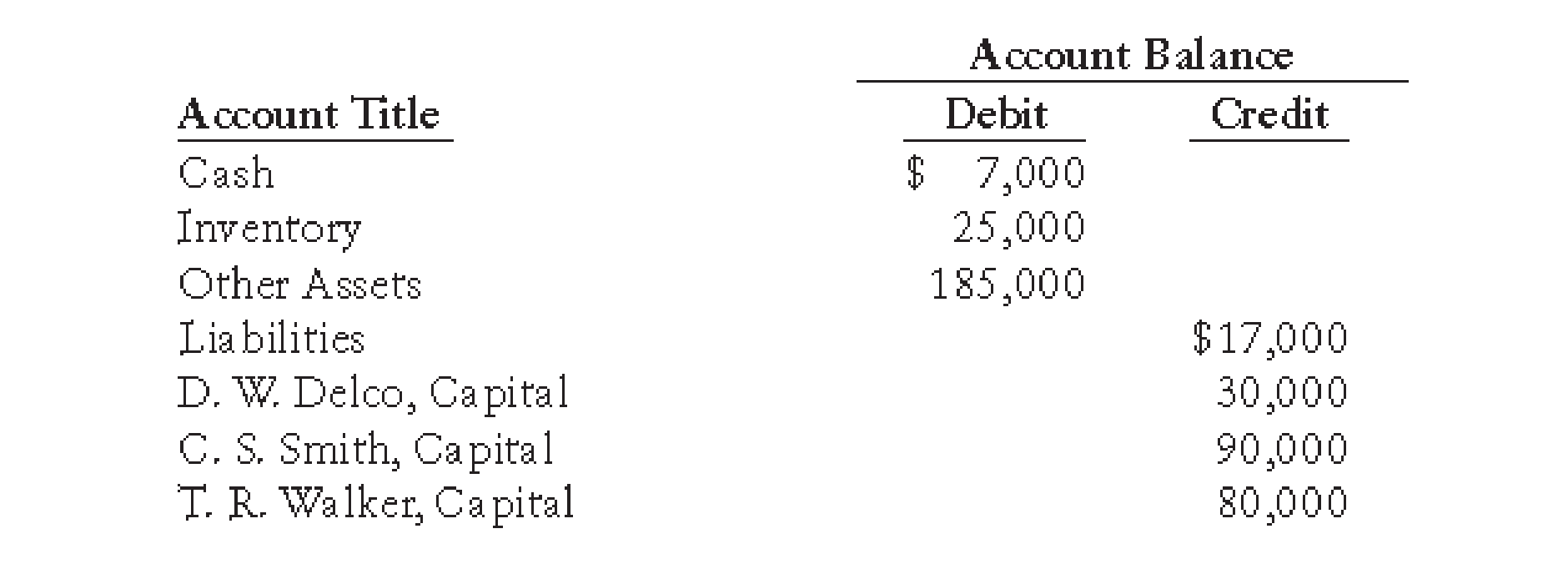

STATEMENT OF PARTNER SHIP LIQUIDATION WITH LOSS After several years of operations, the partnership of Delco, Smith, and Walker is to be liquidated. After making closing entries on March 31, 20--, the following accounts remain Open.

The noncash assets are sold for $165,000.

REQUIRED

1. Prepare a statement of partnership liquidation for the period April 1–15, 20--, showing the following:

(a) The sale of noncash assets on April 1

(b) The allocation of any gain or loss to the partners on April 1

(c) The payment of the liabilities on April 12

(d) The distribution of cash to the partners on April 15

2. Journalize these four transactions in a general journal.

Want to see the full answer?

Check out a sample textbook solution

Chapter 19 Solutions

College Accounting, Chapters 1-9 (New in Accounting from Heintz and Parry)

- Champ Corporation bases its predetermined overhead rate on the estimated labor-hours for the upcoming year. At the beginning of the most recently completed year, the company estimated the labor-hours for the upcoming year at 75,000 labor-hours. The estimated variable manufacturing overhead was $3.50 per labor-hour, and the estimated total fixed manufacturing overhead was $2,400,000. The actual labor-hours for the year turned out to be 75,500 labor-hours. What was the predetermined overhead rate for the recently completed year closest to?arrow_forwardround answer to decimal places.arrow_forwardNo AI ANSWERarrow_forward

- Flare Enterprises sells a product in a competitive marketplace. Market analysis indicates that its product would probably sell at $60 per unit. Flare management desires a 15% profit margin on sales. Their current full cost for the product is $52 per unit. In order to meet the new target cost, how much will the company have to cut costs per unit, if any? a. $3 b. $4 c. $5 d. $1 provide answerarrow_forwardQuick answer of this accounting questionsarrow_forwardNonearrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,