Concept explainers

Accounting for manufacturing

This problem continues the Daniels Consulting situation from Problem P18-42 of Chapter 18. Daniels Consulting uses a job order costing system in which each client is a different job. Daniels assigns direct labor, meal per diem, and travel costs directly to each job. It allocates indirect

At the beginning of 2018, the controller prepared the following budget:

| Direct labor hours (professionals) | 6,250 hours |

| Direct labor costs (professionals) | $ 1,100,000 |

| Support staff salaries | 90,000 |

| Computer leases | 57,000 |

| Office supplies | 40,000 |

| Office rent | 55,000 |

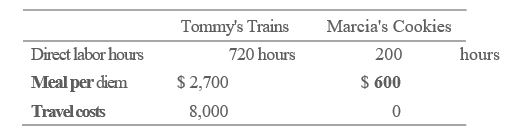

In November 2018, Daniels served several clients. Records for two clients appear here:

Requirements

- Compute Daniels's predetermined overhead allocation rare for 2018.

- Compute the total cost of each job.

- If Daniels wants to earn profits equal to 25% of sales revenue, what fee should it charge each of these two clients?

- Why does Daniels assign costs to jobs?

Want to see the full answer?

Check out a sample textbook solution

Chapter 19 Solutions

Horngren's Accounting, The Financial Chapters, Student Value Edition Plus MyLab Accounting with Pearson eText -- Access Card Package (11th Edition)

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning