Concept explainers

The transactions completed by PS Music during June 20Y5 were described at the end of Chapter 1. The following transactions were completed during July, the second month of the business’s operations:

July 1. Peyton Smith made an additional investment in PS Music in exchange for common stock by depositing $5,000 in PS Music’s checking account.

1. Instead of continuing to share office space with a local real estate agency, Peyton decided to rent office space near a local music store. Paid rent for July, $1,750.

1. Paid a premium of $2,700 for a comprehensive insurance policy covering liability, theft, and fire. The policy covers a one-year period.

2. Received $1,000 on account.

3. On behalf of PS Music, Peyton signed a contract with a local radio station, KXMD, to provide guest spots for the next three months. The contract requires PS Music to provide a guest disc jockey for 80 hours per month for a monthly fee of $3,600. Any additional hours beyond 80 will be billed to KXMD at $40 per hour. In accordance with the contract, Peyton received $7,200 from KXMD as an advance payment for the first two months.

3. Paid $250 on account.

4. Paid an attorney $900 for reviewing the July 3 contract with KXMD. (Record as Miscellaneous Expense.)

5. Purchased office equipment on account from Office Mart, $7,500.

8. Paid for a newspaper advertisement, $200.

11. Received $1,000 for serving as a disc jockey for a party.

13. Paid $700 to a local audio electronics store for rental of digital recording equipment.

14. Paid wages of $1,200 to receptionist and part-time assistant.

Enter the following transactions on Page 2 of the two-column journal:

16. Received $2,000 for serving as a disc jockey for a wedding reception.

18. Purchased supplies on account, $850.

21. Paid $620 to Upload Music for use of its current music demos in making various music sets.

22. Paid $800 to a local radio station to advertise the services of PS Music twice daily for the remainder of July.

23. Served as disc jockey for a party for $2,500. Received $750, with the remainder due August 4, 20Y5.

27. Paid electric bill, $915.

28. Paid wages of $1,200 to receptionist and part-time assistant.

29. Paid miscellaneous expenses, $540.

30. Served as a disc jockey for a charity ball for $1,500. Received $500, with the remainder due on August 9, 20Y5.

31. Received $3,000 for serving as a disc jockey for a party.

31. Paid $1,400 royalties (music expense) to National Music Clearing for use of various artists’ music during July.

31. Paid dividends, $1,250.

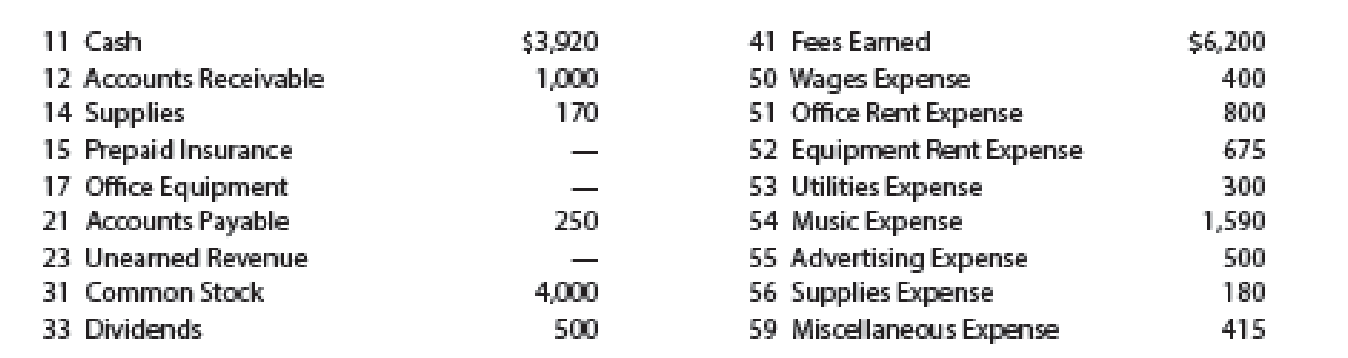

PS Music’s chart of accounts and the balance of accounts as of July 1, 20Y5 (all normal balances), are as follows:

Instructions

1. Enter the July 1, 20Y5, account balances in the appropriate balance column of a four-column account. Write Balance in the Item column, and place a check mark (✓) in the Posting Reference column. (Hint: Verify the equality of the debit and credit balances in the ledger before proceeding with the next instruction.)

2. Analyze and journalize each transaction in a two-column journal beginning on Page 1, omitting

3. Post the journal to the ledger, extending the account balance to the appropriate balance column after each posting.

4. Prepare an unadjusted

(2) and (3)

Journalize the transactions of July in a two column journal beginning on page 18.

Explanation of Solution

Journal:

Journal is the book of original entry. Journal consists of the day today financial transactions in a chronological order. The journal has two aspects; they are debit aspect and the credit aspect.

Rules of debit and credit:

“An increase in an asset account, an increase in an expense account, a decrease in liability account, and a decrease in a revenue account should be debited.

Similarly, an increase in liability account, an increase in a revenue account and a decrease in an asset account, a decrease in an expenses account should be credited”.

Journalize the transactions of July in a two column journal beginning on page 1.

| Journal Page 1 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| 20Y5 | Cash | 11 | 5,000 | ||

| July | 1 | Common stock | 31 | 5,000 | |

| (To record the common stock) | |||||

| 1 | Office rent expense | 51 | 1,750 | ||

| Cash | 11 | 1,750 | |||

| (To record the payment of rent for the month of July) | |||||

| 1 | Prepaid insurance | 15 | 2,700 | ||

| Cash | 11 | 2,700 | |||

| (To record the payment of insurance premium) | |||||

| 2 | Cash | 11 | 1,000 | ||

| Accounts receivable | 12 | 1,000 | |||

| (To record the receipt of cash from customers) | |||||

| 3 | Cash | 11 | 7,200 | ||

| Unearned revenue | 23 | 7,200 | |||

| (To record the cash received for the service yet to be provide) | |||||

| 3 | Accounts payable | 21 | 250 | ||

| Cash | 11 | 250 | |||

| (To record the payment made to creditors on account) | |||||

| 4 | Miscellaneous expense | 59 | 900 | ||

| Cash | 11 | 900 | |||

| (To record the payment made for Miscellaneous expense) | |||||

| 5 | Office equipment | 17 | 7,500 | ||

| Accounts payable | 21 | 7,500 | |||

| (To record the purchase of equipment on account) | |||||

| 8 | Advertising expense | 55 | 200 | ||

| Cash | 11 | 200 | |||

| (To record the payment of advertising expense) | |||||

| 11 | Cash | 11 | 1,000 | ||

| Fees earned | 41 | 1,000 | |||

| (To record the receipt of cash) | |||||

| 13 | Equipment rent expense | 52 | 700 | ||

| Cash | 11 | 700 | |||

| (To record the payment made to equipment) | |||||

| 14 | Wages expense | 50 | 1,200 | ||

| Cash | 11 | 1,200 | |||

| (To record the payment of wages) | |||||

Table (1)

| Journal Page 2 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| 20Y5 | 16 | Cash | 11 | 2,000 | |

| July | Fees earned | 41 | 2,000 | ||

| (To record the receipt of cash) | |||||

| 18 | Supplies | 14 | 850 | ||

| Accounts payable | 21 | 850 | |||

| (To record the purchase of supplies) | |||||

| 21 | Music expense | 54 | 620 | ||

| Cash | 11 | 620 | |||

| (To record the payment incurred for music) | |||||

| 22 | Advertising expense | 55 | 800 | ||

| Cash | 11 | 800 | |||

| (To record the payment of advertising expense) | |||||

| 23 | Cash | 11 | 750 | ||

| Accounts receivable | 12 | 1,750 | |||

| Fees earned | 41 | 2,500 | |||

| (To record the receipt of cash for the service performed party for cash and party on account) | |||||

| 27 | Utilities expense | 53 | 915 | ||

| Cash | 11 | 915 | |||

| (To record the payment of electricity) | |||||

| 28 | Wages expense | 50 | 1,200 | ||

| Cash | 11 | 1,200 | |||

| (To record the payment made for salary and commission expense) | |||||

| 29 | Miscellaneous expense | 59 | 540 | ||

| Cash | 11 | 540 | |||

| (To record the revenue earned and billed) | |||||

| 30 | Cash | 11 | 500 | ||

| Accounts receivable | 12 | 1,000 | |||

| Fees earned | 41 | 1,500 | |||

| (To record the purchase of land party for cash and party on signing a note) | |||||

| 31 | Cash | 11 | 3,000 | ||

| Fees earned | 41 | 3,000 | |||

| (To record the receipt of cash) | |||||

| 31 | Music expense | 54 | 1,400 | ||

| Cash | 11 | 620 | |||

| (To record the payment incurred for music) | |||||

| 31 | Dividends | 32 | 1,250 | ||

| Cash | 11 | 1,250 | |||

| (To record the withdrawal of cash for personal use) | |||||

Table (2)

(1) and (3)

Record the balance of each account in the appropriate balance column of a four-column account and post them to the ledger.

Explanation of Solution

General ledger: General ledger is a record of all accounts of assets, liabilities, and stockholders’ equity, necessary to prepare financial statements.

Record the balance of each account in the appropriate balance column:

| Account: Cash Account no. 11 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 1 | Balance | ✓ | 3,920 | |||

| 1 | 1 | 5,000 | 8,920 | ||||

| 1 | 1 | 1,750 | 7,170 | ||||

| 1 | 1 | 2,700 | 4,470 | ||||

| 2 | 1 | 1,000 | 5,470 | ||||

| 3 | 1 | 7,200 | 12,670 | ||||

| 3 | 1 | 250 | 12,420 | ||||

| 4 | 1 | 900 | 11,520 | ||||

| 8 | 1 | 200 | 11,320 | ||||

| 11 | 1 | 1,000 | 12,320 | ||||

| 13 | 1 | 700 | 11,620 | ||||

| 14 | 1 | 1,200 | 10,420 | ||||

| 16 | 2 | 2,000 | 12,420 | ||||

| 21 | 2 | 620 | 11,800 | ||||

| 22 | 2 | 800 | 11,000 | ||||

| 23 | 2 | 750 | 11,750 | ||||

| 27 | 2 | 915 | 10,835 | ||||

| 28 | 2 | 1,200 | 9,635 | ||||

| 29 | 2 | 540 | 9,095 | ||||

| 30 | 2 | 500 | 9,595 | ||||

| 31 | 2 | 3,000 | 12,595 | ||||

| 31 | 2 | 1,400 | 11,195 | ||||

| 31 | 2 | 1,250 | 9,945 | ||||

Table (3)

| Account: Accounts Receivable Account no. 12 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 1 | Balance | ✓ | 1,000 | |||

| 2 | 1 | 1,000 | – | – | |||

| 23 | 2 | 1,750 | 1,750 | ||||

| 30 | 2 | 1,000 | 2,750 | ||||

Table (4)

| Account: Supplies Account no. 14 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 1 | Balance | ✓ | 170 | |||

| 18 | 2 | 850 | 1,020 | ||||

Table (5)

| Account: Prepaid Insurance Account no. 15 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 1 | 1 | 2,700 | 2,700 | |||

Table (6)

| Account: Office equipment Account no. 17 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 5 | 1 | 7,500 | 7,500 | |||

Table (7)

| Account: Accounts Payable Account no. 21 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 1 | Balance | ✓ | 250 | |||

| 3 | 1 | 250 | – | – | |||

| 5 | 1 | 7,500 | 7,500 | ||||

| 18 | 2 | 850 | 8,350 | ||||

Table (8)

| Account: Unearned Revenue Account no. 23 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 3 | 1 | 7,200 | 7,200 | |||

Table (9)

| Account: Common stock Account no. 31 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 1 | Balance | ✓ | 4000 | |||

| 1 | 1 | 5,000 | 9,000 | ||||

Table (10)

| Account: Dividends Account no. 33 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 1 | Balance | ✓ | 500 | |||

| 31 | 2 | 1,250 | 1,750 | ||||

Table (11)

| Account: Fees earned Account no. 41 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 1 | Balance | ✓ | 6,200 | |||

| 11 | 1 | 1,000 | 7,200 | ||||

| 16 | 2 | 2,000 | 9,200 | ||||

| 23 | 2 | 2,500 | 11,700 | ||||

| 30 | 2 | 1,500 | 13,200 | ||||

| 31 | 2 | 3,000 | 16,200 | ||||

Table (12)

| Account: Wages expense Account no. 50 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 1 | Balance | ✓ | 400 | |||

| 14 | 1 | 1,200 | 1,600 | ||||

| 28 | 2 | 1,200 | 2,800 | ||||

Table (13)

| Account: Office rent expense Account no. 51 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 1 | Balance | ✓ | 800 | |||

| 1 | 1 | 1,750 | 2,550 | ||||

Table (14)

| Account: Equipment rent expense Account no. 52 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 1 | Balance | ✓ | 675 | |||

| 13 | 1 | 700 | 1,375 | ||||

Table (15)

| Account: Utility expense Account no. 53 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 1 | Balance | ✓ | 300 | |||

| 27 | 2 | 915 | 1,215 | ||||

Table (16)

| Account: Music expense Account no. 54 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 1 | Balance | ✓ | 1,590 | |||

| 21 | 2 | 620 | 2,210 | ||||

| 31 | 2 | 1,400 | 3,610 | ||||

Table (17)

| Account: Advertising expense Account no. 55 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 1 | Balance | ✓ | 500 | |||

| 8 | 1 | 200 | 700 | ||||

| 22 | 2 | 800 | 1,500 | ||||

Table (18)

| Account: Supplies expense Account no. 56 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 1 | Balance | ✓ | 180 | |||

Table (19)

| Account: Miscellaneous expense Account no. 59 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20Y5 | |||||||

| July | 1 | Balance | ✓ | 415 | |||

| 4 | 1 | 900 | 1,315 | ||||

| 29 | 2 | 540 | 1,855 | ||||

Table (20)

(4)

Prepare an unadjusted trial balance of Company PS Music at July 31, 20Y5.

Explanation of Solution

Unadjusted trial balance:

The unadjusted trial balance is the summary of all the ledger accounts that appears on the ledger accounts before making adjusting journal entries.

Prepare an unadjusted trial balance of Company PSM at July 31, 20Y5 as follows:

|

Company PSM Unadjusted Trial Balance July 31, 20Y5 | |||

| Particulars |

Account No. | Debit $ | Credit $ |

| Cash | 11 | 9,945 | |

| Accounts receivable | 12 | 2,750 | |

| Supplies | 14 | 1,020 | |

| Prepaid insurance | 15 | 2,700 | |

| Office Equipment | 17 | 7,500 | |

| Accounts payable | 21 | 8,350 | |

| Unearned revenue | 23 | 7,200 | |

| Common Stock | 31 | 9,000 | |

| Dividends | 33 | 1,750 | |

| Fees earned | 41 | 16,200 | |

| Wages expense | 50 | 2,800 | |

| Office Rent expense | 51 | 2,550 | |

| Equipment Rent expense | 52 | 1,375 | |

| Utilities expense | 53 | 1,215 | |

| Music expense | 54 | 3,610 | |

| Advertising expense | 55 | 1,500 | |

| Supplies expense | 56 | 180 | |

| Miscellaneous expense | 59 | 1,855 | |

| Total | 40,750 | 40,750 | |

Table (21)

The debit column and credit column of the unadjusted trial balance are agreed, both having balance of $40,750.

Want to see more full solutions like this?

Chapter 2 Solutions

Financial and Managerial Accounting - CengageNow

- You invest 60% of your money in Asset A (expected return = 8%, standard deviation = 12%) and 40% in Asset B (expected return = 5%, standard deviation = 8%). The correlation coefficient between the two assets is 0.3. What is the expected return and standard deviation of the portfolio?need jelparrow_forwardI mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.no aiarrow_forward1) Identify whethere the company is paying out dividends based on the attached statement. 2) Describe in detail how that the company’s dividend payouts have changed over the past five years. 3)Describe in detail the changes in “total equity” (representing the current “book value” of the company).arrow_forward

- Which is not an objective of internal controls?A. Safeguard assetsB. Improve profitsC. Ensure accurate recordsD. Promote operational efficiencyneed helparrow_forwardWhich is not an objective of internal controls?A. Safeguard assetsB. Improve profitsC. Ensure accurate recordsD. Promote operational efficiencyno aiarrow_forwardCan you solve this general accounting problem using appropriate accounting principles?arrow_forward

- Which is not an objective of internal controls?A. Safeguard assetsB. Improve profitsC. Ensure accurate recordsD. Promote operational efficiency no aiarrow_forwardPlease provide the accurate answer to this financial accounting problem using appropriate methods.arrow_forwardI am searching for the accurate solution to this financial accounting problem with the right approach.arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning