Accounting and Reporting Principles. (LO2-3) The financial statements of the Town of Fordville consist of a statement of cash receipts and a statement of cash disbursements prepared by the town treasurer for each of its three funds: the General Fund, the Road Tax Fund (special revenue fund), and the Sewer Fund (enterprise fund). As required by state law, the town submits its financial statements to the Office of the State Auditor; however, due to its small size, its financial statements have never had to be audited by an independent auditor.

Because of its growing population (nearing 20,000) and increasing financial complexity, the town has hired Emily Ramirez, who recently obtained her CPA license, to supervise all accounting and financial reporting operations. Having worked two years for a CPA firm in a nearby town, Ms. Ramirez gained limited experience auditing not-for-profit organizations, as well as compiling financial statements for small businesses. Although she has little knowledge of governmental accounting, she is confident that her foundation in business and not-for-profit accounting will enable her to handle the job.

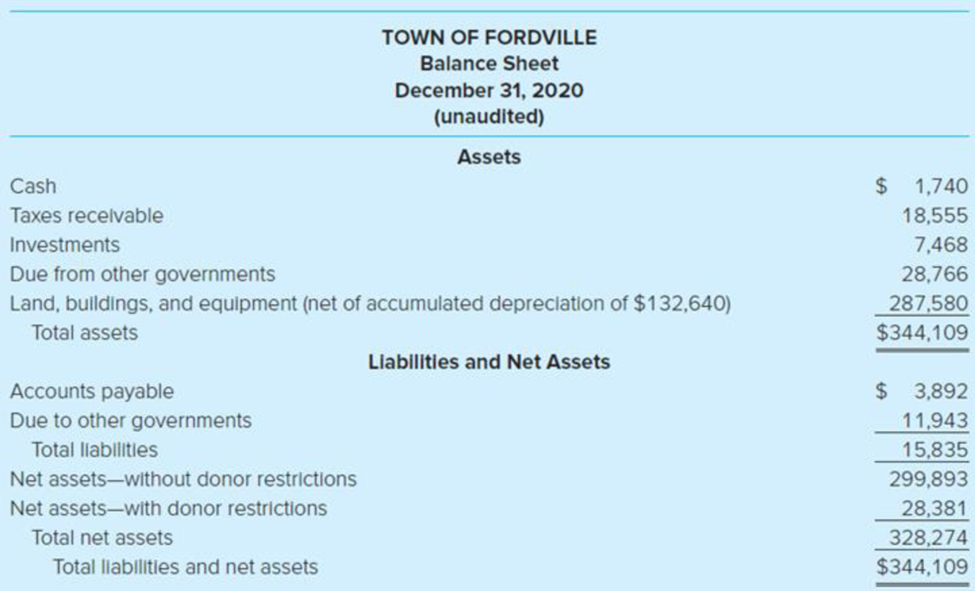

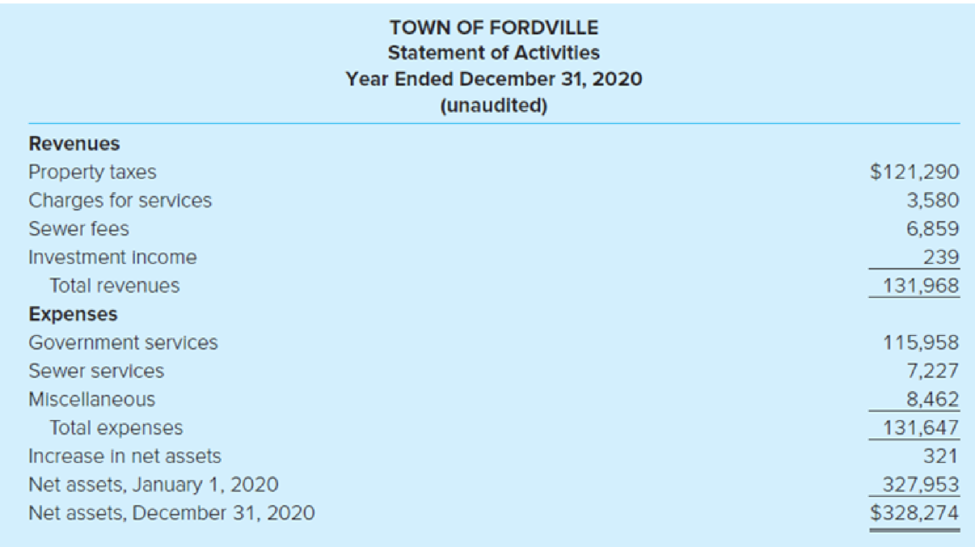

Using her experience with not-for-profit organizations, for the year ended December 31, 2020, Ms. Ramirez prepared the following unaudited financial statements for the Town of Fordville. Assuming the city wants to prepare financial statements in accordance with GASB standards, study the financial statements and answer the questions that follow.

Required

- a. What basis of accounting does it appear Ms. Ramirez has used? Explain how you arrived at your answer.

- b. Given what you know about the town’s activities, what financial statements would the town be required to prepare using GASB standards?

- c. The financial statements presented appear to be most comparable to which two financial statements prepared using GASB standards? Using the information from the Financial Reporting Model section of the text and Illustrations A2-1 and A2-2, explain what modifications would be needed to make the two financial statements conform to the format of the financial statements you have identified.

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

ACCT. FOR GOV.&NONPROF. ENTITIES>CUSTOM

- Kreeps Corporation produces a single productarrow_forwardA college's food operation has an average meal price of $9.20. Variable costs are $4.35 per meal and fixed costs total $95,000. How many meals must be sold to provide an operating income of $33,000? How many meals would have to be sold if fixed costs declined by 23%? (round to the nearest meal)arrow_forwardHiii tutor give me Answerarrow_forward

- Anna company reported the following dataarrow_forwardUse this information to determine the number of unitsarrow_forwardA firm has net working capital of $980, net fixed assets of $4,418, sales of $9,250, and current liabilities of $1,340. How many dollars worth of sales are generated from every $1 in total assets? Need answerarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education