Concept explainers

a.1

Prepare a schedule showing units started and completed in the forging department during July.

a.1

Explanation of Solution

Prepare a schedule showing units started and completed in the forging department during July as follows:

| Flow of Physical units: Forging Department | |

| Particulars | Units |

| Beginning work in process inventory | 5,000 |

| Add: units started | 75,000 |

| Units in process | 80,000 |

| Less: Ending work in process invnetory | 8,000 |

| Units transferred to assembly department | 72,000 |

| Less: beginning work in process inventory | 5,000 |

| Units started and completed | 67,000 |

Table (1)

2.

Compute the equivalent units of direct materials and conversion for the forging department during July.

2.

Explanation of Solution

Prepare a schedule showing units started and completed in the forging department during July as follows:

| Particulars | Direct materials | Conversion |

| Beginning work in process inventory | 0 | 3,000 |

| Units start and complete | 67,000 | 67,000 |

| Ending work in process inventory | 8,000 | 6,000 |

| Equivalent units of production | 75,000 | 76,000 |

Table (2)

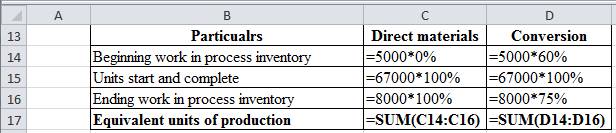

Working note:

Figure (1)

3.

Identify the cost per equivalent unit of input resource for the forging department during July.

3.

Explanation of Solution

Identify the cost per equivalent unit of input resource for the forging department during July as follows:

| Particulars | Direct materials | Conversion |

| Cost incurred by Forging department (A) | $675,000 | $608,000 |

| Equivalent units (B) | 75,000 | 76,000 |

| Cost per equivalent unit (A ÷ B) | $9 | $8 |

Table (3)

4.

Prepare the

4.

Explanation of Solution

Prepare the journal entry to transfer units from Forging department to the assembly department during July as follows:

| Account titles and Explanation | Debit | Credit |

| Work in process inventory - Assembly department | $1,224,000 | |

| Work in process inventory - Forging department | $1,224,000 | |

| (To record transfer of 72,000 units to the assembly department) |

Table (4)

Working note:

Calculate total unit cost transferred.

| Particulars | Amount |

| Beginning work in process inventory ($45,000 +$16,000) | $61,000 |

| Add: Start and complete cost: | |

| Materials (67,000 units × $9) | $603,000 |

| Conversion (70,000 units × $8) | $560,000 |

| Total cost of units transferred | $1,224,000 |

Table (5)

- Work in process inventory – Assembly department is a current asset, and it is increased. Therefore, debit work in process inventory account for $1,224,000.

- Work in process inventory – Forging department is a current asset, and it is decreased. Therefore, credit work in process inventory –Forging department account for $1,224,000.

5.

Compute cost assigned to ending inventory in the forging department on July 31.

5.

Explanation of Solution

Compute cost assigned to ending inventory in the forging department on July 31 as follows:

b.1

Prepare a schedule showing units started and completed in the assembly department during July.

b.1

Explanation of Solution

| Flow of Physical units: Assembly Department | |

| Particulars | Units |

| Beginning work in process inventory | 4,000 |

| Add: units started | 72,000 |

| Units in process | 76,000 |

| Less: Ending work in process inventory | 16,000 |

| Units transferred to assembly department | 60,000 |

| Less: beginning work in process inventory | 4,000 |

| Units started and completed | 56,000 |

Table (6)

2.

Compute equivalent units of direct materials and conversion for the assembly department in July.

2.

Explanation of Solution

Compute equivalent units of direct materials and conversion for the assembly department in July as follows:

| Particulars | Direct materials | Conversion |

| Beginning work in process inventory | 4,000 | 3,000 |

| Units start and complete | 56,000 | 56,000 |

| Ending work in process inventory | - | 4,800 |

| Equivalent units of production | 60,000 | 63,800 |

Table (7)

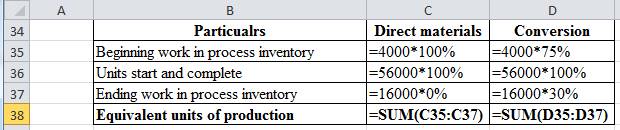

Working note:

Figure (2)

3.

Compute equivalent cost per unit of input resource for the assembly department during July.

3.

Explanation of Solution

Compute equivalent cost per unit of input resource for the assembly department during July as follows:

| Particulars | Direct materials | Conversion |

| Cost incurred by department (A) | $720,000 | $191,400 |

| Equivalent units (B) | 60,000 | 63,800 |

| Cost per equivalent unit (A ÷ B) | $12 | $3 |

Table (8)

4.

Prepare journal entry to record transfer units from the assembly department to finished goods inventory during July.

4.

Explanation of Solution

Prepare journal entry to record transfer units from the assembly department to finished goods inventory during July as follows:

| Account titles and Explanation | Debit | Credit |

| Work in process inventory - Assembly department | $1,920,000 | |

| Work in process inventory - Forging department | $1,920,000 | |

| (To record transfer of 72,000 units to the assembly department) |

Table (9)

Working note:

Calculate total unit cost transferred.

| Particulars | Amount |

| Beginning work in process inventory ($68,000 +$3,000) | $71,000 |

| Add: Start and complete cost: | |

| Materials (60,000 units × $12) | $720,000 |

| July forging materials (56,000 units × $17) | $952,000 |

| Conversion (59,000 units × $3) | $117,000 |

| Total cost of units transferred | $1,920,000 |

Table (10)

- Finished goods inventory is a current asset, and it is increased. Therefore, debit finished goods inventory account for $1,920,000.

- Work in process inventory – Assembly department is a current asset, and it is decreased. Therefore, credit work in process inventory –Assembly department account for $1,920,000.

5.

Compute the cost assigned to ending inventory in the assembly department.

5.

Explanation of Solution

Compute cost assigned to ending inventory in the forging department on July 31 as follows:

Want to see more full solutions like this?

Chapter 18 Solutions

Gen Combo Loose Leaf Financial Accounting; Connect Access Card

- Don't use ai. A company has the following data: Cash: $50,000Accounts Receivable: $30,000Inventory: $60,000Current Liabilities: $70,000a) What is the company’s acid-test ratio?b) Is the company in a strong liquidity position based on this ratio?arrow_forwardQuestion 5:A company has the following data: Cash: $50,000Accounts Receivable: $30,000Inventory: $60,000Current Liabilities: $70,000a) What is the company’s acid-test ratio?b) Is the company in a strong liquidity position based on this ratio?arrow_forwardQuestion 5: Acid-Test RatioA company has the following data: Cash: $50,000Accounts Receivable: $30,000Inventory: $60,000Current Liabilities: $70,000a) What is the company’s acid-test ratio?b) Is the company in a strong liquidity position based on this ratio?arrow_forward

- Question 4: Depreciation (Straight-Line Method)A company purchases machinery for $50,000. The estimated salvage value is $5,000, and the useful life is 10 years. a) Calculate the annual depreciation expense.b) What will the book value of the machinery be after 4 years?arrow_forwardInventory Valuation (FIFO Method)A company had the following inventory transactions during the month: Beginning inventory: 100 units @ $10 eachPurchase: 200 units @ $12 eachPurchase: 150 units @ $13 eachAt the end of the month, 250 units remain in inventory. Calculate the value of the ending inventory using the FIFO method. explainarrow_forwardNeed assistance without use of ai.arrow_forward

- Depreciation (Straight-Line Method)A company purchases machinery for $50,000. The estimated salvage value is $5,000, and the useful life is 10 years. a) Calculate the annual depreciation expense.b) What will the book value of the machinery be after 4 years?arrow_forwardA company has the following data: Cash: $50,000Accounts Receivable: $30,000Inventory: $60,000Current Liabilities: $70,000a) What is the company’s acid-test ratio?b) Is the company in a strong liquidity position based on this ratio?arrow_forwardDon't want AI answerarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education