Advanced Financial Accounting

11th Edition

ISBN: 9780078025877

Author: Theodore E. Christensen, David M Cottrell, Cassy JH Budd Advanced Financial Accounting

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 2.18P

Changes ¡n the Number of Shares Held

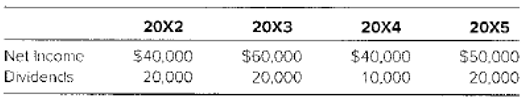

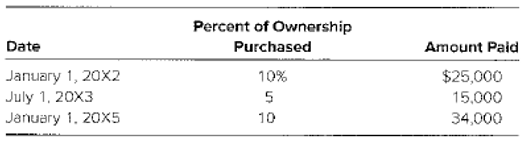

Idle Corporation hasbeen acquiring shares of Fast Track Enterprises at book value forthe last several years Fast Track provided data including the following:

Fast Track declares hind pays its annual dividend on November 1 5 each year. Its net book value on

January 1, 20X2, was $250,000. Idle purchased shares of Fast Track on three occasions:

Required

Give the journalentries to be recorded on Idle’s hooks in 20X5 related to its investment in FastTrack.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

answer

4 PTS

Please provide solution this general accounting question not use ai

Chapter 2 Solutions

Advanced Financial Accounting

Ch. 2 - What types of investments in common stock normally...Ch. 2 - Prob. 2.2AQCh. 2 - When is equity method reporting considered...Ch. 2 - Prob. 2.4QCh. 2 - Prob. 2.5QCh. 2 - Prob. 2.6QCh. 2 - Prob. 2.7QCh. 2 - Prob. 2.8QCh. 2 - How does carrying securities at fair value...Ch. 2 - How does the fully adjusted equity method differ...

Ch. 2 - Prob. 2.11QCh. 2 - What is the modified equity method? When might a...Ch. 2 - Prob. 2.13AQCh. 2 - Prob. 2.14QCh. 2 - Prob. 2.15QCh. 2 - Prob. 2.16QCh. 2 - Prob. 2.17QCh. 2 - How are a subsidiary’s dividend declarations...Ch. 2 - Prob. 2.19QCh. 2 - Give a definition of consolidated retained...Ch. 2 - Prob. 2.21QCh. 2 - Prob. 2.22QCh. 2 - Choice of Accounting Method Slanted Building...Ch. 2 - Prob. 2.2CCh. 2 - Prob. 2.3ACCh. 2 - Prob. 2.4CCh. 2 - Prob. 2.5CCh. 2 - Prob. 2.6CCh. 2 - Prob. 2.1.1ECh. 2 - Multiple-Choice Questions on Accounting for Equity...Ch. 2 - Prob. 2.1.3ECh. 2 - Prob. 2.1.4ECh. 2 - Prob. 2.1.5ECh. 2 - Prob. 2.1.6ECh. 2 - Multiple-Choice Questions on Intercorporate...Ch. 2 - Prob. 2.2.2ECh. 2 - Prob. 2.3.1ECh. 2 - Prob. 2.3.2ECh. 2 - Prob. 2.3.3ECh. 2 - Prob. 2.3.4ECh. 2 - Cost versus Equity Reporting Winston Corporation...Ch. 2 - Prob. 2.5ECh. 2 - Prob. 2.6ECh. 2 - Prob. 2.7ECh. 2 - Income Reporting Grandview Company purchased 40...Ch. 2 - Prob. 2.9ECh. 2 - Carrying an Investment at Fair Value versus Equity...Ch. 2 - Investee with Preferred Stock Outstanding Reden...Ch. 2 - Prob. 2.12AECh. 2 - Prob. 2.13AECh. 2 - Prob. 2.14ECh. 2 - Prob. 2.15ECh. 2 - Prob. 2.16ECh. 2 - Prob. 2.17ECh. 2 - Changes ¡n the Number of Shares Held Idle...Ch. 2 - Prob. 2.19PCh. 2 - Carried at Fair Value Journal Entries Marlow...Ch. 2 - Prob. 2.21APCh. 2 - Equity-Method Income Statement Wealthy...Ch. 2 - Consolidated Worksheet at End of the First Year of...Ch. 2 - Consolidated Worksheet at End of the Second Year...Ch. 2 - Prob. 2.25PCh. 2 - Prob. 2.26PCh. 2 - Prob. 2.27BPCh. 2 - Prob. 2.28BP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- need help this problemarrow_forwardWhat is the percent change in sales for year 2 compared to the base year of this financial accounting question?arrow_forwardPhoenix Industries has twelve million shares outstanding, generates free cash flows of $75 million each year, and has a cost of capital of 12%. It also has $50 million of cash on hand. Phoenix wants to decide whether to repurchase stock or invest the cash in a project that generates free cash flows of $3 million each year. Should Phoenix invest or repurchase the shares? A) Repurchase B) Invest C) Indifferent between options D) Cannot say for sure provide answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Accounting (Text Only)

Accounting

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial instruments products; Author: fi-compass;https://www.youtube.com/watch?v=gvxozM3TUIg;License: Standard Youtube License