Bundle: College Accounting, Chapters 1-27, Loose-Leaf Version, 22nd + CengageNOWv2, 2 terms Printed Access Card

22nd Edition

ISBN: 9781305930421

Author: James A. Heintz, Robert W. Parry

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 18, Problem 9SPB

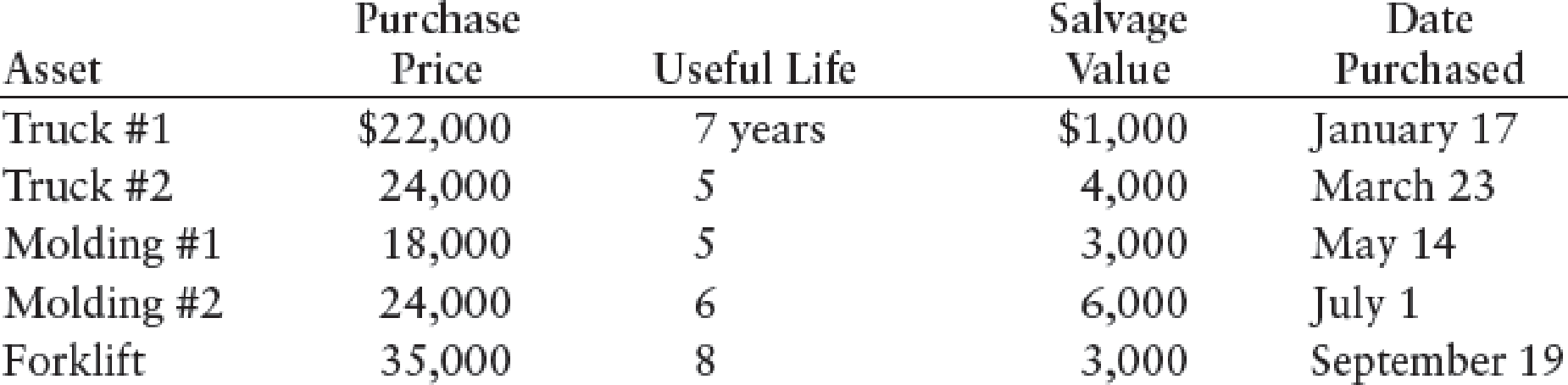

CALCULATING AND JOURNALIZING

REQUIRED

- 1. Calculate the depreciation expense for Byerly Construction as of December 31, 20--.

- 2. Prepare the entry for depreciation expense using a general journal.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Do fast answer of this accounting questions

Hi expert please give me answer general accounting question

General accounting question

Chapter 18 Solutions

Bundle: College Accounting, Chapters 1-27, Loose-Leaf Version, 22nd + CengageNOWv2, 2 terms Printed Access Card

Ch. 18 - Prob. 1TFCh. 18 - Prob. 2TFCh. 18 - Depreciation is a process of asset valuation; that...Ch. 18 - The straight-line method of depreciation allocates...Ch. 18 - Prob. 5TFCh. 18 - Prob. 1MCCh. 18 - Prob. 2MCCh. 18 - Prob. 3MCCh. 18 - Prob. 4MCCh. 18 - Prob. 5MC

Ch. 18 - The following costs were incurred to purchase a...Ch. 18 - Prob. 2CECh. 18 - Prob. 3CECh. 18 - Grandorf Company replaced the engine in a truck...Ch. 18 - Prepare journal entries for the following...Ch. 18 - Prob. 6CECh. 18 - Prob. 7CECh. 18 - Prob. 1RQCh. 18 - Prob. 2RQCh. 18 - Prob. 3RQCh. 18 - What is meant by the depreciable cost of a plant...Ch. 18 - Prob. 5RQCh. 18 - Prob. 6RQCh. 18 - Prob. 7RQCh. 18 - Prob. 8RQCh. 18 - Prob. 9RQCh. 18 - Prob. 10RQCh. 18 - Prob. 11RQCh. 18 - Prob. 12RQCh. 18 - Prob. 13RQCh. 18 - Prob. 14RQCh. 18 - Prob. 15RQCh. 18 - Prob. 16RQCh. 18 - Prob. 17RQCh. 18 - Prob. 18RQCh. 18 - Prob. 19RQCh. 18 - Prob. 20RQCh. 18 - Prob. 21RQCh. 18 - Prob. 22RQCh. 18 - Prob. 1SEACh. 18 - STRAIGHT-LINE, DECLINING-BALANCE, AND...Ch. 18 - UNITS-OF-PRODUCTION METHOD The truck purchased in...Ch. 18 - Prob. 4SEACh. 18 - JOURNAL ENTRIES: DISPOSITION OF PLANT ASSETS...Ch. 18 - Prob. 6SEACh. 18 - STRAIGHT-LINE, DECLINING-BALANCE,...Ch. 18 - UNITS-OF-PRODUCTION METHOD A machine is purchased...Ch. 18 - CALCULATING AND JOURNALIZING DEPRECIATION...Ch. 18 - IMPACT OF IMPROVEMENTS AND REPLACEMENTS ON THE...Ch. 18 - DISPOSITION OF ASSETS: JOURNALIZING Mitchell Parts...Ch. 18 - DEPLETION: CALCULATING AND JOURNALIZING Mineral...Ch. 18 - INTANGIBLE LONG-TERM ASSETS Track Town Co. had the...Ch. 18 - Prob. 1SEBCh. 18 - STRAIGHT-LINE, DECLINING-BALANCE, AND...Ch. 18 - Prob. 3SEBCh. 18 - Prob. 4SEBCh. 18 - JOURNAL ENTRIES: DISPOSITION OF PLANT ASSETS...Ch. 18 - Prob. 6SEBCh. 18 - STRAIGHT-LINE, DECLINING-BALANCE,...Ch. 18 - UNITS-OF-PRODUCTION METHOD A machine is purchased...Ch. 18 - CALCULATING AND JOURNALIZING DEPRECIATION...Ch. 18 - IMPACT OF IMPROVEMENTS AND REPLACEMENTS ON THE...Ch. 18 - DISPOSITION OF ASSETS: JOURNALIZING Mayer Delivery...Ch. 18 - DEPLETION: CALCULATING AND JOURNALIZING Mining...Ch. 18 - Prob. 13SPBCh. 18 - Prob. 1MYWCh. 18 - Creative Solutions purchased a patent from Russell...Ch. 18 - On April 1, 20-3, Kwik Kopy Printing purchased a...Ch. 18 - Prob. 1CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you help me with accounting questionsarrow_forwardAcorn Construction (calendar-year-end C corporation) has had rapid expansion during the last half of the current year due to the housing market's recovery. The company has record income and would like to maximize its cost recovery deduction for the current year. (Use MACRS Table 1, Table 2, Table 3, Table 4, and Table 5.) Note: Round your answer to the nearest whole dollar amount. Acorn provided you with the following information: Asset Placed in Service Basis New equipment and tools August 20 $ 3,800,000 Used light-duty trucks October 17 2,000,000 Used machinery November 6 1,525,000 Total $ 7,325,000 The used assets had been contributed to the business by its owner in a tax-deferred transaction two years ago. a. What is Acorn's maximum cost recovery deduction in the current year?arrow_forwardGeneral accountingarrow_forward

- Multiple Choice 2-32 Educational Incentives (LO 2.14) Wendy is a single taxpayer and pays tuition of $7,800 in 2021. Her 2021 AGI is $66,000. What is the amount of Wendy's tuition deduction? X a. $2,000 O b. $0 O c. $3,733.33 O d. $4,000 O e. $7,800arrow_forwardMultiple Choice 2-32 Educational Incentives (LO 2.14) Wendy is a single taxpayer and pays tuition of $7,800 in 2021. Her 2021 AGI is $66,000. What is the amount of Wendy's tuition deduction? X a. $2,000 O b. $0 O c. $3,733.33 O d. $4,000 O e. $7,800arrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Depreciation -MACRS; Author: Ronald Moy, Ph.D., CFA, CFP;https://www.youtube.com/watch?v=jsf7NCnkAmk;License: Standard Youtube License