Determine a seasonal index for each of the four quarters.

Find the number of visitors for each quarter of 2017 if 10% increase in the total number of visitors in 2016.

Determine the trend equation.

Project the number of visitors for 2017.

Find the seasonally adjusted forecasts.

Identify the best forecast.

Answer to Problem 31CE

The seasonal indexes for the four quarters are 1.2046, 1.0206, 0.6297 and 01.1451, respectively.

The number of visitors for each quarter of 2017 if 10% increase in the total number of visitors in 2016 is 255.25 visitors per quarter.

The trend equation is

The number of visitors for 2017 are 242.0171, 248.634, 255.2509 and 261.8678.

The seasonally adjusted forecasts are 291.5338, 253.7559, 160.7315 and 299.8648.

The best forecast is the fourth quarter of 2017.

Explanation of Solution

Calculation:

Four-Year moving average:

Centered Moving Average:

Specific seasonal index:

| Year | Quarter | Visitors |

Four-quarter moving average |

Centered Moving average | Specific seasonal |

| 2010 | 1 | 86 | |||

| 2 | 62 | ||||

| 3 | 28 | 70 | 0.4 | ||

| 4 | 94 | 67.5 | 75 | 1.253333 | |

| 2011 | 1 | 106 | 72.5 | 80 | 1.325 |

| 2 | 82 | 77.5 | 85 | 0.964706 | |

| 3 | 48 | 82.5 | 91.75 | 0.523161 | |

| 4 | 114 | 87.5 | 100.75 | 1.131514 | |

| 2012 | 1 | 140 | 96 | 109.75 | 1.275626 |

| 2 | 120 | 105.5 | 119 | 1.008403 | |

| 3 | 82 | 114 | 126.75 | 0.646943 | |

| 4 | 154 | 124 | 132 | 1.166667 | |

| 2013 | 1 | 162 | 129.5 | 136.75 | 1.184644 |

| 2 | 140 | 134.5 | 141.5 | 0.989399 | |

| 3 | 100 | 139 | 147.25 | 0.679117 | |

| 4 | 174 | 144 | 154.5 | 1.126214 | |

| 2014 | 1 | 188 | 150.5 | 162 | 1.160494 |

| 2 | 172 | 158.5 | 168.5 | 1.020772 | |

| 3 | 128 | 165.5 | 174 | 0.735632 | |

| 4 | 198 | 171.5 | 180.25 | 1.098474 | |

| 2015 | 1 | 208 | 176.5 | 187.25 | 1.110814 |

| 2 | 202 | 184 | 193.25 | 1.045278 | |

| 3 | 154 | 190.5 | 200.75 | 0.767123 | |

| 4 | 220 | 196 | 210.25 | 1.046373 | |

| 2016 | 1 | 246 | 205.5 | 219.5 | 1.120729 |

| 2 | 240 | 215 | 228 | 1.052632 | |

| 3 | 190 | 224 | |||

| 4 | 252 | 232 |

The Quarterly indexes are,

| I | II | III | IV | |

| 2010 | 0.4 | 1.253333 | ||

| 2011 | 1.325 | 0.964706 | 0.523161 | 1.131514 |

| 2012 | 1.275626 | 1.008403 | 0.646943 | 1.166667 |

| 2013 | 1.184644 | 0.989399 | 0.679117 | 1.126214 |

| 2014 | 1.160494 | 1.020772 | 0.735632 | 1.098474 |

| 2015 | 1.110814 | 1.045278 | 0.767123 | 1.046373 |

| 2016 | 1.120729 | 1.052632 | ||

| Mean | 1.1962 | 1.0135 | 0.6253 | 1.1371 |

Seasonal index:

Here,

Therefore,

The seasonal indexes are,

| I | II | III | IV | |

| 2010 | 0.4 | 1.253333 | ||

| 2011 | 1.325 | 0.964706 | 0.523161 | 1.131514 |

| 2012 | 1.275626 | 1.008403 | 0.646943 | 1.166667 |

| 2013 | 1.184644 | 0.989399 | 0.679117 | 1.126214 |

| 2014 | 1.160494 | 1.020772 | 0.735632 | 1.098474 |

| 2015 | 1.110814 | 1.045278 | 0.767123 | 1.046373 |

| 2016 | 1.120729 | 1.052632 | ||

| Mean | 1.1962 | 1.0135 | 0.6253 | 1.1371 |

| Seasonal Index |

The total number of visitors in year 2016 is

The 10% of 928 visitors is

The number of visitors in 2017 is

Therefore, the number of visitors in each quarter of 2017 is

Trend Equation:

Step-by-step procedure to obtain the regression using the Excel:

- Enter the data for Year, Visitors and t in Excel sheet.

- Go to Data Menu.

- Click on Data Analysis.

- Select ‘Regression’ and click on ‘OK’

- Select the column of Visitors under ‘Input Y Range’.

- Select the column of t under ‘Input X Range’.

- Click on ‘OK’.

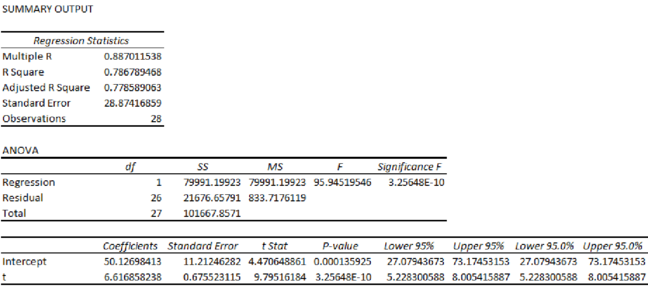

Output for the Regression obtained using the Excel is as follows:

From the output, the regression equation is

Projection of the number of visitors for 2017:

The t value for first quarter of 2017 is 29.

The t value for second quarter of 2017 is 30.

The t value for third quarter of 2017 is 31.

The t value for third quarter of 2017 is 32.

Seasonally Adjusted Forecast:

| Estimated Visitors | Seasonal Index | |

| 242.0171 | 1.2046 | 291.5338 |

| 248.634 | 1.0206 | 253.7559 |

| 255.2509 | 0.6297 | 160.7315 |

| 261.8678 | 1.1451 | 299.8648 |

The seasonal index for the fourth quarter is high compared with remaining three quarters. Hence, the forecast for the fourth quarter is best.

Want to see more full solutions like this?

Chapter 18 Solutions

Loose Leaf for Statistical Techniques in Business and Economics

- Questions An insurance company's cumulative incurred claims for the last 5 accident years are given in the following table: Development Year Accident Year 0 2018 1 2 3 4 245 267 274 289 292 2019 255 276 288 294 2020 265 283 292 2021 263 278 2022 271 It can be assumed that claims are fully run off after 4 years. The premiums received for each year are: Accident Year Premium 2018 306 2019 312 2020 318 2021 326 2022 330 You do not need to make any allowance for inflation. 1. (a) Calculate the reserve at the end of 2022 using the basic chain ladder method. (b) Calculate the reserve at the end of 2022 using the Bornhuetter-Ferguson method. 2. Comment on the differences in the reserves produced by the methods in Part 1.arrow_forwardA population that is uniformly distributed between a=0and b=10 is given in sample sizes 50( ), 100( ), 250( ), and 500( ). Find the sample mean and the sample standard deviations for the given data. Compare your results to the average of means for a sample of size 10, and use the empirical rules to analyze the sampling error. For each sample, also find the standard error of the mean using formula given below. Standard Error of the Mean =sigma/Root Complete the following table with the results from the sampling experiment. (Round to four decimal places as needed.) Sample Size Average of 8 Sample Means Standard Deviation of 8 Sample Means Standard Error 50 100 250 500arrow_forwardA survey of 250250 young professionals found that two dash thirdstwo-thirds of them use their cell phones primarily for e-mail. Can you conclude statistically that the population proportion who use cell phones primarily for e-mail is less than 0.720.72? Use a 95% confidence interval. Question content area bottom Part 1 The 95% confidence interval is left bracket nothing comma nothing right bracket0.60820.6082, 0.72510.7251. As 0.720.72 is within the limits of the confidence interval, we cannot conclude that the population proportion is less than 0.720.72. (Use ascending order. Round to four decimal places as needed.)arrow_forward

- I need help with this problem and an explanation of the solution for the image described below. (Statistics: Engineering Probabilities)arrow_forwardA survey of 250 young professionals found that two-thirds of them use their cell phones primarily for e-mail. Can you conclude statistically that the population proportion who use cell phones primarily for e-mail is less than 0.72? Use a 95% confidence interval. Question content area bottom Part 1 The 95% confidence interval is [ ], [ ] As 0.72 is ▼ above the upper limit within the limits below the lower limit of the confidence interval, we ▼ can cannot conclude that the population proportion is less than 0.72. (Use ascending order. Round to four decimal places as needed.)arrow_forwardI need help with this problem and an explanation of the solution for the image described below. (Statistics: Engineering Probabilities)arrow_forward

- I need help with this problem and an explanation of the solution for the image described below. (Statistics: Engineering Probabilities)arrow_forwardI need help with this problem and an explanation of the solution for the image described below. (Statistics: Engineering Probabilities)arrow_forwardQuestions An insurance company's cumulative incurred claims for the last 5 accident years are given in the following table: Development Year Accident Year 0 2018 1 2 3 4 245 267 274 289 292 2019 255 276 288 294 2020 265 283 292 2021 263 278 2022 271 It can be assumed that claims are fully run off after 4 years. The premiums received for each year are: Accident Year Premium 2018 306 2019 312 2020 318 2021 326 2022 330 You do not need to make any allowance for inflation. 1. (a) Calculate the reserve at the end of 2022 using the basic chain ladder method. (b) Calculate the reserve at the end of 2022 using the Bornhuetter-Ferguson method. 2. Comment on the differences in the reserves produced by the methods in Part 1.arrow_forward

- Questions An insurance company's cumulative incurred claims for the last 5 accident years are given in the following table: Development Year Accident Year 0 2018 1 2 3 4 245 267 274 289 292 2019 255 276 288 294 2020 265 283 292 2021 263 278 2022 271 It can be assumed that claims are fully run off after 4 years. The premiums received for each year are: Accident Year Premium 2018 306 2019 312 2020 318 2021 326 2022 330 You do not need to make any allowance for inflation. 1. (a) Calculate the reserve at the end of 2022 using the basic chain ladder method. (b) Calculate the reserve at the end of 2022 using the Bornhuetter-Ferguson method. 2. Comment on the differences in the reserves produced by the methods in Part 1.arrow_forwardFrom a sample of 26 graduate students, the mean number of months of work experience prior to entering an MBA program was 34.67. The national standard deviation is known to be18 months. What is a 90% confidence interval for the population mean? Question content area bottom Part 1 A 9090% confidence interval for the population mean is left bracket nothing comma nothing right bracketenter your response here,enter your response here. (Use ascending order. Round to two decimal places as needed.)arrow_forwardA test consists of 10 questions made of 5 answers with only one correct answer. To pass the test, a student must answer at least 8 questions correctly. (a) If a student guesses on each question, what is the probability that the student passes the test? (b) Find the mean and standard deviation of the number of correct answers. (c) Is it unusual for a student to pass the test by guessing? Explain.arrow_forward

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL Trigonometry (MindTap Course List)TrigonometryISBN:9781305652224Author:Charles P. McKeague, Mark D. TurnerPublisher:Cengage Learning

Trigonometry (MindTap Course List)TrigonometryISBN:9781305652224Author:Charles P. McKeague, Mark D. TurnerPublisher:Cengage Learning Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt

Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt College Algebra (MindTap Course List)AlgebraISBN:9781305652231Author:R. David Gustafson, Jeff HughesPublisher:Cengage Learning

College Algebra (MindTap Course List)AlgebraISBN:9781305652231Author:R. David Gustafson, Jeff HughesPublisher:Cengage Learning