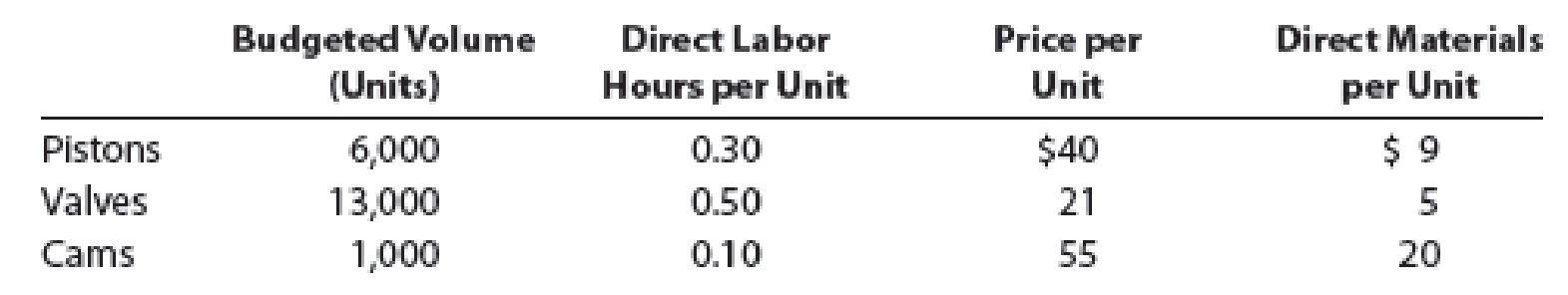

Isaac Engines Inc. produces three products—pistons, valves, and cams—for the heavy equipment industry. Isaac Engines has a very simple production process and product line and uses a single plantwide factory

The estimated direct labor rate is $20 per direct labor hour. Beginning and ending inventories are negligible and are, thus, assumed to be zero. The budgeted factory overhead for Isaac Engines is $235,200.

a. Determine the plantwide factory overhead rate.

b. Determine the factory overhead and direct labor cost per unit for each product.

c. Use the information provided to construct a budgeted gross profit report by product line for the year ended December 31, 20Y2. Include the gross profit as a percent of sales in the last line of your report, rounded to one decimal place.

d. What does the report in (c) indicate to you?

a.

Compute the plant-wide overhead rate using direct labor hours (DLH) as the allocation base.

Explanation of Solution

Single plant-wide factory overhead rate: The rate at which the factory or manufacturing overheads are allocated to products is referred to as single plant-wide factory overhead rate.

Formula to compute single plant-wide overhead rate:

Compute single plant-wide overhead rate using DLH as the allocation base.

Working note (1):

Compute the total number of direct labor hours (DLH) budgeted.

| Types of Products | Number of Budgeted Units | × | Number of DLH Per Unit | = | Total Number of Budgeted DLH |

| Pistons | 6,000 units | × | 0.30 DLH | = | 1,800 DLH |

| Valves | 13,000 units | × | 0.50 DLH | = | 6,500 DLH |

| Cams | 1,000 units | × | 0.10 DLH | = | 100 DLH |

| Total number of budgeted DLH | 8,400 DLH | ||||

Table (1)

b.

Calculate the factory overhead allocated per unit of each product, and direct labor cost per unit.

Explanation of Solution

Compute the factory overhead allocated per unit for each product.

| Types of Products | Single Plant-Wide Overhead Rate | × | Number of DLH Per Unit of Each Product | = | Factory Overhead Per Unit |

| Pistons | $28 per DLH | × | 0.30 DLH | = | $8.40 per unit |

| Valves | $28 per DLH | × | 0.50 DLH | = | $14.00 per unit |

| Cams | $28 per DLH | × | 0.10 DLH | = | $2.80 per unit |

Table (2)

Compute direct labor cost per unit for each product.

| Types of Products | Estimated Direct Labor Rate | × | Number of DLH Per Unit of Each Product | = | Direct Labor Cost Per Unit |

| Pistons | $20 per DLH | × | 0.30 DLH | = | $6 per unit |

| Valves | $20 per DLH | × | 0.50 DLH | = | $10 per unit |

| Cams | $20 per DLH | × | 0.10 DLH | = | $2 per unit |

Table (3)

c.

Prepare a budgeted gross profit report of Company I for the year ended December 31, 20Y2.

Explanation of Solution

Prepare a budgeted gross profit report of Company I, by product line, for the year ended December 31, 20Y2.

| Company I | |||

| Budgeted Gross Profit Report | |||

| December 31, 20Y2 | |||

| Pistons | Valves | Cams | |

| Revenues (2) | $240,000 | $273,000 | $55,000 |

| Direct materials cost (3) | (54,000) | (65,000) | (20,000) |

| Direct labor cost (4) | (36,000) | (130,000) | (2,000) |

| Factory overhead (5) | (50,400) | (182,000) | (2,800) |

| Gross profit | $99,600 | $(104,000) | $30,200 |

| Gross profit as a percent of sales (6) | 41.5% | (38.1)% | 54.9% |

Table (4)

Working note (2):

Compute the sales revenues for each product.

| Types of Products | Number of Budgeted Units | × | Price Per Unit | = | Sales Revenue |

| Pistons | 6,000 units | × | $40 | = | $240,000 |

| Valves | 13,000 units | × | 21 | = | 273,000 |

| Cams | 1,000 units | × | 55 | = | 55,000 |

Table (5)

Working note (3):

Compute the direct material cost for each product.

| Types of Products | Number of Budgeted Units | × | Cost Per Unit | = | Direct material Cost |

| Pistons | 6,000 units | × | $9.00 | = | $54,000 |

| Valves | 13,000 units | × | 5.00 | = | 65,000 |

| Cams | 1,000 units | × | 20.00 | = | 20,000 |

Table (6)

Working note (4):

Compute the direct labor cost for each product.

| Types of Products | Number of Budgeted Units | × | Cost Per Unit | = | Direct labor Cost |

| Pistons | 6,000 units | × | $6.00 | = | $36,000 |

| Valves | 13,000 units | × | 10.00 | = | 130,000 |

| Cams | 1,000 units | × | 2.00 | = | 2,000 |

Table (7)

Working note (5):

Compute the total factory overhead allocated for each product.

| Types of Products | Number of Budgeted Units | × | Factory Overhead Per Unit | = | Total Factory Overhead |

| Pistons | 6,000 units | × | $8.40 per unit | = | $50,400 |

| Valves | 13,000 units | × | 14.00 per unit | = | 182,000 |

| Cams | 1,000 units | × | 2.80 per unit | = | 2,800 |

Table (8)

Note: Refer to table (2) for value and computation of factory overhead per unit.

Working note (6):

Compute the gross profit as a percent of sales for each product.

| Types of Products |

Gross Profit (A) |

Sales Revenues (B) |

Gross Profit Percentage |

| Pistons | $99,600 | $240,000 | 41.5% |

| Valves | (104,000) | 273,000 | (38.1)% |

| Cams | 30,200 | 55,000 | 54.9% |

Table (9)

Note: Refer to Table (4) for value and computation of sales revenues.

d.

Discuss the interpretations from the gross profit report.

Explanation of Solution

Of the three products, cams are highly profitable, and pistons are also profitable as well. But valves are at loss. The sales price per unit should be increased or the cost price should be cut down to increase the profitability of valves.

Want to see more full solutions like this?

Chapter 18 Solutions

FINANCIAL & MANAGERIAL ACCW/CENGAGENOWV

- What is the gearing ratio on these financial accounting question?arrow_forwardCost Pools Budgeted Costs Cost Driver Practical Capacity Budgeted Activity for S-101 Budgeted Activity for C-110 Setup activity 250000 Setup hours 5000 2500 2350 Packing and shipping 50000 Number of shipments 2000 1200 775 Inspection 30000 Number of batches 1000 250 700 Machining 750000 Units produced 150000 100000 40000 Purchase ordering 40000 Number of orders 300 50 110 1. Which Cost Pool is approximately 22 percent of the total budgeted costs? 2. What percentage of the total budgeted costs does Machining take up? 3. What is the percentage of the total budgeted costs taken up by the smallest Cost Pool? 4. Which Cost Pool has 1.25 percent slack? 5. Which Cost Pool has the highest percent slack? 6. In the Inspection Cost Pool, what is the amount of difference between budgeted costs and the budgeted activity for both products? 7. In how many cost pools is the S-101 manufacturing overhead (MO) greater than the C-110 manufacturing overhead (MO)? 8. In which Cost Pools is…arrow_forwardFinancial statements for Askew Industries for 2024 are shown below (in thousands): 2024 Income Statement Net sales $ 8,600 Cost of goods sold (6,050) Gross profit 2,550 Operating expenses (1,850) Interest expense (100) Income tax expense (240) Net income $ 360 Comparative Balance Sheets December 31 2024 2023 Assets Cash $ 500 $ 400 Accounts receivable 500 300 Inventory 700 500 Property, plant, and equipment (net) 1,000 1,100 $ 2,700 $ 2,300 Liabilities and Shareholders’ Equity Current liabilities $ 500 $ 250 Bonds payable 900 900 Common stock 500 500 Retained earnings 800 650 $ 2,700 $ 2,300 Calculate the following ratios for 2024. Note: Consider 365 days a year. Round your intermediate calculations and final answers to 2 decimal places.arrow_forward

- What is the firm's weighted average cost of capital?arrow_forwardThe following condensed income statements of the Jackson Holding Company are presented for the two years ended December 31, 2024 and 2023: 2024 2023 Sales revenue $ 15,900,000 $ 10,500,000 Cost of goods sold 9,650,000 6,450,000 Gross profit 6,250,000 4,050,000 Operating expenses 3,560,000 2,960,000 Operating income 2,690,000 1,090,000 Gain on sale of division 690,000 — 3,380,000 1,090,000 Income tax expense 845,000 272,500 Net income $ 2,535,000 $ 817,500 On October 15, 2024, Jackson entered into a tentative agreement to sell the assets of one of its divisions. The division qualifies as a component of an entity as defined by GAAP. The division was sold on December 31, 2024, for $5,270,000. Book value of the division’s assets was $4,580,000. The division’s contribution to Jackson’s operating income before-tax for each year was as follows: 2024 $ 445,000 2023 $ 345,000 Assume an income tax rate of 25%. Required: Note: In each case, net any gain or…arrow_forwardWant to this question answer general Accountingarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College