Analyze William’s Ball & Jersey Shop

William’s Ball & Jersey Shop is a small athletic products company currently trying to determine cost allocations. Accurate costing numbers are important but not crucial; no employee bonuses depend on them, and the company wants to keep the cost allocation process simple and cost-effective.

The company produces and sells footballs, basketballs, baseballs, and jerseys for each of those sports. The jerseys of each sport go through a joint production process before they are dyed, embroidered, and printed with the appropriate colors and logos for whatever team they are to represent. William Lind, the owner, believes an adjustment might need to be made to the company’s current physical units method of joint cost allocation. Presently, youth- and adult-size jerseys go through the same joint production process, but the adult-size jerseys require more material, cutting, and sewing than youth-size jerseys. William is also considering the addition of a toddler-size jersey to his baseball jersey joint product line. The market value at the split-off point of the toddler-size jersey is expected to be barely less than its share of the joint production cost (based on the company’s current joint cost allocation method), but it will only incur a S3 per jersey additional production

- a. Which support department cost allocation method should be used to allocate support department cost?

- b. What adjustment could be made to improve the company’s current joint cost allocation method?

- c. What other information does William need to consider before deciding whether to add the toddler-size jersey to his product line?

- d. If the market value at split-off of the toddler-size jersey is $10, and its market price after further processing is estimated to be $17.99, should William add the jersey?

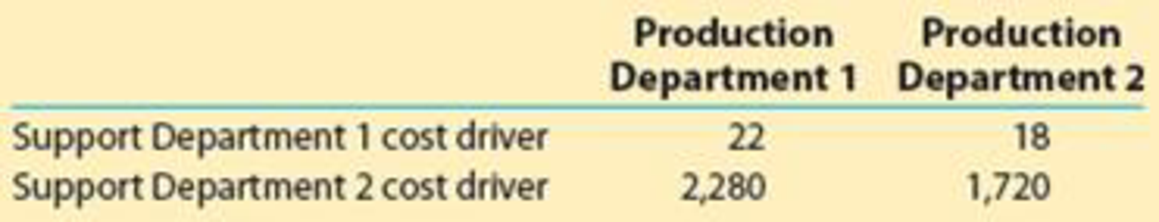

- e. Suppose William provides the following information:

What percentage of each support department’s cost should be allocated to each production department using the direct method?

Want to see the full answer?

Check out a sample textbook solution

Chapter 19 Solutions

Financial And Managerial Accounting

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning