Concept explainers

a.1

Prepare a schedule showing units started and completed in the forging department during July.

a.1

Explanation of Solution

Prepare a schedule showing units started and completed in the forging department during July as follows:

| Flow of Physical units: Forging Department | |

| Particulars | Units |

| Beginning work in process inventory | 5,000 |

| Add: units started | 75,000 |

| Units in process | 80,000 |

| Less: Ending work in process invnetory | 8,000 |

| Units transferred to assembly department | 72,000 |

| Less: beginning work in process inventory | 5,000 |

| Units started and completed | 67,000 |

Table (1)

2.

Compute the equivalent units of direct materials and conversion for the forging department during July.

2.

Explanation of Solution

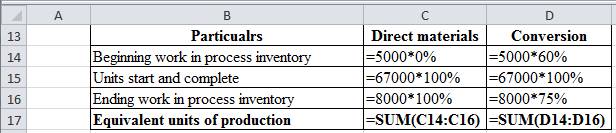

Prepare a schedule showing units started and completed in the forging department during July as follows:

| Particulars | Direct materials | Conversion |

| Beginning work in process inventory | 0 | 3,000 |

| Units start and complete | 67,000 | 67,000 |

| Ending work in process inventory | 8,000 | 6,000 |

| Equivalent units of production | 75,000 | 76,000 |

Table (2)

Working note:

Figure (1)

3.

Identify the cost per equivalent unit of input resource for the forging department during July.

3.

Explanation of Solution

Identify the cost per equivalent unit of input resource for the forging department during July as follows:

| Particulars | Direct materials | Conversion |

| Cost incurred by Forging department (A) | $675,000 | $608,000 |

| Equivalent units (B) | 75,000 | 76,000 |

| Cost per equivalent unit (A ÷ B) | $9 | $8 |

Table (3)

4.

Prepare the

4.

Explanation of Solution

Prepare the journal entry to transfer units from Forging department to the assembly department during July as follows:

| Account titles and Explanation | Debit | Credit |

| Work in process inventory - Assembly department | $1,224,000 | |

| Work in process inventory - Forging department | $1,224,000 | |

| (To record transfer of 72,000 units to the assembly department) |

Table (4)

Working note:

Calculate total unit cost transferred.

| Particulars | Amount |

| Beginning work in process inventory ($45,000 +$16,000) | $61,000 |

| Add: Start and complete cost: | |

| Materials (67,000 units × $9) | $603,000 |

| Conversion (70,000 units × $8) | $560,000 |

| Total cost of units transferred | $1,224,000 |

Table (5)

- Work in process inventory – Assembly department is a current asset, and it is increased. Therefore, debit work in process inventory account for $1,224,000.

- Work in process inventory – Forging department is a current asset, and it is decreased. Therefore, credit work in process inventory –Forging department account for $1,224,000.

5.

Compute cost assigned to ending inventory in the forging department on July 31.

5.

Explanation of Solution

Compute cost assigned to ending inventory in the forging department on July 31 as follows:

b.1

Prepare a schedule showing units started and completed in the assembly department during July.

b.1

Explanation of Solution

| Flow of Physical units: Assembly Department | |

| Particulars | Units |

| Beginning work in process inventory | 4,000 |

| Add: units started | 72,000 |

| Units in process | 76,000 |

| Less: Ending work in process inventory | 16,000 |

| Units transferred to assembly department | 60,000 |

| Less: beginning work in process inventory | 4,000 |

| Units started and completed | 56,000 |

Table (6)

2.

Compute equivalent units of direct materials and conversion for the assembly department in July.

2.

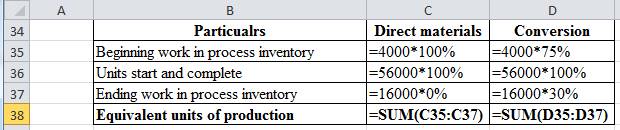

Explanation of Solution

Compute equivalent units of direct materials and conversion for the assembly department in July as follows:

| Particulars | Direct materials | Conversion |

| Beginning work in process inventory | 4,000 | 3,000 |

| Units start and complete | 56,000 | 56,000 |

| Ending work in process inventory | - | 4,800 |

| Equivalent units of production | 60,000 | 63,800 |

Table (7)

Working note:

Figure (2)

3.

Compute equivalent cost per unit of input resource for the assembly department during July.

3.

Explanation of Solution

Compute equivalent cost per unit of input resource for the assembly department during July as follows:

| Particulars | Direct materials | Conversion |

| Cost incurred by department (A) | $720,000 | $191,400 |

| Equivalent units (B) | 60,000 | 63,800 |

| Cost per equivalent unit (A ÷ B) | $12 | $3 |

Table (8)

4.

Prepare journal entry to record transfer units from the assembly department to finished goods inventory during July.

4.

Explanation of Solution

Prepare journal entry to record transfer units from the assembly department to finished goods inventory during July as follows:

| Account titles and Explanation | Debit | Credit |

| Work in process inventory - Assembly department | $1,920,000 | |

| Work in process inventory - Forging department | $1,920,000 | |

| (To record transfer of 72,000 units to the assembly department) |

Table (9)

Working note:

Calculate total unit cost transferred.

| Particulars | Amount |

| Beginning work in process inventory ($68,000 +$3,000) | $71,000 |

| Add: Start and complete cost: | |

| Materials (60,000 units × $12) | $720,000 |

| July forging materials (56,000 units × $17) | $952,000 |

| Conversion (59,000 units × $3) | $117,000 |

| Total cost of units transferred | $1,920,000 |

Table (10)

- Finished goods inventory is a current asset, and it is increased. Therefore, debit finished goods inventory account for $1,920,000.

- Work in process inventory – Assembly department is a current asset, and it is decreased. Therefore, credit work in process inventory –Assembly department account for $1,920,000.

5.

Compute the cost assigned to ending inventory in the assembly department.

5.

Explanation of Solution

Compute cost assigned to ending inventory in the forging department on July 31 as follows:

Want to see more full solutions like this?

Chapter 18 Solutions

Financial Accounting

- Alicia has been working for JMM Corporation for 32 years. Alicia participates in JMM's defined benefit plan. Under the plan, for every year of service for JMM, she is to receive 2 percent of the average salary of her three highest consecutive calendar years of compensation from JMM. She retired on January 1, 2024. Before retirement, her annual salary was $588,000, $627,000, and $666,000 for 2021, 2022, and 2023. What is the maximum benefit Alicia can receive in 2024?arrow_forwardABC Manufacturing Company produces widgets and has been operating for several years. The company's management team is responsible for preparing and monitoring the company's budget to ensure that it stays on track and achieves its financial objectives. ABC Manufacturing Company has recently completed its fiscal year. Management has compiled the planning budget and actual results for the year and has found that the company's actual performance fell short of its budgeted expectations. Management wants your help in gleaning extra information from what we have. The budget and actual results are as follows: Planning budget Sales revenue $5,000 Direct materials 1,000 Direct labor 1,500 Manufacturing overhead 750 Selling and administrative expenses 1,500 Profit $250 Actual results Sales revenue $4,500 Direct materials 1,200 Direct labor 1,100 Manufacturing overhead 900…arrow_forwardYou gave me unhelpful so i am also gave you unhelpful.if you will not give unhelpful then also i will not give unhelpful. what is accoun?arrow_forward

- Kling Company was organized in December Year 1 and began operations on January 2, Year 2. Prior to the start of operations, it incurred the following costs: Costs of hiring new employees Attorney's fees in connection with the organization of the company Improvements to leased offices prior to occupancy (10-year lease) Costs of pre-opening advertising Required: 1. What amount should the company expense in Year 1? 600 $3,000 12,000 6,000 5,000 Chapter 12 Homework assignment take frame Start-Up Costs What amount should the company expense in Year 2? +A $arrow_forwardI needarrow_forwardProvide correct solution and accounting questionarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education