Concept explainers

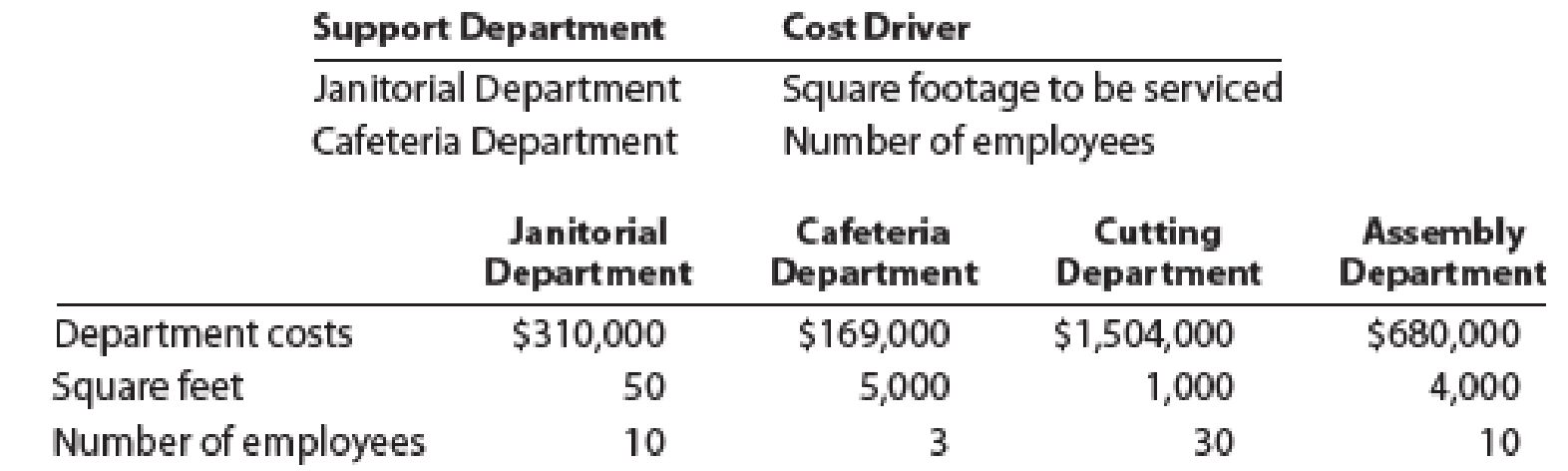

Becker Tabletops has two support departments (Janitorial and Cafeteria) and two production departments (Cutting and Assembly). Relevant details for these departments are as follows:

Allocate the support department costs to the production departments using the direct method.

EX 19-8 Support department cost allocation–sequential method Obj.3

Refer to the information provided for Becker Tabletops in Exercise 7. Allocate the support department costs to the production departments using the sequential method. Allocate the support department with the highest department cost first.

EX 19-9 Support department cost allocation–reciprocal services method Obj.3

Refer to the information provided for Becker Tabletops in Exercise 7. Allocate the support department costs to the production departments using the reciprocal services method.

Compute the total cost of each production department after allocating all support costs to the production departments.

Explanation of Solution

Cost allocation:

The cost allocation refers to the process of allocating the costs associated with the production of the products mainly indirectly and are generally ignored. The main objective of cost allocation is to ensure proper pricing of the products. This can be done by several methods.

Janitorial Department Cost to be allocated:

The total Janitorial Department costs include 20% of the Cafeteria department costs as,

Therefore, the Cafeteria Department cost is,

Cafeteria Department Cost to be allocated:

The total Cafeteria Department costs include 50% of the Janitorial department costs as,

Therefore, the Cafeteria Department cost is,

Substitute the equation for J into the C equation:

Substitute the value of C into the J equation:

Janitorial Department Cost Allocation:

Compute the allocation of costs from Janitorial Department to Cafeteria Department:

The costs allocated from Janitorial Department to Cafeteria Department is $191,000.

Compute the allocation of costs from Janitorial Department to Cutting Department:

The costs allocated from Janitorial Department to Cutting Department is $38,200.

Compute the allocation of costs from Janitorial Department to Assembly Department:

The costs allocated from Janitorial Department to Assembly Department is $152,800.

Cafeteria Department Cost Allocation:

Compute the allocation of costs from Cafeteria Department to Janitorial Department:

The costs allocated from Cafeteria Department to Janitorial Department is $72,000.

Compute the allocation of costs from Cafeteria Department to Cutting Department:

The costs allocated from Cafeteria Department to Cutting Department is $216,000.

Compute the allocation of costs from Cafeteria Department to Assembly Department:

The costs allocated from Cafeteria Department to Assembly Department is $72,000.

Want to see more full solutions like this?

Chapter 19 Solutions

Financial And Managerial Accounting

- If total debits exceed total credits on a trial balance, the difference is most likely:A. A net lossB. A recording errorC. A net incomeD. An overstatement of assetsarrow_forwardWhich of the following accounts would be found on the post-closing trial balance?A. Service RevenueB. Salaries ExpenseC. Retained EarningsD. Dividendsarrow_forwardNeed answer What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forward

- No chatgpt What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forwardWhat type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenueneed helparrow_forwardno ai What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forward

- What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forwardNo chatgpt Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forwardWhich of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersno aiarrow_forward

- Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customerhelo mearrow_forwardHelp Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forwardWhich of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College