PRIN.OF CORPORATE FINANCE

13th Edition

ISBN: 9781260013900

Author: BREALEY

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 19, Problem 6PS

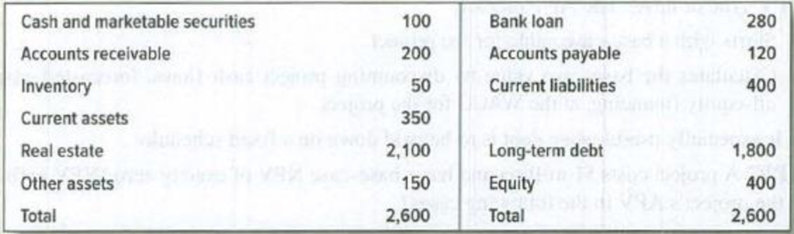

WACC Table 19.3 shows a book

Calculate Wishing Well’s WACC. Assume that the book and market values of Wishing Well’s debt are the same. The marginal tax rate is 21%.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

How can the budgeting process be used to reinforce (or fail to reinforce) public service goals? Provide an example of a local, state, or federal budget where funding allocations reflected policy priorities.

How do changes in working capital affect cash flow? Hrlp

I need correct answer

What does a current ratio below 1 indicate about a company's liquidity?

Chapter 19 Solutions

PRIN.OF CORPORATE FINANCE

Ch. 19.A - The U.S. government has settled a dispute with...Ch. 19.A - You are considering a five-year lease of office...Ch. 19 - WACC True or false? Use of the WACC formula...Ch. 19 - WACC The WACC formula seems to imply that debt is...Ch. 19 - Prob. 3PSCh. 19 - Prob. 4PSCh. 19 - WACC Whispering Pines Inc. is all-equity-financed....Ch. 19 - WACC Table 19.3 shows a book balance sheet for the...Ch. 19 - WACC Table 19.4 shows a simplified balance sheet...Ch. 19 - Prob. 8PS

Ch. 19 - WACC Nevada Hydro is 40% debt-financed and has a...Ch. 19 - Flow-to-equity valuation What is meant by the...Ch. 19 - APV True or false? The APV method a. Starts with a...Ch. 19 - APV A project costs 1 million and has a base-case...Ch. 19 - APV Consider a project lasting one year only. The...Ch. 19 - APV Digital Organics (DO) has the opportunity to...Ch. 19 - Prob. 17PSCh. 19 - Prob. 18PSCh. 19 - Prob. 19PSCh. 19 - Prob. 20PSCh. 19 - Prob. 22PSCh. 19 - Company valuation Chiara Companys management has...Ch. 19 - Prob. 26PSCh. 19 - Prob. 27PS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Dear expert need help. What factors can lead to a high price-to-earnings (P/E) ratio?arrow_forwardWhat is the 50/30/20 budgeting rule in finance , and how is it applied?dont use chatarrow_forwardI need help in this question What is the weighted average cost of capital (WACC) and why is it important?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

What is WACC-Weighted average cost of capital; Author: Learn to invest;https://www.youtube.com/watch?v=0inqw9cCJnM;License: Standard YouTube License, CC-BY