1.

Determine the amount of central office cost that are allocated to each resort and the shortcomings of the mentioned allocation method.

1.

Explanation of Solution

Calculate the amount of central office cost that is allocated to each resort.

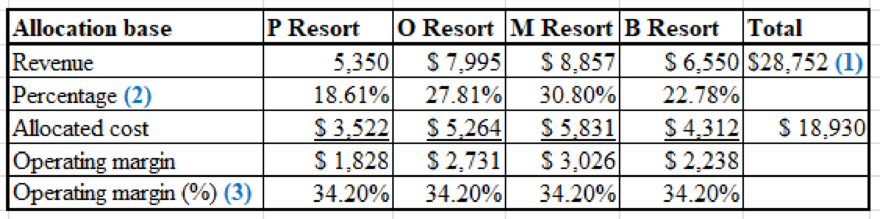

Table (1)

Therefore, the operating margin percentage for all the four resorts is 34.2%.

The short comings of this method of allocation are:

- Various items in the central office costs are not related to revenue for instance, Interests are not related to revenue.

- The cost of front office personnel is related to the number of customers of the resort. The better measure for number of rooms is the cost of front office personnel.

Working notes:

1) Calculate the total revenue:

2) Calculate the percentage allocation of revenue:

For P’s revenue:

For O’s resort:

For M’s resort:

For B’s resort:

3) Calculate the operation margin percentage:

For P’s resort:

For O’s resort:

For M’s resort:

For B’s resort:

2.

Determine the cost that should be collected in each of the pools.

2.

Explanation of Solution

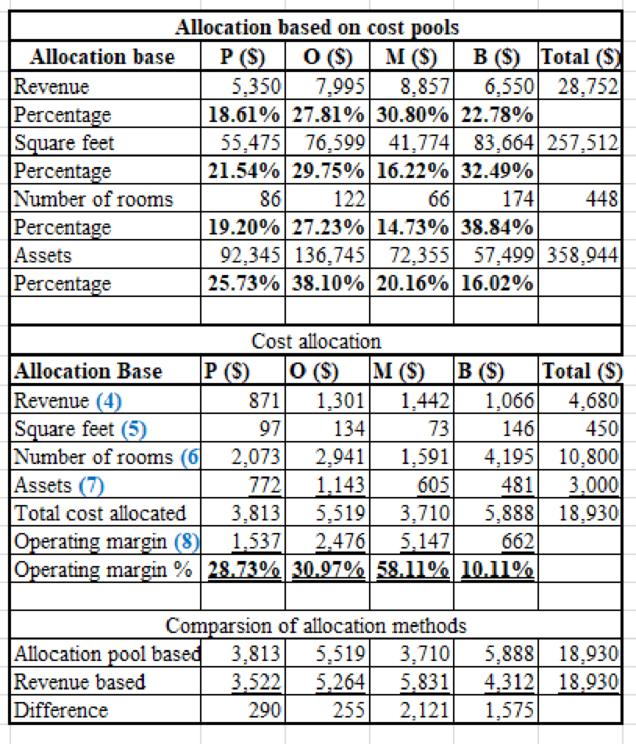

The operating costs are to be allocated the four allocation base of resorts which are revenue, square feet, number of rooms and the value of resort assets. The following are the ways for allocation:

Revenue: The central office costs that are allocated to the revenue are advertising,

Square feet: The central office costs that are allocated to the revenue are carpet cleaning and contract to repaint rooms.

Number of rooms: The central office costs that are allocated to the number of rooms are front office personnel, housekeeping, and room maintenance.

Value of resort’s assets: The central office costs that are allocated to the value of resort assets are interest on resort purchase.

3.

Determine the amount of central office cost that is allocated to each of four resorts.

3.

Explanation of Solution

The allocations for the multiple costs are done in manner which is related to the cause-and-effect relationship of these central office cost. For example, advertising is related to revenue. The allocations that are close will motivate the strategic performance measurement system.

3.

Calculate the cost that should be allocated to each resort.

3.

Explanation of Solution

Calculate the cost that should be allocated to each resort:

Working notes:

Calculate the percentage for revenue:

Likewise it is calculated for all the allocation bases.

4) Calculate the revenue:

For P:

For O:

For M:

For B:

5) Calculate the square feet:

For P:

For O:

For M:

For B:

6) Calculate the number of rooms:

For P:

For O:

For M:

For B:

7) Calculate the assets:

For P:

For O:

For M:

For B:

8) Calculate the operating margin:

For P:

For O:

For M:

For B:

The above calculation show that P has the smaller resort with lesser room rates, whereas M has also small resort but with high room rates, and in case of B it is a big resort with a lower room rate.

The relationships that exist between the revenue and number of rooms, the results shows that the resort P and O’s cost allocation and operating margin are similar. Whereas in case of B, large number of rooms are in B resort so higher cost is allocated with a lower operating margin.

Want to see more full solutions like this?

Chapter 18 Solutions

COST MANAGEMENT (W/CONNECT ACCESS)(LOOS

- I need help finding the correct solution to this financial accounting problem with valid methods.arrow_forwardSouth-western Manufacturing estimates its manufacturing overhead to be $420,000 and its direct labor costs to be $840,000 for year 1. The first three jobs that South-western worked on had actual direct labor costs of $25,000 for Job 101, $32,000 for job 102, and $41,000 for Job 103. For the year, actual manufacturing overhead was $435,000 and total direct labor cost was $870,000. Manufacturing overhead is applied to jobs on the basis of direct labor costs using predetermined rates. How much overhead was assigned to each of the three jobs, 101, 102, and 103?arrow_forwardWhich of the following is an example of an accrual?A) Paying cash for rentB) Recognizing revenue when it is earned, not when it is receivedC) Buying inventory on accountD) Paying for utilities in the month they are consumedarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education