E

Figure (1)

Explanation of Solution

Investing activities:

Investing activities refer to the activities carried out by a company for acquisition of long term assets. The examples for investing activities are purchase of equipment, long term investment, sale of land, and others.

Financing activities:

Financing activities refer to the activities carried out by a company to mobilize funds to carry out the business activities. The examples for financing activities are purchase of bonds, issuance of common shares, and others.

- (a) Additional borrowing from banks comes under financing activity, and it increases the cash by $1,290 million.

- (b) Purchase of investments comes under investing activity, and it decreases the cash by $1 million.

- (c) Sales of assets and investment (assume sold at cost) comes under investing activity, and it increases the cash by $806 million.

- (d) Issuance of common stock comes under financing activity, and increases the cash by $70 million.

- (e) Purchase of plant, property, and equipment comes under investing activity, and decreases the cash by $327 million.

- (f) Payment of debt principal comes under financing activity, and decreases the cash by $108 million.

- (g) Dividend paid comes under financing activity, and decreases the cash by $735 million.

- (h) Receipt of principal payment on a note receivable comes under investing activity, and increases the cash by $5 million.

Want to see more full solutions like this?

Chapter 2 Solutions

Financial Accounting

- Can you explain this general accounting question using accurate calculation methods?arrow_forwardI am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardI am looking for a step-by-step explanation of this financial accounting problem with correct standards.arrow_forward

- What was the balance in retained earings at december 31, 2024?arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forwardRiverstone Company began the year with inventory worth $87,500. During the year, they purchased additional inventory for $325,000. At the end of the year, a physical count showed inventory worth $93,200. Calculate the Cost of Goods Sold (COGS) for the period using the periodic inventory system.arrow_forward

- What was the balance in retaind earnings at December 31, 2024?arrow_forwardAspireWealth Partners shows drawing account balance $22,000 and capital account $130,000. Determine the proprietor's closing capital. A) $108,000 B) $110,000 C) $112,000 D) $152,000. MCQarrow_forwardCan you explain this financial accounting question using accurate calculation methods?arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub