Concept explainers

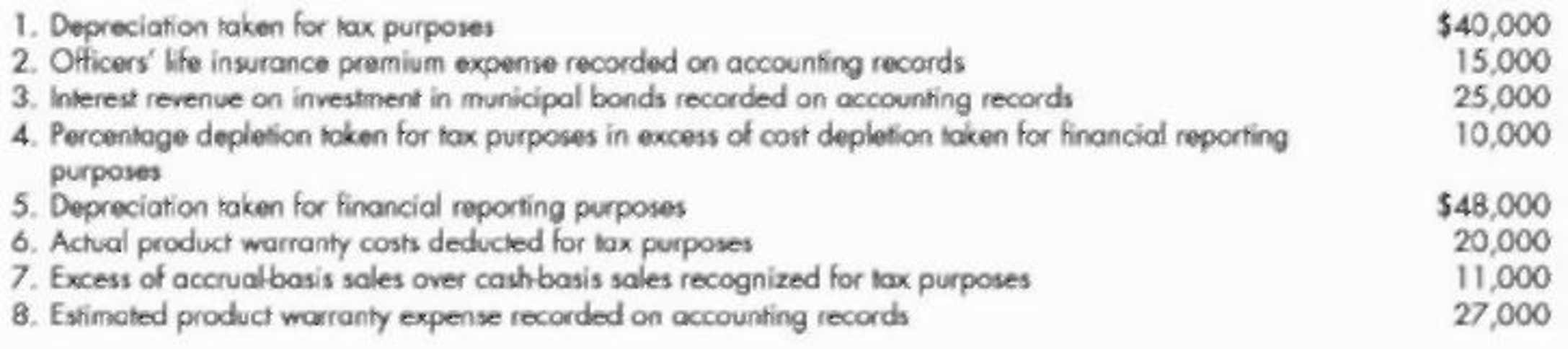

Interperiod Tax Allocation Peterson Company has computed its pretax financial income to be $66,000 in 2019 after including the effects of the appropriate items from the following information:

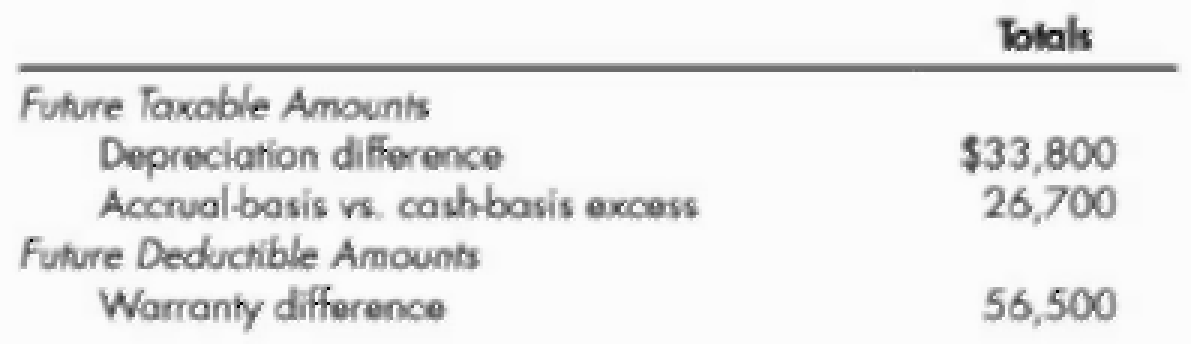

Peterson’s accountant has prepared the following schedule showing the future taxable and deductible amounts at the end of 2019 for its three temporary differences:

At the beginning of 2019, Peterson had a

Required:

- 1. Compute Peterson’s taxable income for 2019.

- 2. Prepare Peterson’s income tax journal entry for 2019 (assume no valuation allowance is necessary).

- 3. Next Level Identify the permanent differences in Items 1 through & and explain why you did or did not account for them as deferred tax items in Requirement 2.

1.

Determine the taxable income of Company P for 2019.

Explanation of Solution

Temporary Difference: Temporary difference refers to the difference of one income recognized by the tax rules and accounting rules of a company in different periods. Consequently the difference between the amount of assets and liabilities reported in the financial reports and the amount of assets and liabilities as per the company’s tax records is known as temporary difference.

Determine the taxable income of Company P for 2019:

| Computation of taxable income | |

| Particulars | Amount |

| Pre-tax financial income | $66,000 |

| Add: Excess of depreciation in financial reporting over tax income (1) | $8,000 |

| Excess of warranty expense in financial reporting over tax income (2) | $7,000 |

| Non-deductible officer's insurance premium for tax purpose | $15,000 |

| $96,000 | |

| Less: Non-taxable interest of Municipal bonds | ($25,000) |

| Excess of depletion percentage over cost depletion | ($10,000) |

| Excess of gross profit recognized for financial reporting over tax purpose (3) | ($11,000) |

| Taxable Income | $50,000 |

Table (1)

Thus, the taxable income of Company P is $50,000.

Working Note 1: Determine the Excess of depreciation in financial reporting over tax income:

Working Note 2: Determine the Excess of depreciation in financial reporting over tax income:

Working Note 3: Determine the Excess gross profit recognized for financial reporting over tax purpose:

2.

Record the income tax entry for Company P.

Explanation of Solution

Income Tax Expenses: The expenses which are related to the taxable income of the individuals and business entities for an accounting period, and are recognized by them for the purpose of federal government and state government tax are called as income tax expenses.

Record the income tax entry for Company P.

| Date | Accounts title and explanation | Post Ref. | Debit ($) | Credit ($) |

| 2019 | ||||

| December 31 | Income Tax Expense (Balancing figure) | 13,800 | ||

| Deferred Tax Asset- Warranty expense (4) | 2,100 | |||

| Deferred Tax Liability- Depreciation expense (5) | 2,400 | |||

| Income Tax Payable (6) | 15,000 | |||

| Deferred Tax Liability-Accrual basis sales (7) | 3,300 | |||

| (To record income tax expense with deferred tax asset and deferred tax liability) |

Table (2)

- Income Tax Expense is a component of stockholders’ equity and decreases, so debit it for $13,800.

- Deferred Tax Asset is an asset and increased, so debit it for $2,100.

- Deferred Tax Liability is a liability and decreases, so debit it for $2,400.

- Income Tax Payable is a liability and increases, so credit it for $15,000.

- Deferred Tax Liability is a liability and increases, so credit it for $3,300.

Working note 4: Determine the deferred tax asset – warranty expense:

Working note 5: Determine the deferred tax liability – depreciation expense:

Thus, there is a decrease of ($2,400) in deferred tax liability.

Working note 6: Compute the income tax payable:

Working note 7: Determine the deferred tax liability – accrual sales basis:

3.

Determine the permanent differences in Items 1 through 8 and elaborate the reasons for accounting the deferred tax items in requirement 2.

Explanation of Solution

The permanent differences in items 1 through 8 are as follows:

- Officer’s life insurance premium expense.

- Non-taxable interest revenue form municipal bonds.

- Percentage of depletion in excess of cost exhaustion.

These items are considered as permanent difference and would never be reversed in future (since the pre-tax financial income and taxable income are always different) and hence are not considered as deferred tax items for which the journal entries are recorded as per requirement 2.

Want to see more full solutions like this?

Chapter 18 Solutions

EBK INTERMEDIATE ACCOUNTING: REPORTING

- Financial Accounting Questionarrow_forwardWhat is the investment turnover for this financial accounting question?arrow_forwardSuppose you take out a five-year car loan for $14000, paying an annual interest rate of 4%. You make monthly payments of $258 for this loan. Complete the table below as you pay off the loan. Months Amount still owed 4% Interest on amount still owed (Remember to divide by 12 for monthly interest) Amount of monthly payment that goes toward paying off the loan (after paying interest) 0 14000 1 2 3 + LO 5 6 7 8 9 10 10 11 12 What is the total amount paid in interest over this first year of the loan?arrow_forward

- Suppose you take out a five-year car loan for $12000, paying an annual interest rate of 3%. You make monthly payments of $216 for this loan. mocars Getting started (month 0): Here is how the process works. When you buy the car, right at month 0, you owe the full $12000. Applying the 3% interest to this (3% is "3 per $100" or "0.03 per $1"), you would owe 0.03*$12000 = $360 for the year. Since this is a monthly loan, we divide this by 12 to find the interest payment of $30 for the month. You pay $216 for the month, so $30 of your payment goes toward interest (and is never seen again...), and (216-30) = $186 pays down your loan. (Month 1): You just paid down $186 off your loan, so you now owe $11814 for the car. Using a similar process, you would owe 0.03* $11814 = $354.42 for the year, so (dividing by 12), you owe $29.54 in interest for the month. This means that of your $216 monthly payment, $29.54 goes toward interest and $186.46 pays down your loan. The values from above are included…arrow_forwardSuppose you have an investment account that earns an annual 9% interest rate, compounded monthly. It took $500 to open the account, so your opening balance is $500. You choose to make fixed monthly payments of $230 to the account each month. Complete the table below to track your savings growth. Months Amount in account (Principal) 9% Interest gained (Remember to divide by 12 for monthly interest) Monthly Payment 1 2 3 $500 $230 $230 $230 $230 + $230 $230 10 6 $230 $230 8 9 $230 $230 10 $230 11 $230 12 What is the total amount gained in interest over this first year of this investment plan?arrow_forwardGiven correct answer general Accounting questionarrow_forward

- On 1st May, 2024 you are engaged to audit the financial statement of Giant Pharmacy for the period ending 30th December 2023. The Pharmacy is located at Mgeni Nani at the outskirts of Mtoni Kijichi in Dar es Salaam City. Materiality is judged to be TZS. 200,000/=. During the audit you found that all tests produced clean results. As a matter of procedures you drafted an audit report with an unmodified opinion to be signed by the engagement partner. The audit partner reviewed your file in October, 2024 and concluded that your audit complied with all requirements of the international standards on auditing and that; sufficient appropriate audit evidence was in the file to support a clean audit opinion. Subsequently, an audit report with an unmodified opinion was issued on 1st November, 2024. On 18th January 2025, you receive a letter from Dr. Fatma Shemweta, the Executive Director of the pharmacy informing you that their cashier who has just absconded has been arrested in Kigoma with TZS.…arrow_forwardNonearrow_forwardNeed help this questionarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning