Concept explainers

Product costing and decision analysis for a service company

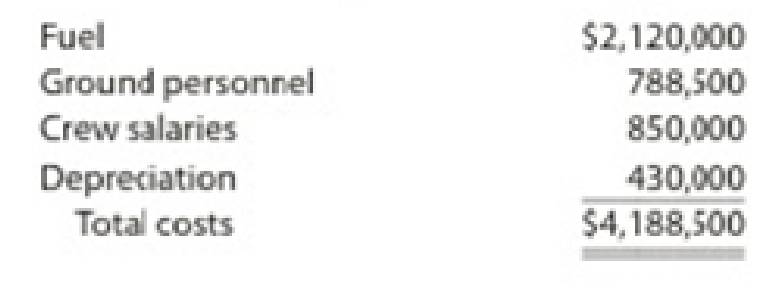

Blue Star Airline provides passenger airline service, using small jets. The airline connects four major cities: Charlotte, Pittsburgh, Detroit, and San Francisco. The company expects to fly 170,000 miles during a month. The following costs are budgeted for a month:

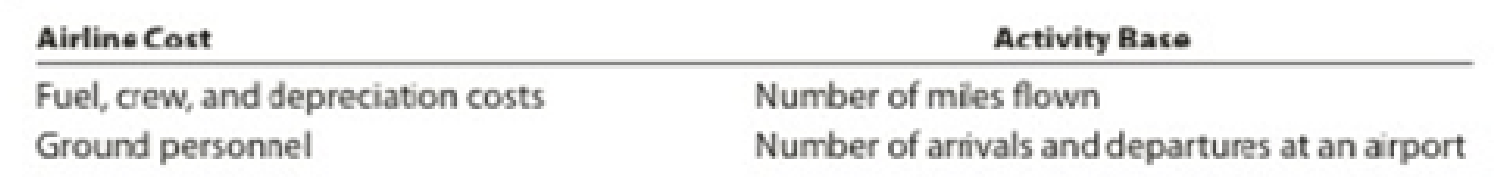

Blue Star management wishes to assign these costs to individual flights in order to gauge the profitability of its service offerings. The following activity bases were identified with the budgeted costs:

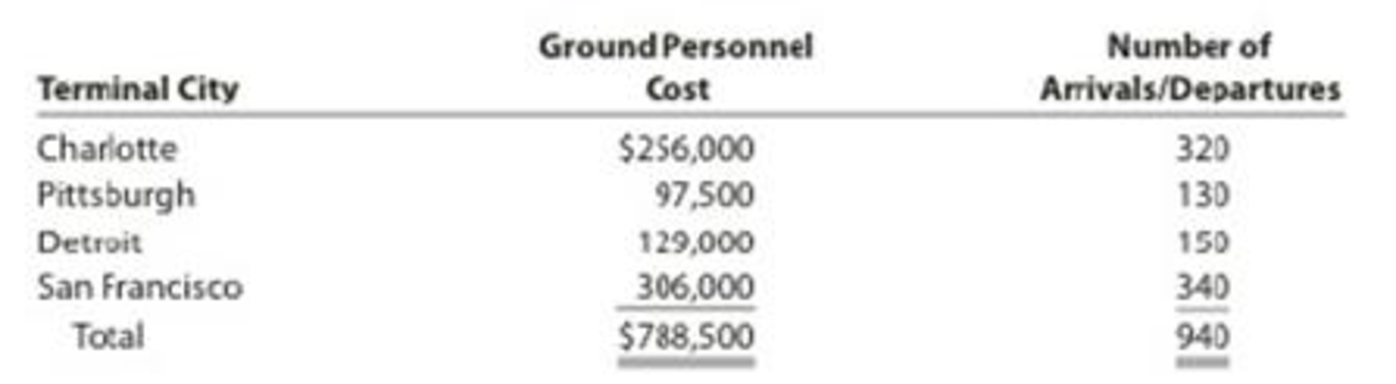

The size of the company’s ground operation in each city is determined by the size of the workforce. The following monthly data are available from corporate records for each terminal operation:

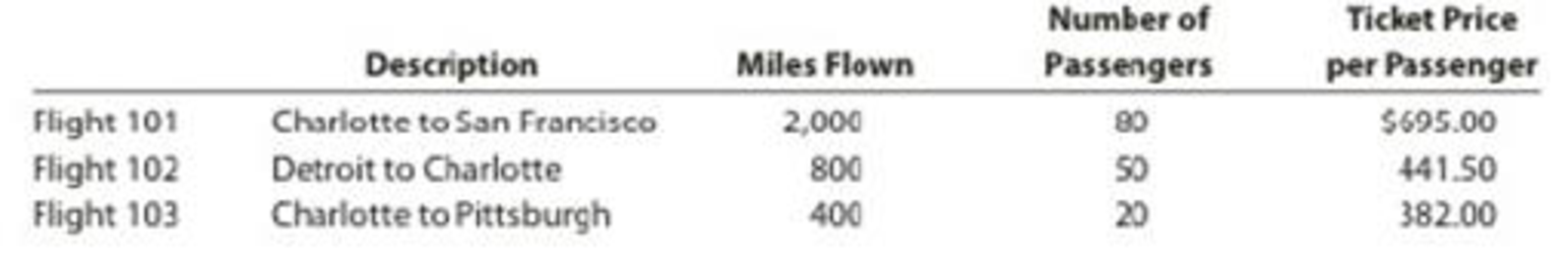

Three recent representative flights have been selected for the profitability study. Their characteristics are as follows:

Instructions

Determine the fuel, crew, and

Determine the cost per arrival or departure by terminal city.

Use the information in (1) and (2) to construct a profitability report for the three flights. Each flight has a single arrival and departure to its origin and destination city pairs.

Trending nowThis is a popular solution!

Chapter 18 Solutions

FINANCIAL&MANAGERIAL ACCOUNTING(LL)W/AC

- The following condensed income statements of the Jackson Holding Company are presented for the two years ended December 31, 2024 and 2023: 2024 2023 Sales revenue $ 15,900,000 $ 10,500,000 Cost of goods sold 9,650,000 6,450,000 Gross profit 6,250,000 4,050,000 Operating expenses 3,560,000 2,960,000 Operating income 2,690,000 1,090,000 Gain on sale of division 690,000 — 3,380,000 1,090,000 Income tax expense 845,000 272,500 Net income $ 2,535,000 $ 817,500 On October 15, 2024, Jackson entered into a tentative agreement to sell the assets of one of its divisions. The division qualifies as a component of an entity as defined by GAAP. The division was sold on December 31, 2024, for $5,270,000. Book value of the division’s assets was $4,580,000. The division’s contribution to Jackson’s operating income before-tax for each year was as follows: 2024 $ 445,000 2023 $ 345,000 Assume an income tax rate of 25%. Required: Note: In each case, net any gain or…arrow_forwardWant to this question answer general Accountingarrow_forwardWhat is this firm s WACC?? Solve this problem general Accounting questionarrow_forward

- Accounting questionarrow_forwardGreen Grow Incorporated (GGI) manufactures lawn fertilizer. Because of the product’s very high quality, GGI often receives special orders from agricultural research groups. For each type of fertilizer sold, each bag is carefully filled to have the precise mix of components advertised for that type of fertilizer. GGI’s operating capacity is 34,000 one-hundred-pound bags per month, and it currently is selling 32,000 bags manufactured in 32 batches of 1,000 bags each. The firm just received a request for a special order of 7,400 one-hundred-pound bags of fertilizer for $210,000 from APAC, a research organization. The production costs would be the same, but there would be no variable selling costs. Delivery and other packaging and distribution services would cause a one-time $3,900 cost for GGI. The special order would be processed in two batches of 3,700 bags each. (No incremental batch-level costs are anticipated. Most of the batch-level costs in this case are short-term fixed costs,…arrow_forwardGeneral accountingarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning