College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN: 9781305666160

Author: James A. Heintz, Robert W. Parry

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 18, Problem 9SPB

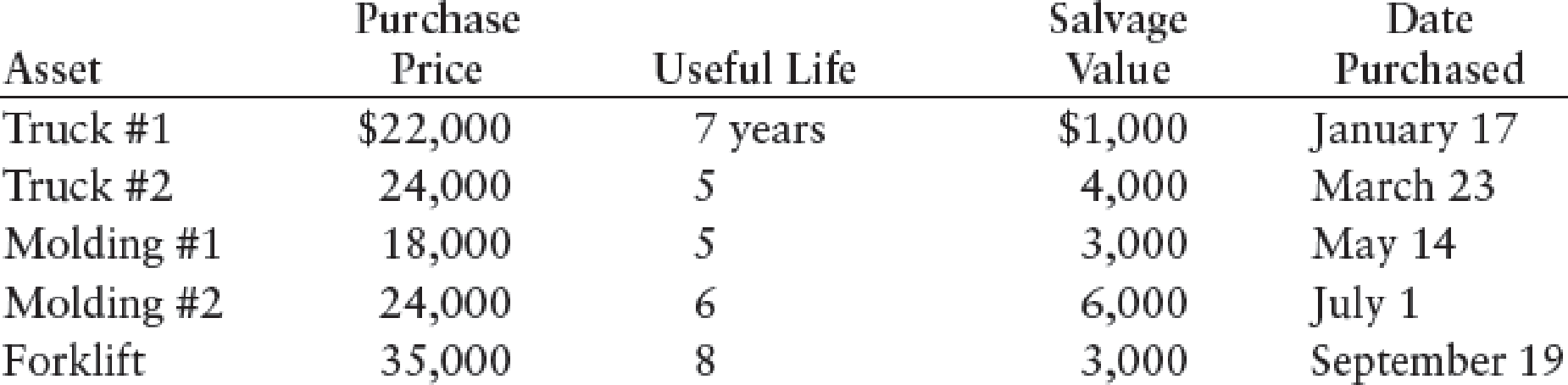

CALCULATING AND JOURNALIZING

REQUIRED

- 1. Calculate the depreciation expense for Byerly Construction as of December 31, 20--.

- 2. Prepare the entry for depreciation expense using a general journal.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Kendall Company has sales of 1,000 units at $60 a unit. Variable

expenses are 30% of the selling price. If total fixed expenses are

$30,000, the degree of operating leverage is

i need this question answer General accounting question

At an output level of 19,500 units, you have calculated that the degree of operating leverage is 2.92. The operating cash flow is $66,300 in this case. Ignoring the effect of taxes, what are fixed costs? Provide answer

Chapter 18 Solutions

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

Ch. 18 - Prob. 1TFCh. 18 - Prob. 2TFCh. 18 - Depreciation is a process of asset valuation; that...Ch. 18 - The straight-line method of depreciation allocates...Ch. 18 - Prob. 5TFCh. 18 - Prob. 1MCCh. 18 - Prob. 2MCCh. 18 - Prob. 3MCCh. 18 - Prob. 4MCCh. 18 - Prob. 5MC

Ch. 18 - The following costs were incurred to purchase a...Ch. 18 - Prob. 2CECh. 18 - Prob. 3CECh. 18 - Grandorf Company replaced the engine in a truck...Ch. 18 - Prepare journal entries for the following...Ch. 18 - Prob. 6CECh. 18 - Prob. 7CECh. 18 - Prob. 1RQCh. 18 - Prob. 2RQCh. 18 - Prob. 3RQCh. 18 - What is meant by the depreciable cost of a plant...Ch. 18 - Prob. 5RQCh. 18 - Prob. 6RQCh. 18 - Prob. 7RQCh. 18 - Prob. 8RQCh. 18 - Prob. 9RQCh. 18 - Prob. 10RQCh. 18 - Prob. 11RQCh. 18 - Prob. 12RQCh. 18 - Prob. 13RQCh. 18 - Prob. 14RQCh. 18 - Prob. 15RQCh. 18 - Prob. 16RQCh. 18 - Prob. 17RQCh. 18 - Prob. 18RQCh. 18 - Prob. 19RQCh. 18 - Prob. 20RQCh. 18 - Prob. 21RQCh. 18 - Prob. 22RQCh. 18 - Prob. 1SEACh. 18 - STRAIGHT-LINE, DECLINING-BALANCE, AND...Ch. 18 - UNITS-OF-PRODUCTION METHOD The truck purchased in...Ch. 18 - Prob. 4SEACh. 18 - JOURNAL ENTRIES: DISPOSITION OF PLANT ASSETS...Ch. 18 - Prob. 6SEACh. 18 - STRAIGHT-LINE, DECLINING-BALANCE,...Ch. 18 - UNITS-OF-PRODUCTION METHOD A machine is purchased...Ch. 18 - CALCULATING AND JOURNALIZING DEPRECIATION...Ch. 18 - IMPACT OF IMPROVEMENTS AND REPLACEMENTS ON THE...Ch. 18 - DISPOSITION OF ASSETS: JOURNALIZING Mitchell Parts...Ch. 18 - DEPLETION: CALCULATING AND JOURNALIZING Mineral...Ch. 18 - INTANGIBLE LONG-TERM ASSETS Track Town Co. had the...Ch. 18 - Prob. 1SEBCh. 18 - STRAIGHT-LINE, DECLINING-BALANCE, AND...Ch. 18 - Prob. 3SEBCh. 18 - Prob. 4SEBCh. 18 - JOURNAL ENTRIES: DISPOSITION OF PLANT ASSETS...Ch. 18 - Prob. 6SEBCh. 18 - STRAIGHT-LINE, DECLINING-BALANCE,...Ch. 18 - UNITS-OF-PRODUCTION METHOD A machine is purchased...Ch. 18 - CALCULATING AND JOURNALIZING DEPRECIATION...Ch. 18 - IMPACT OF IMPROVEMENTS AND REPLACEMENTS ON THE...Ch. 18 - DISPOSITION OF ASSETS: JOURNALIZING Mayer Delivery...Ch. 18 - DEPLETION: CALCULATING AND JOURNALIZING Mining...Ch. 18 - Prob. 13SPBCh. 18 - Prob. 1MYWCh. 18 - Creative Solutions purchased a patent from Russell...Ch. 18 - On April 1, 20-3, Kwik Kopy Printing purchased a...Ch. 18 - Prob. 1CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Kendall Company has sales of 1,990 units at $63 a unit. Variable expenses are 42% of the selling price. If total fixed expenses are $64,000, what is the degree of operating leverage? Provide answerarrow_forwardSolve this general accounting questionarrow_forwardPlease solve this questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Depreciation -MACRS; Author: Ronald Moy, Ph.D., CFA, CFP;https://www.youtube.com/watch?v=jsf7NCnkAmk;License: Standard Youtube License