Record the following operating activities:1. Student fees of $600,000 were assessed, of which $575,000 has been collected and $4,000 is estimated to be uncollectible.2. The bookstore operates in rented space and is run on a break-even basis. Revenues totaled $100,000, of which 80% was collected to date. Salaries of $35,000 and rent of $10,000 are paid. Other operating expenses amount to $60,000, of which $15,000 has not been paid.3. A mandatory transfer of $75,000 was made for a payment due on the gymnasium building mortgage.4. The Student Aid Committee report showed the following:Cash scholarships issued. . . . . . . . . . . . . . . . $25,000Remission of tuition . . . . . . . . . . . . . . . . . . . . 10,0005. A check for $10,000 and a pledge for $4,500 are received from the local medical society to cover part of the cost of research on drug effects, one of the university’s educational programs. The educational programs will be conducted and paid for in the next fiscal period.6. The endowment fund received a check for $12,000 of interest on investments. The premium amortization on the investment is $240. The unrestricted current fund is the recipient of the income.

Record the following operating activities:

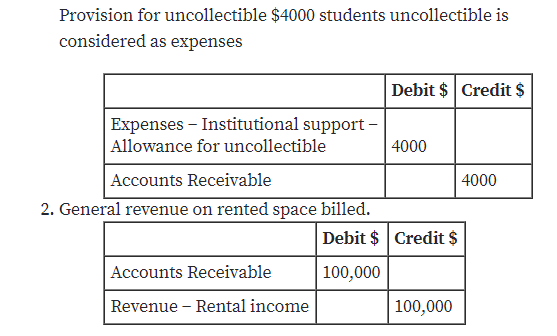

1. Student fees of $600,000 were assessed, of which $575,000 has been collected and $4,000 is estimated to be uncollectible.

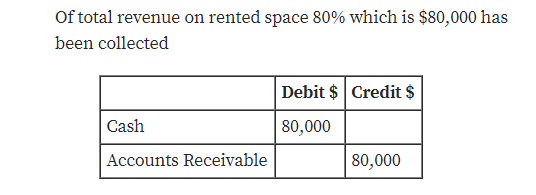

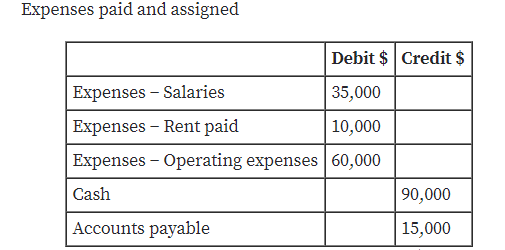

2. The bookstore operates in rented space and is run on a break-even basis. Revenues totaled $100,000, of which 80% was collected to date. Salaries of $35,000 and rent of $10,000 are paid. Other operating expenses amount to $60,000, of which $15,000 has not been paid.

3. A mandatory transfer of $75,000 was made for a payment due on the gymnasium building mortgage.

4. The Student Aid Committee report showed the following:

Cash scholarships issued. . . . . . . . . . . . . . . . $25,000

Remission of tuition . . . . . . . . . . . . . . . . . . . . 10,000

5. A check for $10,000 and a pledge for $4,500 are received from the local medical society to cover part of the cost of research on drug effects, one of the university’s educational programs. The educational programs will be conducted and paid for in the next fiscal period.

6. The endowment fund received a check for $12,000 of interest on investments. The premium amortization on the investment is $240. The unrestricted current fund is the recipient of the income.

Operating activity in Universities:

College and university funds include three broad categories: current funds, plant funds, and trusts and agency funds. The day to day activities of the public university is recorded in its current funds, which consists of two self-balancing sub-funds.

The unrestricted current fund represents amounts that are available for current activity appropriate with university objectives. The restricted current fund accounts for those resources available only for an externally specified purpose

Step by step

Solved in 4 steps with 9 images