INTERMEDIATE ACCOUNTING (LL) W/CONNECT

9th Edition

ISBN: 9781260679694

Author: SPICELAND

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 19, Problem 19.21E

EPS; convertible

• LO19–7, LO19–9

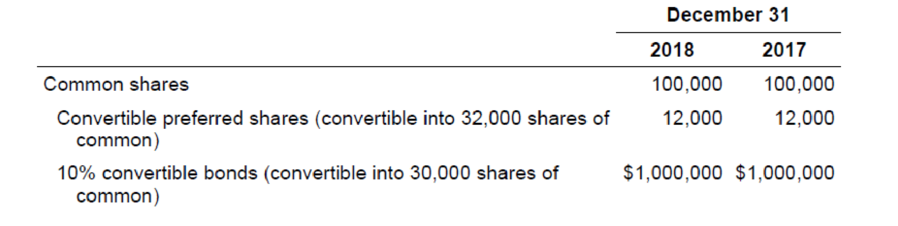

Compute Stanley’s basic and diluted earnings per share for the year ended December 31, 2018. Information from the financial statements of Ames Fabricators, Inc., included the following:

Ames’s net income for the year ended December 31, 2018, is $500,000. The income tax rate is 40%. Ames paid dividends of $5 per share on its preferred stock during 2018.

Required:

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Can you solve this general accounting question with accurate accounting calculations?

I need help with this general accounting question using the proper accounting approach.

I need help with this general accounting question using the proper accounting approach.

Chapter 19 Solutions

INTERMEDIATE ACCOUNTING (LL) W/CONNECT

Ch. 19 - Prob. 19.1QCh. 19 - Prob. 19.2QCh. 19 - The Tax Code differentiates between qualified...Ch. 19 - Stock option (and other share-based) plans often...Ch. 19 - What is a simple capital structure? How is EPS...Ch. 19 - Prob. 19.6QCh. 19 - Blake Distributors had 100,000 common shares...Ch. 19 - Why are preferred dividends deducted from net...Ch. 19 - Prob. 19.9QCh. 19 - The treasury stock method is used to incorporate...

Ch. 19 - The potentially dilutive effect of convertible...Ch. 19 - How is the potentially dilutive effect of...Ch. 19 - Prob. 19.13QCh. 19 - If stock options and restricted stock are...Ch. 19 - Wiseman Electronics has an agreement with certain...Ch. 19 - Prob. 19.16QCh. 19 - When the income statement includes discontinued...Ch. 19 - Prob. 19.18QCh. 19 - Prob. 19.19QCh. 19 - (Based on Appendix B) LTV Corporation grants SARs...Ch. 19 - Prob. 19.1BECh. 19 - Prob. 19.2BECh. 19 - Stock options LO192 Under its executive stock...Ch. 19 - Prob. 19.4BECh. 19 - Prob. 19.5BECh. 19 - Prob. 19.6BECh. 19 - Prob. 19.7BECh. 19 - Prob. 19.8BECh. 19 - Prob. 19.9BECh. 19 - Performance-based options LO192 Refer to the...Ch. 19 - Prob. 19.11BECh. 19 - Prob. 19.12BECh. 19 - EPS; nonconvertible preferred shares LO197 At...Ch. 19 - Prob. 19.14BECh. 19 - Prob. 19.15BECh. 19 - Prob. 19.16BECh. 19 - Prob. 19.1ECh. 19 - Prob. 19.2ECh. 19 - Prob. 19.3ECh. 19 - Prob. 19.4ECh. 19 - Prob. 19.5ECh. 19 - Prob. 19.6ECh. 19 - Prob. 19.7ECh. 19 - Prob. 19.8ECh. 19 - Prob. 19.9ECh. 19 - Prob. 19.10ECh. 19 - Prob. 19.11ECh. 19 - EPS; shares issued; stock dividend LO195, LO196...Ch. 19 - Prob. 19.13ECh. 19 - EPS; stock dividend; nonconvertible preferred...Ch. 19 - EPS; net loss; nonconvertible preferred stock;...Ch. 19 - EPS; stock dividend; nonconvertible preferred...Ch. 19 - Prob. 19.17ECh. 19 - EPS; stock dividend; nonconvertible preferred...Ch. 19 - EPS; stock dividend; nonconvertible preferred...Ch. 19 - EPS; shares issued; stock options LO196 through...Ch. 19 - EPS; convertible preferred stock; convertible...Ch. 19 - Prob. 19.22ECh. 19 - Prob. 19.23ECh. 19 - Prob. 19.24ECh. 19 - Prob. 19.25ECh. 19 - EPS; concepts; terminology LO195 through LO1913...Ch. 19 - FASB codification research LO192 The FASB...Ch. 19 - Prob. 19.28ECh. 19 - Prob. 19.29ECh. 19 - Prob. 19.30ECh. 19 - Restricted stock units; cash settlement Appendix...Ch. 19 - Stock options; forfeiture; exercise LO192 On...Ch. 19 - Stock options; graded vesting LO192 January 1,...Ch. 19 - Stock options; graded vesting; measurement using a...Ch. 19 - Stock options; graded vesting; IFRS LO192, LO1914...Ch. 19 - Prob. 19.5PCh. 19 - Prob. 19.6PCh. 19 - Prob. 19.7PCh. 19 - Prob. 19.8PCh. 19 - EPS from statement of retained earnings LO194...Ch. 19 - EPS from statement of shareholders equity LO194...Ch. 19 - EPS; non convertible preferred stock; treasury...Ch. 19 - EPS; non convertible preferred stock; treasury...Ch. 19 - EPS; non convertible preferred stock; treasury...Ch. 19 - EPS; convertible preferred stock; convertible...Ch. 19 - EPS; antidilution LO194 through LO1910, LO1913...Ch. 19 - EPS; convertible bonds; treasury shares LO194...Ch. 19 - Prob. 19.17PCh. 19 - Prob. 19.18PCh. 19 - EPS; options; restricted stock; additional...Ch. 19 - Prob. 19.1BYPCh. 19 - Communication Case 192 Stock options; basic...Ch. 19 - Prob. 19.3BYPCh. 19 - Real World Case 195 Share-based plans; Walmart ...Ch. 19 - Prob. 19.6BYPCh. 19 - Prob. 19.7BYPCh. 19 - Analysis Case 198 EPS concepts LO194 through...Ch. 19 - Prob. 19.9BYPCh. 19 - Prob. 19.10BYPCh. 19 - Communication Case 1911 Dilution LO199 I thought...Ch. 19 - Real World Case 1912 Reporting EPS; discontinued...Ch. 19 - Analysis Case 1913 Analyzing financial statements;...Ch. 19 - Analysis Case 1915 Kelloggs EPS; PE ratio;...Ch. 19 - Prob. 19.16BYPCh. 19 - Prob. 1CCTCCh. 19 - Air FranceKLM Case IFRS LO199 Air FranceKLM (AF),...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which financial statement reports a company’s assets, liabilities, and equity at a specific point in time?A. Income StatementB. Balance SheetC. Statement of Cash FlowsD. Trial Balancearrow_forwardCan you explain the correct methodology to solve this general accounting problem?arrow_forwardAccrued expenses are:A. Paid and recordedB. Incurred but not yet paidC. Not yet incurredD. Always non-casharrow_forward

- I am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardNo AI Unearned Revenue is classified as a:A. RevenueB. AssetC. LiabilityD. Contra Revenuearrow_forwardPlease provide the answer to this general accounting question with proper steps.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial instruments products; Author: fi-compass;https://www.youtube.com/watch?v=gvxozM3TUIg;License: Standard Youtube License