Mixed cost: Mixed cost is a cost that includes both the fixed cost and the variable cost. It represents the total cost of the activity or production.

Variable Cost: Variable cost is a cost that changes when the volume of production changes, in the same direction and in the same proportion.

Fixed Cost: Fixed cost is a cost that remains constant irrespective of the changes in the production volume.

High-low method: High-low method is a method of calculating the variable cost and the fixed cost of a product or service. The calculation of this method is based on the total production/activity cost and the lowest production/activity cost of the product during any period.

Income Statement: Income statement is a financial statement that shows the net income or loss for a particular period. It is the summary of expenses and income of a particular period.

- Each of the company's expenses (including cost of goods sold) as variable, fixed, or mixed.

- Using the high-low method, separate each mixed expense into variable and fixed elements. State the cost formula for each mixed expense.

- The company's income statement at the 5,000-unit level of activity using the contribution format.

Answer to Problem 16P

Solution:

- Cost classification of the company’s expenses is done.

- Each mixed expense is separated into variable and fixed elements and the cost formula for each mixed expense is prepared.

- Income statement at the 5,000-unit level of activity using the contribution format is prepared.

Explanation of Solution

- Cost classification is as under

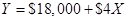

- a. Shipping expenses per unit is $4 & fixed shipping expense is $18,000 and the cost formula for each shipping expense is:

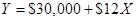

- b. Salaries and commissions per unit is $4 & fixed shipping expense is $18,000 and the cost formula for each shipping expense is:

- Income statement at the 5,000-unit level of activity using the contribution format is as below.

| Expenses | Classification |

| Cost of goods sold | Variable |

| Advertising expense | Fixed |

| Shipping expense | Mixed |

| Salaries and commissions | Mixed |

| Insurance expense | Fixed |

| Fixed |

Explanations of the cost classification

| Expenses | Classification | |

| Cost of goods sold | Variable | Per unit cost is same in all month. |

| Advertising expense | Fixed | Constant irrespective of changes in the number of units sold |

| Shipping expense | Mixed | Per unit cost is not same in all month. |

| Salaries and commissions | Mixed | Per unit cost is not same in all month. |

| Insurance expense | Fixed | Constant irrespective of changes in the number of units sold |

| Depreciation expense | Fixed | Constant irrespective of changes in the number of units sold |

| Morrisey & Brown, Ltd. | ||

| Income Statement | ||

| For the month ended September 30 | ||

| Sales in units | 5,000.00 | |

| Sales ( 5000 unit sold) | $500,000.00 | |

| Less : Variable expenses | ||

| Cost of goods sold | $300,000.00 | |

| Shipping expenses | $20,000.00 | |

| Salaries and commissions | $60,000.00 | -$380,000.00 |

| Contribution margin | $120,000.00 | |

| Less : Variable expenses | ||

| Advertising expenses | $21,000.00 | |

| Insurance expense | $6,000.00 | |

| Shipping expenses | $18,000.00 | |

| Salaries and commissions | $30,000.00 | |

| Depreciation expenses | $15,000.00 | $90,000.00 |

| Net Operating Income | $30,000.00 | |

Calculations:

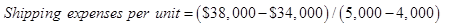

a.) Cost formula for shipping expenses

Step 1: Identify high and low activities level.

| Particulars | Cost/Unit | Month |

| (X1) : Total cost of highest activity | $38,000 | September |

| (X2) : Highest activity unit | 5,000 | September |

| (Y1) : Total cost of lowest activity | $34,000 | July |

| (Y2) : Lowest activity unit | 4,000 | July |

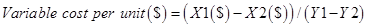

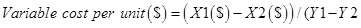

Step 2: Calculate the variable cost per day

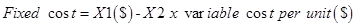

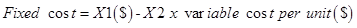

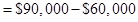

Step 3: Calculate the fixed cost

=

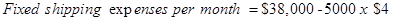

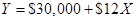

Step 4: Cost formula for shipping expense.

Where X is the number of units sold per month and Y is total shipping expense.

b.) Cost formula for Salaries and commissions

Step 1: Identify high and low activities level.

| Particulars | Cost/Unit | Month |

| (X1) : Total cost of highest activity | $90,000 | September |

| (X2) : Highest activity unit | 5,000 | September |

| (Y1) : Total cost of lowest activity | $78,000 | July |

| (Y2) : Lowest activity unit | 4,000 | July |

Step 2: Calculate the variable cost per day

Step 3: Calculate the fixed cost

Step 4: Cost formula for shipping expense.

Where X is the number of units sold per month and Y is total Salaries and commission.

Thus, for Morrisey & Brown, Ltd., cost classification is done, the cost formula & the income statement are determined and the calculations are explained.

Want to see more full solutions like this?

Chapter 2 Solutions

MANAGERIAL ACCT W/CONNECT >IC<

- Please provide answer the following requirements on these financial accounting questionarrow_forwardThe highest value of total cost was $940,000 in August for Honda Foods Ltd. Its lowest value of total cost was $700,000 in February. The company produces onlyone product. The production volumes in August and February were 20,000 and 14,000 units, respectively. What is the fixed cost per month?arrow_forwardFinancial accountingarrow_forward

- Please provide step by step instructions to help me understand the process.arrow_forwardPlease need Help with this Question provide Solution with Correct According Solving methodarrow_forwardI am searching for the accurate solution to this general accounting problem with the right approach.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education