PRINCIPLES OF TAXATION F/BUS.+INVEST.

22nd Edition

ISBN: 9781259917097

Author: Jones

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 16QPD

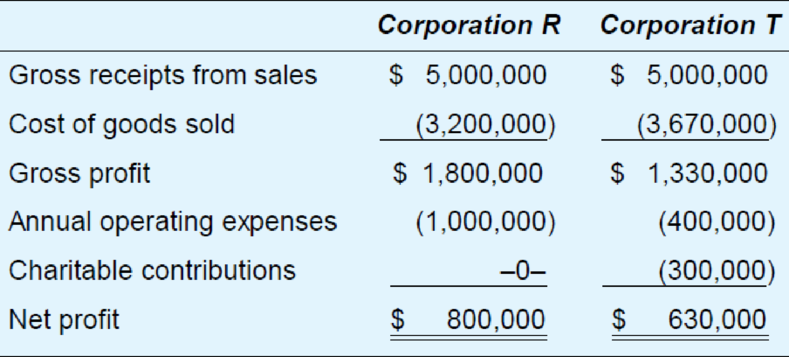

Corporation R and Corporation T conduct business in Jurisdiction Q. The corporations’ financial records for last year show the following.

Jurisdiction Q decided to enact a tax on corporations conducting business within its jurisdiction but has not decided on the tax base. Identify four different tax bases suggested by the corporations’ financial records and discuss each base in terms of horizontal equity.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Kindly help me with accounting questions

Quick answer of this accounting questions

Can you help me with accounting questions

Chapter 2 Solutions

PRINCIPLES OF TAXATION F/BUS.+INVEST.

Ch. 2 - What evidence suggests that the federal tax system...Ch. 2 - Prob. 3QPDCh. 2 - National governments have the authority to print...Ch. 2 - In each of the following cases, discuss how the...Ch. 2 - Prob. 6QPDCh. 2 - Ms. V resides in a jurisdiction with a 35 percent...Ch. 2 - What nonmonetary incentives affect the amount of...Ch. 2 - Prob. 9QPDCh. 2 - Prob. 10QPDCh. 2 - Discuss the tax policy implications of the saying...

Ch. 2 - Prob. 12QPDCh. 2 - Jurisdiction E spends approximately 7 million each...Ch. 2 - Prob. 14QPDCh. 2 - Prob. 15QPDCh. 2 - Corporation R and Corporation T conduct business...Ch. 2 - Ms. P is considering investing 20,000 in a new...Ch. 2 - Country M levies a 10 percent excise tax on the...Ch. 2 - The city of Lakeland levies a 2 percent tax on the...Ch. 2 - The city of Clement levies a 5 percent tax on the...Ch. 2 - Mrs. K, a single taxpayer, earns a 42,000 annual...Ch. 2 - Prob. 5APCh. 2 - Prob. 6APCh. 2 - Prob. 7APCh. 2 - Jurisdiction B levies a flat 7 percent tax on the...Ch. 2 - Jurisdiction X levies a flat 14 percent tax on...Ch. 2 - Prob. 10APCh. 2 - Prob. 11APCh. 2 - Country A levies an individual income tax with the...Ch. 2 - Prob. 13APCh. 2 - Prob. 14APCh. 2 - Prob. 1IRPCh. 2 - Identify the tax issue or issues suggested by the...Ch. 2 - Prob. 3IRPCh. 2 - Prob. 4IRPCh. 2 - Prob. 5IRPCh. 2 - Prob. 6IRPCh. 2 - Prob. 1TPC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I don't need ai answer general accounting questionarrow_forwardAnswer? ? Financial accounting questionarrow_forwardData for the two departments of Gurley Industries for September of the current fiscal year are as follows: Drawing Department Winding Department Work in process, September 1 4,900 units, 20% completed 3,000 units, 65% completed Completed and transferred to next processing department during September 67,100 units 66,000 units Work in process, September 30 3,700 units, 55% completed 4,100 units, 20% completed Production begins in the Drawing Department and finishes in the Winding Department. Question Content Area a. If all direct materials are placed in process at the beginning of production, determine the direct materials and conversion equivalent units of production for September for the Drawing Department. If an amount is zero, enter in "0". Drawing DepartmentDirect Materials and Conversion Equivalent Units of ProductionFor September Line Item Description Whole Units Direct MaterialsEquivalent Units ConversionEquivalent Units Inventory in process,…arrow_forward

- The charges to Work in Process—Assembly Department for a period, together with information concerning production, are as follows. All direct materials are placed in process at the beginning of production. Work in Process-Assembly Department Transaction Debit amount Transaction Credit amount Bal., 3,000 units, 45% completed 6,900 To Finished Goods, 69,000 units ? Direct materials, 71,000 units @ $1.4 99,400 Direct labor 106,400 Factory overhead 41,440 Bal., ? units, 55% completed ? Cost per equivalent units of $1.40 for Direct Materials and $2.10 for Conversion Costs. a. Based on the above data, determine the different costs listed below. Line Item Description Amount 1. Cost of beginning work in process inventory completed this period fill in the blank 1 of 4$ 2. Cost of units transferred to finished goods during the period fill in the blank 2 of 4$ 3. Cost of ending work in process inventory fill in the blank 3 of 4$ 4. Cost per unit of…arrow_forwardHii expert please given correct answer financial accountingarrow_forwardThe following information concerns production in the Baking Department for August. All direct materials are placed in process at the beginning of production. Date Item Debit Credit BalanceDebit BalanceCredit August 1 Bal., 6,300 units, 4/5 completed 16,884 31 Direct materials, 113,400 units 226,800 243,684 31 Direct labor 64,390 308,074 31 Factory overhead 36,212 344,286 31 Goods finished, 114,900 units 332,958 11,328 31 Bal., ? units, 2/5 completed 11,328 a. Based on the above data, determine each cost listed below. Round "cost per equivalent unit" answers to the nearest cent. Line Item Description Amount 1. Direct materials cost per equivalent unit $fill in the blank 1 2. Conversion cost per equivalent unit $fill in the blank 2 3. Cost of the beginning work in process completed during August $fill in the blank 3 4. Cost of units started and completed during August $fill in the blank 4 5. Cost of the ending work in…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Operating Loss Carryback and Carryforward; Author: SuperfastCPA;https://www.youtube.com/watch?v=XiYhgzSGDAk;License: Standard Youtube License