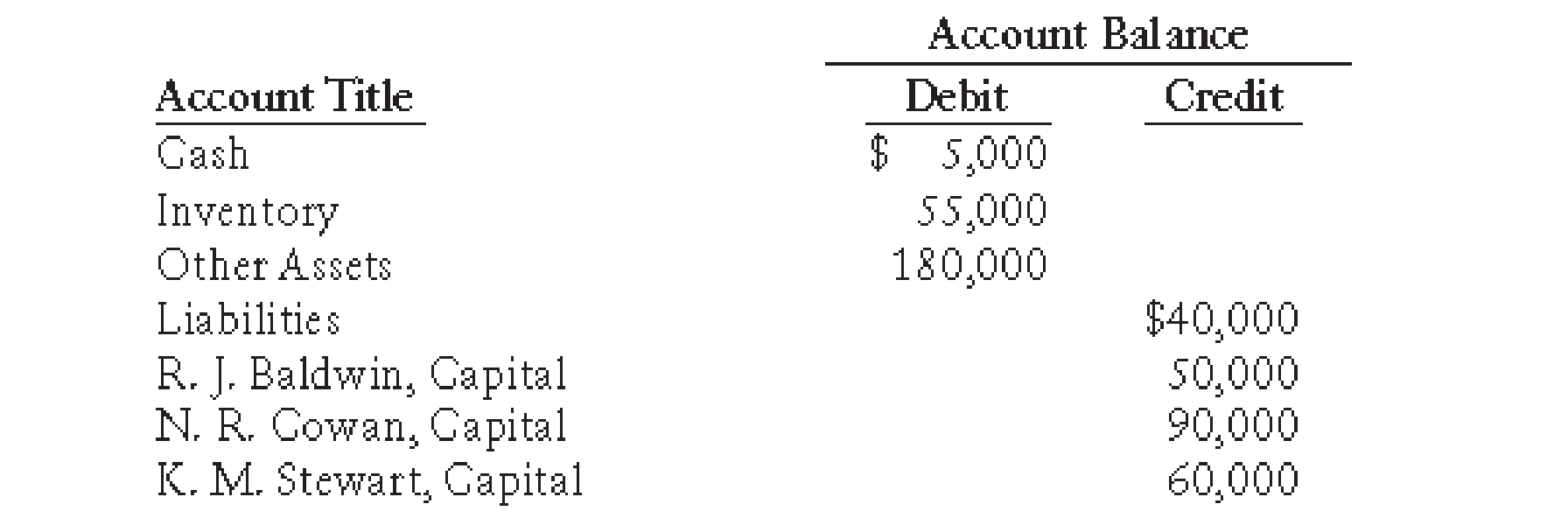

STATEMENT OF PARTNER SHIP LIQUIDATION WITH LOSS After several years of operations, the partnership of Nelson, Pope, and Williams is to be liquidated. After making closing entries on March 31, 20--, the following accounts remain open:

REQUIRED

1. Prepare a statement of partnership liquidation for the period July 1–20, 20--, showing the following:

(a) The sale of noncash assets on July 1

(b) The allocation of any gain or loss to the partners on July 1

(c) The payment of the liabilities on July 15

(d) The distribution of cash to the partners on July 20

2. Journalize these four transactions in a general journal.

Trending nowThis is a popular solution!

Chapter 19 Solutions

Bundle: College Accounting, Chapters 1-15, 22nd + Study Guide with Working Papers + CengageNOWv2™, 1 term Printed Access Card

- 4 POINTSarrow_forwardAspire Enterprises produces two products, GR and HT, from a joint production process. Product IF has been allocated $18,500 of the total joint costs of $41,000. A total of 3,500 units of Product IF were produced. Product IF can be sold at the split-off point for $14 per unit, or it can be further processed at an additional cost of $12,200 and then sold for $18 per unit. How would the company's overall profit change if product IF is processed further instead of being sold immediately at the split-off point? a. $1,800 more profit b. $8,200 less profit c. $12,200 less profit d. $5,300 more profitarrow_forwardWhat is the dividend payout ratio of this financial accounting question?arrow_forward

- What is the gross profit margin?arrow_forwardProvide correct option this accounting questionsarrow_forwardJamison Enterprises plans to generate $720,000 of sales revenue if a capital project is implemented. Assuming a 25% tax rate, the sales revenue should be reflected in the analysis by:arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning