Concept explainers

a. 1

Prepare a schedule showing units started and completed in the Molding Department during June.

a. 1

Explanation of Solution

It is a method of cost accounting used by an enterprise with processes categorised by continuous production. The cost for manufacturing those products are assigned to the manufacturing department before the averaged over units are being produced.

Prepare a schedule showing units started and completed in the Molding Department during June.

| Particulars | Units |

| Flow of physical units: Molding Department | |

| Units in beginning inventory, June 1 | 3,000 |

| Units started in June | 50,000 |

| Units in process during June | 53,000 |

| Units in ending inventory, June 30 | (1,000) |

| Units transferred to Finishing Department in June | 52,000 |

| Units in beginning inventory, June 1 | (3,000) |

| Units started and completed in June | 49,000 |

(Table 1)

Therefore, the units started and completed in the Molding Department during June is 49,000.

a. 2

Compute the equivalent units of direct materials and conversion for the Molding Department in June.

a. 2

Explanation of Solution

Compute the equivalent units of direct materials and conversion for the Molding Department in June.

| Particulars | Input Resources | |

| Direct Materials | Conversion | |

| To finish units in process on June 1: | ||

| Direct materials (3,000 units require 30% to complete) | 900 | |

| Conversion (3,000 units require 60% to complete) | 1,800 | |

| To start and complete 49,000 units in June | 49,000 | 49,000 |

| To start units in process on June 30: | ||

| Direct materials (1,000 units 80% complete) | 800 | |

| Conversion (1,000 units 20% complete) | 200 | |

| Equivalent units of resources in June | 50,700 | 51,000 |

(Table 2)

Therefore, the equivalent units of direct materials and conversion for the Molding Department in June are 50,700 and 51,000 respectively.

a. 3

Calculate the cost per equivalent unit of input resource for the Molding Department during June.

a. 3

Explanation of Solution

Calculate the cost per equivalent unit of input resource for the Molding Department during June.

| Particulars | Direct Materials in $ | Conversion Cost in $ |

| Cost per equivalent unit in June : | ||

| Costs incurred by Molding Department in June (A) | 912,600 | 612,000 |

| Equivalent units in June (B) | 50,700 | 51,000 |

| Cost per equivalent unit in June (A÷B) | 18 | 12 |

(Table 3)

Therefore, the cost per equivalent unit of input resource for the Molding Department during June is $18 per unit and $12 per unit respectively.

a. 4

Prepare

a. 4

Explanation of Solution

Prepare journal entry to record the transfer of units from the Molding Department to the Finishing Department during June.

| Date | Accounts title and explanation |

Debit ($) |

Credit ($) |

|

Work in process: Finishing Department (4) | 1,560,000 | ||

| Work in process: Molding Department | 1,560,000 | ||

| (To record the transfer of 52,000 units to the Finishing department in June) |

(Table 4)

- Work in process: Finishing department is an asset and there is an increase in the value of an asset. Hence, debit the work in process: finishing department by $1,560,000.

- Work in process: Molding department is an asset and there is a decrease in the value of an asset. Hence, credit the work in process: molding department by $1,560,000.

Working Notes:

Calculate the cost of beginning inventory:

(1)

Calculate the cost of direct materials during the month June:

(2)

Calculate the cost of conversion during the month June:

(3)

Calculate the total cost of units transferred:

| Particulars | Amount in $ |

| Cost of beginning inventory, June 1 (1) | 52,200 |

| June direct materials cost (2) | 898,200 |

| June conversion cost (3) | 609,600 |

| Total cost of units transferred | 1,560,000 |

(Table 5)

(4)

a.5

Compute the costs assigned to ending inventory in the Molding Department on June 30.

a.5

Explanation of Solution

Compute the costs assigned to ending inventory in the Molding Department on June 30.

| Particulars | Amount in $ |

| Work in Process: Molding Department, June 30: | |

| Direct materials cost (5) | 14,400 |

| Conversion cost (6) | 2,400 |

| Ending inventory in process, June 30 | 16,800 |

(Table 6)

Working Notes:

Calculate the cost of direct materials during the month end of June 30:

(5)

Calculate the cost of conversion during the month end of June 30:

(6)

b. 1

Prepare a schedule showing units started and completed in the Finishing Department during June.

b. 1

Explanation of Solution

Prepare a schedule showing units started and completed in the finishing Department during June.

| Particulars | Units |

| Flow of physical units: Finishing Department | |

| Units in beginning inventory, June 1 | 5,000 |

| Units started in June | 52,000 |

| Units in process during June | 57,000 |

| Units in ending inventory, June 30 | (2,000) |

| Units transferred to Finishing Department in June | 55,000 |

| Units in beginning inventory, June 1 | (5,000) |

| Units started and completed in June | 50,000 |

(Table 7)

Therefore, the units started and completed in the Finishing Department during June is 50,000

b. 2

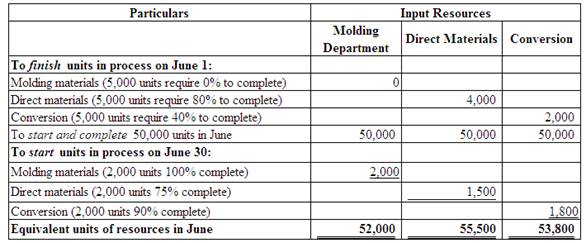

Compute the equivalent units of direct materials and conversion for the Finishing Department in June.

b. 2

Explanation of Solution

(Figure 4)

b. 3

Calculate the cost per equivalent unit of input resource for the Finishing Department during June.

b. 3

Explanation of Solution

Calculate the cost per equivalent unit of input resource for the Finishing Department during June.

| Particulars | Input Resources | ||

| Molding materials in $ | Direct Materials in $ | Conversion in $ | |

| Cost per equivalent unit in June | |||

| Costs charged to Finishing Department in June (A) | 1,560,000 | 222,000 | 430,400 |

| Equivalent units in June (B) | 52,000 | 55,500 | 53,800 |

| Cost per equivalent unit in June (A÷B) | 30 | 4 | 8 |

(Table 8)

Note:

Total cost of Molding Department $1,560,000 is transferred to the Finishing Department in June.

b.4

Prepare journal entry to record the transfer of units from the Finishing Department to Finished goods inventory during June.

b.4

Explanation of Solution

Prepare journal entry to record the transfer of units from the Finishing Department to Finished goods inventory during June.

| Date | Accounts title and explanation |

Debit ($) |

Credit ($) |

| Finished goods inventory | 2,310,000 | ||

|

Work in process: Finishing Department (9) | 2,310,000 | ||

| (To record the transfer of 55,000 units to the Finishing goods in June) |

(Table 9)

- Finished goods inventory is an asset and there is an increase in the value of an asset. Hence, debit the finished goods inventory by $2,310,000.

- Work in process: Molding department is an asset and there is a decrease in the value of an asset. Hence, credit the work in process: molding department by $2,310,000.

Working Notes:

Calculate the cost of beginning inventory:

(5)

Calculate the cost of molding department during the month June:

(6)

Calculate the cost of direct materials during the month June for finishing department:

(7)

Calculate the cost of conversion during the month June for finishing department:

(8)

Calculate the total cost of units transferred:

| Particulars | Amount in $ |

| Cost of beginning inventory, June 1 (5) | 178,000 |

| June molding materials (6) | 1,500,000 |

| June direct materials cost (7) | 216,000 |

| June conversion cost (8) | 416,000 |

| Total cost of units transferred | 2,310,000 |

(Table 10)

(9)

a.5

Compute the costs assigned to ending inventory in the Finishing Department on June 30.

a.5

Explanation of Solution

Compute the costs assigned to ending inventory in the Finishing Department on June 30.

| Particulars | Amount in $ |

| Work in Process: Finishing department, June 30: | |

| Molding materials (10) | 60,000 |

| Direct materials cost (11) | 6,000 |

| Conversion cost (12) | 14,400 |

| Ending inventory in process, June 30 | 80,400 |

(Table 11)

Working Notes:

Calculate the cost of molding materials during the month end of June 30 for finishing department:

(10)

Calculate the cost of direct materials during the month end of June 30 for finishing department:

(11)

Calculate the cost of conversion during the month end of June 30 for finishing department:

(12)

Want to see more full solutions like this?

Chapter 18 Solutions

Connect Online Access for Financial Accounting

- Need help this accounting questionarrow_forwardPlease provide the answer to this general accounting question using the right approach.arrow_forwardCreditors Sales Revenue 22,500 1,143,700 Land at cost 550,000 Building at cost 570,000 Furniture and fittings at cost 85,000 Bank 14,000 Provision for Depreciation Buildings 120,000 Furniture and fittings 15,000 Discounts 5,700 5,800 Retained Earnings at 1 Oct 2022 14,800 Provision for bad debts 2,200 Goodwill 400,000 Cash 16,400 Inventory at 1 Oct 2022 48,000 Rent Received(from Breezy Ltd) 27,000 Rent 7,900 Wages and Salaries 122,000 Insurance 16,300 Carriage Inwards 2,300 Returns 8,500 12,000 Commission received 5,200 8% Mortgage 100,000 Other Operating Expenses 2,500 Debtors 45,000 Purchases 340,000 Debenture Interest 1,200 Mortgage Interest 4,600 Bad debt 4,700 7% Debentures 150,000 4% Preference Shares @ $0.5 130,000 Ordinary Shares @ $0.75 375,000 General Reserves 127,000 Interim ordinary dividends paid 4,500 2,249,400 2,249,400arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education