INTERM.ACCT.:REPORTING...-CENGAGENOWV2

3rd Edition

ISBN: 9781337909358

Author: WAHLEN

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 19, Problem 9RE

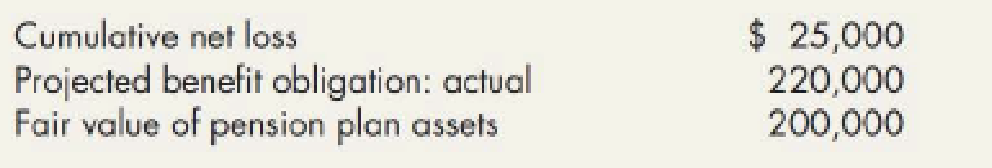

Given the following information for Tyler Company’s pension plan at the beginning of the year, calculate the corridor, excess net loss (gain), and amortized net loss (gain). Assume an average remaining service life of 15 years.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Hello tutor please help me this question

General accounting

What is its net income? Round the answer to the nearest cent. ??

Chapter 19 Solutions

INTERM.ACCT.:REPORTING...-CENGAGENOWV2

Ch. 19 - Prob. 1GICh. 19 - Prob. 2GICh. 19 - Prob. 3GICh. 19 - Prob. 4GICh. 19 - Prob. 5GICh. 19 - Prob. 6GICh. 19 - Prob. 7GICh. 19 - Prob. 8GICh. 19 - Prob. 9GICh. 19 - Prob. 10GI

Ch. 19 - Prob. 11GICh. 19 - Prob. 12GICh. 19 - Prob. 13GICh. 19 - Prob. 14GICh. 19 - Prob. 15GICh. 19 - Prob. 16GICh. 19 - Prob. 17GICh. 19 - Prob. 18GICh. 19 - Prob. 19GICh. 19 - Prob. 20GICh. 19 - Prob. 21GICh. 19 - Prob. 22GICh. 19 - Prob. 23GICh. 19 - The actuarial present value of all the benefits...Ch. 19 - Prob. 2MCCh. 19 - Prob. 3MCCh. 19 - Prob. 4MCCh. 19 - Prob. 5MCCh. 19 - Prob. 6MCCh. 19 - Which of the following is not a component of...Ch. 19 - Prob. 8MCCh. 19 - Prob. 9MCCh. 19 - Prob. 10MCCh. 19 - Prob. 1RECh. 19 - Prob. 2RECh. 19 - Pinecone Company has plan assets of 500,000 at the...Ch. 19 - Prob. 4RECh. 19 - Prob. 5RECh. 19 - Prob. 6RECh. 19 - Prob. 7RECh. 19 - Prob. 8RECh. 19 - Given the following information for Tyler Companys...Ch. 19 - At the beginning of Year 1, Cactus Company has...Ch. 19 - Prob. 11RECh. 19 - Prob. 1ECh. 19 - Prob. 2ECh. 19 - Prob. 3ECh. 19 - Prob. 4ECh. 19 - Prob. 5ECh. 19 - Prob. 6ECh. 19 - Prob. 7ECh. 19 - Prob. 8ECh. 19 - Prob. 9ECh. 19 - Prob. 10ECh. 19 - Prob. 11ECh. 19 - Prob. 12ECh. 19 - Prob. 13ECh. 19 - Refer to the information provided in E19-13....Ch. 19 - Prob. 15ECh. 19 - Prob. 16ECh. 19 - Prob. 1PCh. 19 - Prob. 2PCh. 19 - Prob. 3PCh. 19 - Prob. 4PCh. 19 - Prob. 5PCh. 19 - Prob. 6PCh. 19 - Prob. 7PCh. 19 - Prob. 8PCh. 19 - Prob. 9PCh. 19 - Prob. 10PCh. 19 - Prob. 11PCh. 19 - Prob. 12PCh. 19 - Prob. 1CCh. 19 - Prob. 2CCh. 19 - Prob. 3CCh. 19 - Prob. 4CCh. 19 - Prob. 5CCh. 19 - Prob. 6CCh. 19 - Prob. 7CCh. 19 - Prob. 9C

Additional Business Textbook Solutions

Find more solutions based on key concepts

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

Assume the United States is an importer of televisions and there are no trade restrictions. US consumers buy 1 ...

Principles of Microeconomics (MindTap Course List)

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

Whether callable bonds have a higher or lower yield than otherwise identical bonds without a call feature. Intr...

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

• Illustrate and interpret shifts in the short-run and long-run aggregate supply curves.

Economics of Money, Banking and Financial Markets, The, Business School Edition (5th Edition) (What's New in Economics)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the company's cost of goods manufactured for the year of this general accounting question?arrow_forwardExercise 2 Make an Excel spreadsheet to compute gross wages due each employee under federal wage-hour law. See notes below. Ryan is normally paid $1,000 for a 40-hour workweek. One week, he works 46 hours. 2.Latisha is normally paid $1,200 for a 40-hour workweek. One Monday she is out sick but receives 8 hours sick pay. She then works 40 hours Tuesday–Friday. 3. Al is normally paid $500 for a 40-hour workweek. One week, he works 45 hours. 4. Lee is normally paid $1,500 for a 40-hour workweek. To make up for leaving early one Friday, he works 44 hours this week.arrow_forwardHello tutor please provide this question solution general accountingarrow_forward

- Get accurate answer of this financial accounting questionarrow_forwardThe cost of goods sold isarrow_forwardRequired information [The following information applies to the questions displayed below.] Kitimat Company manufactures winter hats that sell for $42 per unit. The following information pertains to the company's first year of operations in which it produced 40,100 units and sold 37,600 units. Variable costs per unit: Manufacturing: Direct materials Direct labour Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expenses 16 $ 16 $ $ 1 $ 2 $401,000 $247,000 9. What would have been the company's variable costing operating income if it had produced and sold 37,600 units?arrow_forward

- Required information [The following information applies to the questions displayed below.] Kitimat Company manufactures winter hats that sell for $42 per unit. The following information pertains to the company's first year of operations in which it produced 40,100 units and sold 37,600 units. Variable costs per unit: Manufacturing: Direct materials Direct labour Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expenses $ 16 LA LA LA LA $ $ 6612 $401,000 $247,000 4. What is the company's operating income under variable costing?arrow_forwardDo fast answer of this general accounting questionarrow_forwardUsing the high-low method, estimate a cost formula for power cost. ??arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Operating Loss Carryback and Carryforward; Author: SuperfastCPA;https://www.youtube.com/watch?v=XiYhgzSGDAk;License: Standard Youtube License