Concept explainers

Click the Chart sheet tab. This chart is based on the problem data and the two income statements. Answer the following questions about the chart:

- a. What is the title for the X-axis?

- b. What is the title for the Y-axis?

- c. What does data range A represent?

- d. What does data range B represent?

- e. Why do the two data ranges cross?

- f. What would be a good title for this chart?

When the assignment is complete, close the file without saving it again.

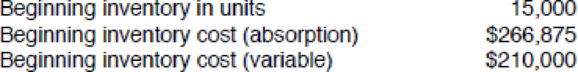

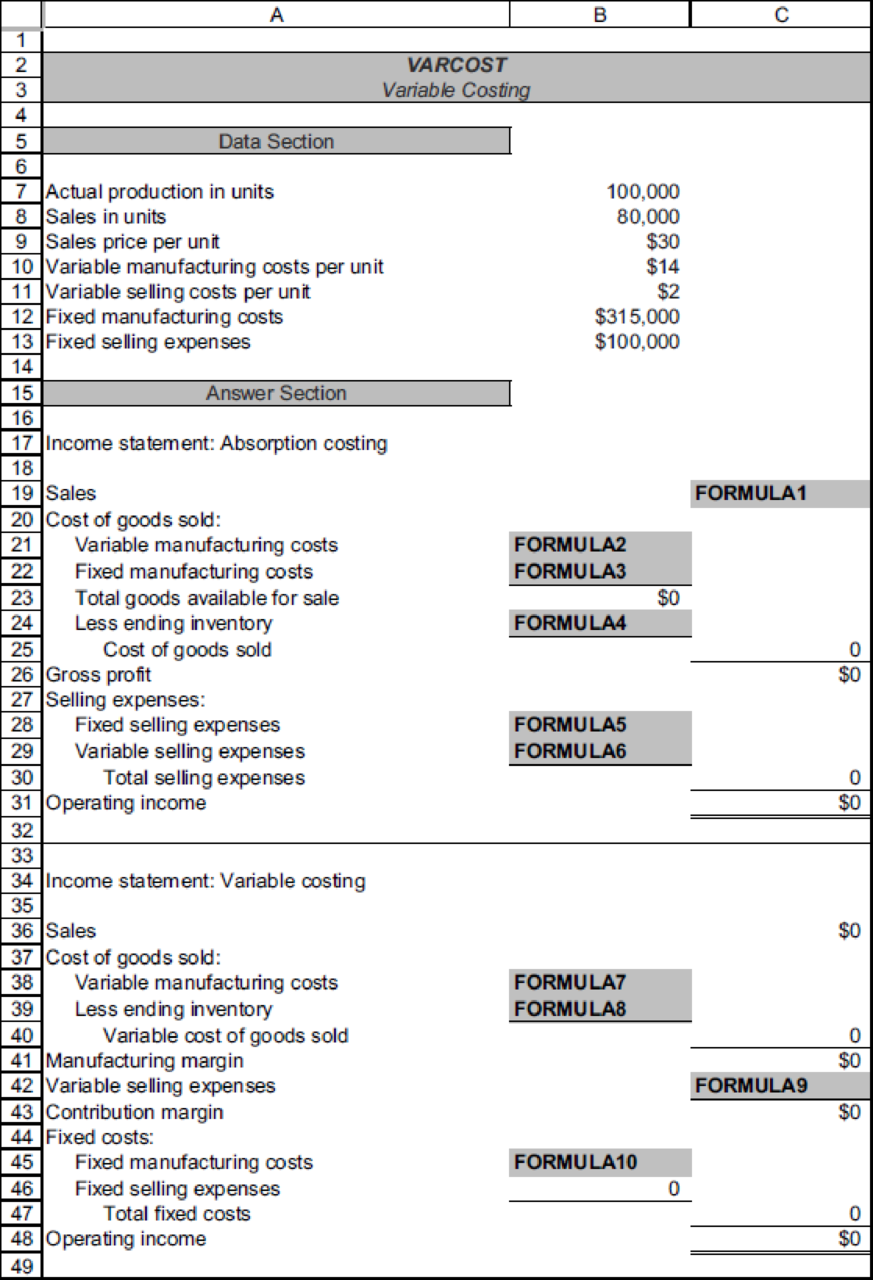

Worksheet. The VARCOST2 worksheet is capable of calculating variable and absorption income when unit sales are equal to or less than production. An equally common situation (that this worksheet cannot handle) is when beginning inventory is present and sales volume exceeds production volume. Revise the worksheet Data Section to include:

Also, change actual production to 70,000.

Revise the Answer Section to accommodate this new data. Assume that Anderjak uses the weighted-average costing method for inventory. Preview the printout to make sure that the worksheet will print neatly on one page, and then print the worksheet. Save the completed file as VARCOSTT. Check figure: Absorption income, $670,000.

Chart. Using the VARCOST2 file, fix up the chart used in requirement 5 by adding appropriate titles and legends and formatting the X- and Y-axes. Enter your name somewhere on the chart. Save the file again as VARCOST2. Print the chart.

Want to see the full answer?

Check out a sample textbook solution

Chapter 19 Solutions

Excel Applications for Accounting Principles

- Which inventory method results in higher cost of goods sold when prices are rising?A. FIFOB. LIFOC. Weighted AverageD. Specific Identificationcorrect aarrow_forwardWhich inventory method results in higher cost of goods sold when prices are rising?A. FIFOB. LIFOC. Weighted AverageD. Specific Identification needarrow_forwardWhich inventory method results in higher cost of goods sold when prices are rising?A. FIFOB. LIFOC. Weighted AverageD. Specific Identificationarrow_forward

- no aiI mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful. need help but clear amswerarrow_forwardThe income summary account is used:A. To record net cash flowB. Only by service businessesC. During the closing processD. To adjust retained earnings directlyneedarrow_forwardNo AI The income summary account is used:A. To record net cash flowB. Only by service businessesC. During the closing processD. To adjust retained earnings directlyarrow_forward

- Please provide the correct answer with financial accounting questionarrow_forwardHi expert please given correct answer with accounting questionarrow_forwardThe income summary account is used:A. To record net cash flowB. Only by service businessesC. During the closing processD. To adjust retained earnings directlyarrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College