a.

Compute the number of sheets started by the Pressing Department in June.

a.

Explanation of Solution

It is a method of cost accounting used by an enterprise with processes categorised by continuous production. The cost for manufacturing those products are assigned to the manufacturing department before the averaged over units are being produced.

Compute the number of sheets started by the Pressing Department in June.

| Particulars | Units |

| Units transferred to the Painting Department in June | 1,500 |

| Add: Ending inventory in Pressing Department, June 30 | 500 |

| Total units in process during June | 2,000 |

| Less: Beginning inventory in Pressing Department, June 1 | (300) |

| Units started by Pressing Department in June | 1,700 |

(Table 1)

Therefore, the number of sheets started by the Pressing Department in June is 1,700 units.

b.

Compute the number of units started and completed by the Pressing Department in June.

b.

Explanation of Solution

Compute the number of units started and completed by the Pressing Department in June.

| Particulars | Units |

| Units transferred to the Painting Department in June | 1,500 |

| Units in beginning inventory in Pressing Department, June 1 | (300) |

| Units started and completed by Pressing Department in June | 1,200 |

(Table 2)

Therefore, the units started and completed by the pressing department during the month June is 1,200 units respectively.

c.

Compute the equivalent units of input resources for the Pressing Department in June.

c.

Explanation of Solution

Compute the equivalent units of input resources for the Pressing Department in June.

| Particulars | Input Resources | |

| Direct Materials | Conversion | |

| To finish beginning inventory in process on June1: | ||

| Direct materials (300 units require 0% to complete) | 0 | |

| Conversion (300 units require 80% to complete) | 240 | |

| To start and complete 1,200 units in June | 1,200 | 1,200 |

| To start ending inventory in process on June 31: | ||

| Direct materials (500 units 100% complete) | 500 | |

| Conversion (500 units 40% complete) | 200 | |

| Equivalent units of resources in June | 1,700 | 1,640 |

(Table 3)

Therefore, the equivalent units of input resources for the Pressing Department in June are 1,700 and 1,640 units respectively

d.

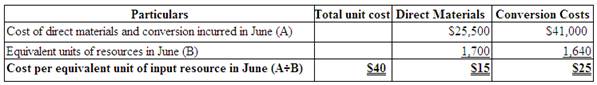

Compute the cost per equivalent unit of input resource for the Pressing Department in June.

d.

Explanation of Solution

Compute the cost per equivalent unit of input resource for the Cutting Department in June.

(Figure 1)

Therefore, the cost per equivalent unit of input resource for the Pressing Department for the month of June is $15 and $25 per unit respectively.

e.

Prepare

e.

Explanation of Solution

Prepare journal entry to transfer pressed sheets from the Pressing Department to the Painting Department in June.

| Date | Accounts title and explanation |

Debit ($) |

Credit ($) |

|

Work in process: Pressing Department (3) | 60,000 | ||

| Work in process: Painting Department | 60,000 | ||

| (To record the transfer of 1,500 units to the painting department in June ) |

(Table 4)

- Work in process: Pressing department is an asset and there is an increase in the value of an asset. Hence, debit the work in process: pressing department by $60,000.

- Work in process: Painting department is an asset and there is a decrease in the value of an asset. Hence, credit the work in process: painting department by $60,000.

Working Notes:

Calculate the cost of direct materials during the month June:

(1)

Calculate the cost of conversion during the month June:

(2)

Calculate the total cost of units transferred:

| Particulars | Amount in $ |

| Cost of beginning inventory, June1 | 6,000 |

| June direct materials cost (1) | 18,000 |

| June conversion cost (2) | 36,000 |

| Total cost of units transferred in June | 60,000 |

(Table 5)

(3)

f.

Calculate the total cost assigned to the Pressing Department’s ending inventory on June 30.

f.

Explanation of Solution

Calculate the total cost assigned to the Pressing Department’s ending inventory on June 30.

| Particulars | Amount in $ |

| Work in Process: Cutting department, May 31: | |

| Direct materials cost (4) | 7,500 |

| Conversion cost (5) | 5,000 |

| Ending inventory in process, May 31 | 12,500 |

(Table 6)

Therefore, the total cost assigned to the Pressing Department’s ending inventory on June 30 is $12,500.

Working Notes:

Calculate the cost of direct materials during the month end of June 30 for pressing department:

(4)

Calculate the cost of conversion during the month end of June 30 for pressing department:

(5)

Want to see more full solutions like this?

Chapter 18 Solutions

Gen Combo Loose Leaf Financial Accounting; Connect Access Card

- answer ?? Financial Accounting questionarrow_forwardWhich of the following is an example of an accrual?A) Paying cash for rentB) Recognizing revenue when it is earned, not when it is receivedC) Buying inventory on accountD) Paying for utilities in the month they are consumed Explarrow_forwardPlease show me the correct way to solve this financial accounting problem with accurate methods.arrow_forward

- Accounts receivable: 395, Accounts payable:145arrow_forwardWhich of the following is an example of an accrual?A) Paying cash for rentB) Recognizing revenue when it is earned, not when it is receivedC) Buying inventory on accountD) Paying for utilities in the month they are consumed Explanation.arrow_forwardI am looking for a step-by-step explanation of this financial accounting problem with correct standards.arrow_forward

- Horizon Corporation has the following data for the year: • Beginning inventory: $80,000 Purchases during the year: $150,000 Ending inventory: $60,000 What is Horizon Corporation's Cost of Goods Sold (COGS) for the year?arrow_forwardOne of Timothee Manufacturing Company's activity cost pools is quality testing, with an estimated overhead of $144,000. It produces compact models (900 tests) and deluxe models (1,200 tests). How much of the quality testing cost pool should be assigned to compact models? A. $48,050 B. $54,503 C. $61,713 D. $72,506arrow_forwardI need help solving this general accounting question with the proper methodology.arrow_forward

- What is the primary purpose of financial accounting?A) To prepare financial statements for internal use onlyB) To provide financial information to external usersC) To assist managers in decision-making within a companyD) To manage day-to-day operations of the business explain.arrow_forwardPlease provide the answer to this general accounting question using the right approach.arrow_forwardI am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education