Concept explainers

Analyzing the Effects of Transactions In T-Accounts

Precision Builders Construction Company was incorporated by Chris Stoschek. The following activities occurred during the year:

- a. Received from three investors $60,000 cash and land valued at $35,000: each investor was issued 1,000 shams of common stock with a par value of $0.10 per share.

- b. Purchased construction equipment for use in the business at a cost of $36,000: one-fourth was paid in cash and the company signed a note for the balance (due in six months).

- c. Lent $2,500 to one of the investors, who signed a note due in six months.

- d. Chris Stoschek purchased a truck for personal use: paid $5,000 down and signed a one-year note for $22,000.

- e. Paid $12,000 on the note for the construction equipment in (b) (ignore interest).

Required:

- 1. Create T-accounts for the following accounts: Cash. Notes Receivable. Equipment, Land, Notes Payable. Common Stock, and Additional Paid-in Capital. Beginning balances are $0. For each of the transactions (a) through (e). record the effects of the transaction in the appropriate T-accounts. Include good referencing and totals for each T-account.

- 2. Using the balances in the T-accounts. Till in the following amounts for the

accounting equation: Assets $_______ = Liabilities $ ______ + Stockholders’ Equity $_________

- 3. Explain your response to event (d).

- 4. Compute the market value per share of the stock issued in (a).

1.

Prepare T-accounts for the given accounts.

Explanation of Solution

T-account:

T-account refers to an individual account, where the increases or decreases in the value of specific asset, liability, stockholder’s equity, revenue, and expenditure items are recorded.

This account is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.’ An account consists of the three main components which are as follows:

- (a) The title of the account

- (b) The left or debit side

- (c) The right or credit side

T-accounts for the given accounts are as follows:

| Cash | |||

| Beg. | 0 | ||

| (a) | 60,000 | 9,000 | (b) |

| 2,500 | (c) | ||

| 12,000 | (e) | ||

| 36,500 | |||

| Notes Receivable | |||

| Beg. | 0 | ||

| (c) | 2,500 | ||

| 2,500 | |||

| Land | |||

| Beg. | 0 | ||

| (a) | 35,000 | ||

| 35,000 | |||

| Notes Payable | |||

| 0 | Beg. | ||

| (e) | 12,000 | 27,000 | (b) |

| 15,000 | |||

| Common Stock | |||

| 0 | Beg. | ||

| 300 | (a) (1) | ||

| 300 | |||

| Additional Paid-in Capital | |||

| 0 | Beg. | ||

| 94,700 | (a) (12) | ||

| 94,700 | |||

Working note:

Calculate the value of common stock for event (a).

Calculate the value of additional paid in capital for event (a).

2.

Discuss the accounting equation effect for the given accounts.

Explanation of Solution

Accounting equation:

Accounting equation is an accounting tool expressed in the form of equation, by creating a relationship between the resources or assets of a company, and claims on the resources by the creditors and the owners. Accounting equation is expressed as shown below:

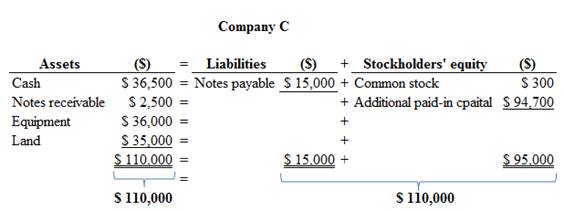

Accounting equation effect for given accounts is as follows:

Figure (1)

Therefore, the total assets are equal to the liabilities and stockholder’s equity.

3.

Explain the response to events (d).

Explanation of Solution

Transaction:

A transaction is a business event which has a monetary value that creates an impact on the business. The process of identifying the economic effects of each transaction of the business is known as transaction analysis.

Event (d) – In this case, there is no exchange of cash, goods or service. So it is not a transaction.

4.

Calculate the market value of per share.

Explanation of Solution

Stock:

Stock represents the number of shares owned by the investors (individual or group) in a Corporation.

Calculate the market value of per share

Here,

Total amount of cash received at the time of issuance of share is $95,000

Number of shares issued is 3,000 shares

Therefore, the market value of per share is $31.67.

Want to see more full solutions like this?

Chapter 2 Solutions

FINANCIAL ACCOUNTING 9TH

- A company reported the following information for its most recent year of operation: purchases, $175,000; beginning inventory, $35,000; and cost of goods sold, $180,000. How much was the company's ending inventory?need helparrow_forwardI need help with this problem and accountingarrow_forwardAt the beginning of the year, Vertex Technologies, Inc. determined that estimated overhead costs would be $540,000, while actual overhead costs for the year totaled $562,000. Furthermore, it was determined that the estimated allocation basis would be 60,000 machine hours, while production actually required 63,500 machine hours. What was the dollar amount of underallocated or overallocated manufacturing overhead?arrow_forward

- Armani Manufacturing produces widgets at a variable cost of $12 per unit. Fixed costs are $180,000 per year. If each widget sells for $27, how many units must be sold to break even?arrow_forwardWhat characterizes the aggregate constraint principle in accounting? (a) Economic constraints don't affect reporting (b) Only individual transactions matter (c) Resources available limit total possible economic activity reporting (d) Business size determines all limitationsarrow_forwardIcarus Tools produces 4,100 units. Each unit was expected to require 2.2 labor hours at a cost of $12 per hour. Total labor cost was $107,100 for 9,000 hours worked. Direct labor is measured in labor hours. What is the flexible budget variance for direct labor?arrow_forward

- The actual cost of direct labor per hour is $29.75 and the standard cost of direct labor per hour is $31.20. The direct labor hours allowed per finished unit is 0.85hours. During the current period, 7,500 units of finished goods were produced using 4,100 direct labor hours. How much is the direct labor rate variance?arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forwardFind outarrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,