a.

Record the given transactions in an

a.

Explanation of Solution

Record the given transactions in an

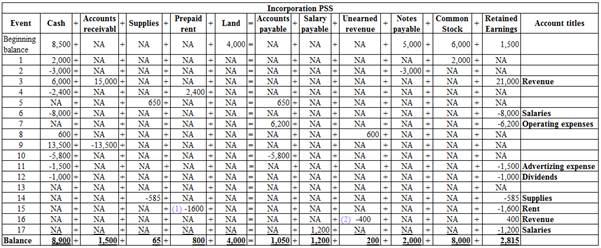

Table (1)

Cash: Cash represents the cash reserves available with the company at a point of time.

Prepaid Expense: Prepaid expense refers to the expense made for the service prior to the consumption or utilization, and is recorded as an asset.

Accounts payable: Accounts payable is a liability of the firm, which refers to the accounts which the company owes for purchase of certain goods or services in the past; hence it is shown in the

Unearned revenue: It is an advance made by the buyer before receiving the product or service. In upcoming period, the seller will have an obligation to provide goods or perform the services to the buyer for the payment already received. It is a current liability until the goods are delivered or the service is performed.

Common stock: These are the ordinary shares that a corporation issues to the investors in order to raise funds. In return, the investors receive a share of profit from the profits earned by the corporation in the form of dividend.

Retained earnings: Retained earnings are the portion of earnings kept by the business for the purpose of reinvestments, payment of debts, or for future growth. In other words, Accumulated amount of all net income less the accumulated amount of dividends declared till date is known as retained earnings.

Revenues: Revenue refers to the income received from the business activity or sale of the output, during the accounting period.

Expenses: Expenses refer to the cost incurred on the necessary purchases of the fixed assets by the firm, or the production of the goods and services, during the accounting period.

Working notes:

Calculate the rent expense

$4,800 paid in advance for one year contract to rent office space (event no. 4). Rent expense recognized for eight months.

Calculate revenue recognized from transaction 8.

b)

Prepare an income statement, statement of changes in

b)

Explanation of Solution

Prepare an income statement, statement of changes in stockholders’ equity, balance sheet, and statement of cash flows for the Year 2012.

Income statement: Income statement is a financial statement that shows the net income or net loss by deducting the expenses from the revenues.

| Incorporation PSS | ||

| Income Statement | ||

| For the Year Ended December 31, 2012 | ||

| Particulars | Amount ($) |

Amount ($) |

| Service Revenue | $21,400 | |

| Expenses | ||

| Salaries Expense | $9,200 | |

| Other Operating Expenses | 6,200 | |

| Advertising Expense | 1,500 | |

| Supplies Expense | 585 | |

| Rent Expense | 1,600 | |

| Total Expenses | 19,085 | |

| Net Income | $ 2,315 | |

Table (2)

Statement of changes in stockholders’ equity: It is one of the financial statements which report the changes in the stockholders equity from the beginning stockholder's equity to ending stockholder's equity.

| Incorporation PSS | ||

| Statement of changes in stockholders’ Equity | ||

| For the Year Ended December 31, 2012 | ||

| Particulars |

Amount ($) |

Amount ($) |

| Beginning Common Stock | 6,000 | |

| Add: Common Stock Issued | 2,000 | |

| Ending Common Stock | 8,000 | |

| Beginning Retained Earnings | 1,500 | |

| Add: Net Income | 2,315 | |

| Less: Dividends | (1,000) | |

| Ending Retained Earnings | 2,815 | |

| Total Stockholders’ Equity | 10,815 | |

Table (3)

Balance Sheet: Balance Sheet summarizes the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business

| Incorporation PSS | ||

| Balance Sheet | ||

| As of December 31, 2012 | ||

| Particulars |

Amount ($) |

Amount ($) |

| Assets | ||

| Cash | $8,900 | |

| Accounts Receivable | 1,500 | |

| Supplies | 65 | |

| Prepaid Rent | 800 | |

| Land | 4,000 | |

| Total Assets | $15,265 | |

| Liabilities | ||

| Accounts Payable | $1,050 | |

| Unearned Revenue | 200 | |

| Salaries Payable | 1,200 | |

| Notes Payable | 2,000 | |

| Total Liabilities | $ 4,450 | |

| Stockholders’ Equity | ||

| Common Stock | $8,000 | |

| Retained Earnings | 2,815 | |

| Total Stockholders’ Equity | 10,815 | |

| Total Liabilities and Stockholders’ Equity | $15,265 | |

Table (4)

Statement of cash flows: This statement reports all the cash transactions which are responsible for inflow and outflow of cash, and result of these transactions is reported as ending balance of cash at the end of reported period.

| Incorporation PSS | ||

| Statement of cash flows | ||

| For the Year Ended December 31, 2012 | ||

| Particulars |

Amount ($) |

Amount ($) |

| Cash Flows From Operating Activities: | ||

| Cash Receipts from Customers (3) | $20,100 | |

| Cash Payment for Expenses (4) | (17,700) | |

| Net Cash Flow from Operating Activities | $2,400 | |

| Cash Flows From Investing Activities: | 0 | |

| Cash Flows From Financing Activities: | ||

| Cash Receipts from Stock Issue | $ 2,000 | |

| Cash Payments on Loan | (3,000) | |

| Cash Payments for Dividends | (1,000) | |

| Net Cash Flow from Financing Activities | (2,000) | |

| Net Increase in Cash | 400 | |

| Add: Beginning Cash Balance | 8,500 | |

| Ending Cash Balance | $8,900 | |

Table (5)

Working note:

Calculate the cash receipts from the customers.

| Particulars |

Amount ($) |

| Cash sales | 6,000 |

| Cash received from unearned income | 600 |

| Collection of accounts receivables | 13,500 |

| Cash receipts from the customers | 20,100 |

(3)

Table (6)

Calculate the cash payments for expenses.

| Particulars |

Amount ($) |

| Payment of prepaid rent | 2,400 |

| Payment of salaries | 8,000 |

| Payment of accounts payable | 5,800 |

| Payment of advertising expenses | 1,500 |

| Cash payments for expenses | 17,700 |

(4)

Table (7)

Want to see more full solutions like this?

Chapter 2 Solutions

Fundamental Financial Accounting Concepts, 9th Edition

- I need help with this problem and accounting questionarrow_forwardThe equipment was sold for $60,000 The equipment was originally purchased for $33,000. At the time of the sale, the equipment had accumulated depreciation of$30,000. Calculate the gain or loss to be recorded on the sale of equipment. I want answerarrow_forwardThe predetermined overhead rate for RON Company is $10, comprised of a variable overhead rate of $6 and a fixed rate of $4. The amount of budgeted overhead costs at a normal capacity of $300,000 was divided by the normal capacity of 30,000 direct labor hours, to arrive at the predetermined overhead rate of $10. Actual overhead for July was $40,000 variable and $28,200 fixed, and the standard hours allowed for the product produced in July was 7,000 hours. The total overhead variance is: A. $6,100 U B. $1,100 U C. $500 U D. $1,800 F.Answerarrow_forward

- The equipment was sold for $60,000 The equipment was originally purchased for $33,000. At the time of the sale, the equipment had accumulated depreciation of$30,000. Calculate the gain or loss to be recorded on the sale of equipment. Provide answerarrow_forwardThe equipment was sold for $60,000 The equipment was originally purchased for $33,000. At the time of the sale, the equipment had accumulated depreciation of$30,000. Calculate the gain or loss to be recorded on the sale of equipment.arrow_forward??!!arrow_forward

- Meridian Manufacturing estimates that annual manufacturing overhead costs will be $924,500. Estimated annual operating activity bases are direct labor costs of $530,000, direct labor hours of 53,000, and machine hours of 106,000. Compute the predetermined overhead rate for each activity base. a. Overhead rate per direct labor cost. b. Overhead rate per direct labor hour. c. Overhead rate per machine hour.arrow_forwardAt the beginning of the year, Ironclad Corp. had total assets of $920,000 and total liabilities of $610,000. During the year, total liabilities increased by $90,000 and stockholders' equity decreased by $45,000. What is the amount of total assets at the end of the year?arrow_forwardNeed answer the financial accounting questionarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education