MyLab Accounting with Pearson eText -- Access Card -- for Financial Accounting

12th Edition

ISBN: 9780134727677

Author: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

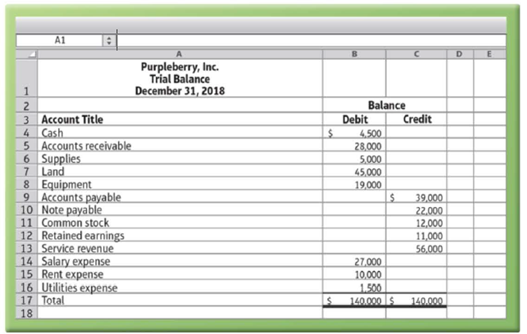

Chapter 2, Problem 2.14S

(Learning Objective 5: Use a

Calculate these amounts for the business:

- 1. Total assets

- 2. Total liabilities

- 3. Net income or net loss during December

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

General Accounting 5.3

Hello teacher please solve this problem

Starma Inc

Chapter 2 Solutions

MyLab Accounting with Pearson eText -- Access Card -- for Financial Accounting

Ch. 2 - All of the following events at a sandwich shop are...Ch. 2 - Identify the asset from the following list of...Ch. 2 - Amounts owed to a company by its customers would...Ch. 2 - Thorpe Corporation purchases a new delivery truck...Ch. 2 - Adam Corporation issues stock to Cara Riley in...Ch. 2 - Blake Company completed a consulting job and...Ch. 2 - Prob. 7QCCh. 2 - Accounts Payable had a normal beginning balance of...Ch. 2 - Which of the following debit and credit rules is...Ch. 2 - A companys beginning Cash balance was 8,000. At...

Ch. 2 - Prob. 11QCCh. 2 - Prob. 12QCCh. 2 - Prob. 13QCCh. 2 - In a double-entry accounting system, a. a debit...Ch. 2 - Prob. 15QCCh. 2 - Prob. 16QCCh. 2 - Prob. 2.1ECCh. 2 - LO 1 (Learning Objective 1: Identify transactions)...Ch. 2 - (Learning Objective 1: Differentiate between...Ch. 2 - (Learning Objective 1: Differentiate between...Ch. 2 - (Learning Objective 2: Show the impact of...Ch. 2 - (Learning Objective 2: Show the impact of...Ch. 2 - LO 3 (Learning Objective 3: Analyze the impact of...Ch. 2 - (Learning Objective 3: Analyze the impact of...Ch. 2 - (Learning Objective 3: Analyze the impact of...Ch. 2 - (Learning Objective 4: Journalize transactions)...Ch. 2 - (Learning Objective 4: Journalize and post...Ch. 2 - (Learning Objective 4: Journalize and post...Ch. 2 - (Learning Objective 4: Journalize transactions)...Ch. 2 - Prob. 2.13SCh. 2 - (Learning Objective 5: Use a trial balance)...Ch. 2 - Prob. 2.15SCh. 2 - (Learning Objectives 1, 2, 3, 4, 5: Define...Ch. 2 - Group A LO 1, 2, 4 (Learning Objectives 1, 2, 4:...Ch. 2 - LO 3 (Learning Objective 3: Analyze the impact of...Ch. 2 - (Learning Objective 3: Analyze the impact of...Ch. 2 - (Learning Objective 2: Show the impact of business...Ch. 2 - (Learning Objective 4: Journalize transactions in...Ch. 2 - (Learning Objectives 4, 5: Post journal entries...Ch. 2 - Prob. 2.23AECh. 2 - (Learning Objective 5: Construct and use a trial...Ch. 2 - (Learning Objective 5: Construct and use a trial...Ch. 2 - (Learning Objective 5: Solve for cash and...Ch. 2 - (Learning Objectives 1, 2, 4: Identify...Ch. 2 - (Learning Objective 3: Analyze the impact of...Ch. 2 - (Learning Objective 3: Analyze the impact of...Ch. 2 - (Learning Objective 2: Show the impact of business...Ch. 2 - LO 4 (Learning Objective 4: Journalize...Ch. 2 - Prob. 2.32BECh. 2 - (Learning Objective 4: Journalize entries and...Ch. 2 - (Learning Objective 5: Construct and use a trial...Ch. 2 - Prob. 2.35BECh. 2 - LO 5 (Learning Objective 5: Solve for cash and...Ch. 2 - (Learning Objectives 4, 5; Journalize and poet...Ch. 2 - Which of the following is an asset? a. Common...Ch. 2 - Prob. 2.39QCh. 2 - The journal entry to record the acquisition of...Ch. 2 - The journal entry to record the purchase of...Ch. 2 - If the credit to record the purchase of supplies...Ch. 2 - The journal entry to record a payment on account...Ch. 2 - If the credit to record the payment of an account...Ch. 2 - Which statement is false? a. A trial balance lists...Ch. 2 - If a corporation purchases a delivery van for...Ch. 2 - Prob. 2.47QCh. 2 - Prob. 2.48QCh. 2 - Prob. 2.49QCh. 2 - Prob. 2.50QCh. 2 - Receiving cash from a customer on account will a....Ch. 2 - Prob. 2.52QCh. 2 - Purchasing a building for 115,000 by paying cash...Ch. 2 - Prob. 2.54QCh. 2 - Prob. 2.55QCh. 2 - Prob. 2.56QCh. 2 - Prob. 2.57QCh. 2 - (Learning Objective 5: Construct and use a trial...Ch. 2 - LO 2,3 (Learning Objectives 2, 3: Analyze the...Ch. 2 - (Learning Objective 4: Journalize transactions and...Ch. 2 - LO 4,5 (Learning Objectives 4, 5: Journalize and...Ch. 2 - Prob. 2.62APCh. 2 - Prob. 2.63BPCh. 2 - Prob. 2.64BPCh. 2 - Prob. 2.65BPCh. 2 - (Learning Objectives 4, 5: Journalize and post...Ch. 2 - (Learning Objectives 3, 5: Analyze the impact of...Ch. 2 - (Learning Objective 5: Analyzing accounts) The...Ch. 2 - Prob. 2.69CEPCh. 2 - Prob. 2.70CEPCh. 2 - (Learning Objectives 2, 3, 4: Analyze the impact...Ch. 2 - Prob. 2.72SCCh. 2 - Prob. 2.73DCCh. 2 - Prob. 2.74DCCh. 2 - Prob. 2.75EICCh. 2 - Prob. 2.76EICCh. 2 - Prob. 1FFCh. 2 - Prob. 1FA

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- MCQarrow_forwardNot use ai given answer general Accountingarrow_forwardStrama, Inc., manufactures and sells two products: Product A6 and Product Is. The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity: Expected Activity Activity Cost Pools Activity Measures Estimated Overhead Cost (5) Product A6 | Product Is Total Labor-related Production orders Order size DLHs $187,682 9,300 Orders $39,125 2,350 4,900 2,750 14,200 5,100 MHS $175,140 7,600 7,800 15,400 $ 401,897 The activity rate for the Order Size activity cost pool under activity-based costing is: A. $29.58 per MH B. $15.10 per MH C. $11.87 per MH D. $19.80 per MHarrow_forward

- Pell Company acquires 80% of Demers Company for $500,000 on January 1, 2022. Demers reported common stock of $300,000 and retained earnings of $210,000 on that date. Equipment was undervalued by $30,000 and buildings were undervalued by $40,000, each having a 10-year remaining life. Any excess consideration transferred over fair value was attributed to goodwill with an indefinite life. Based on an annual review, goodwill has not been impaired. Demers earns income and pays dividends as follows: 2022 2023 2024 Net income $ 100,000 $ 120,000 $ 130,000 Dividends 40,000 50,000 60,000 Assume the equity method is applied. Compute Pell's equity income from Demers for the year ended December 31, 2022. Multiple Choice $42,400 $74,400 $73,000 $41,000 $80,000arrow_forwardNo Wrong Answerarrow_forward?? Financial accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:CengagePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License