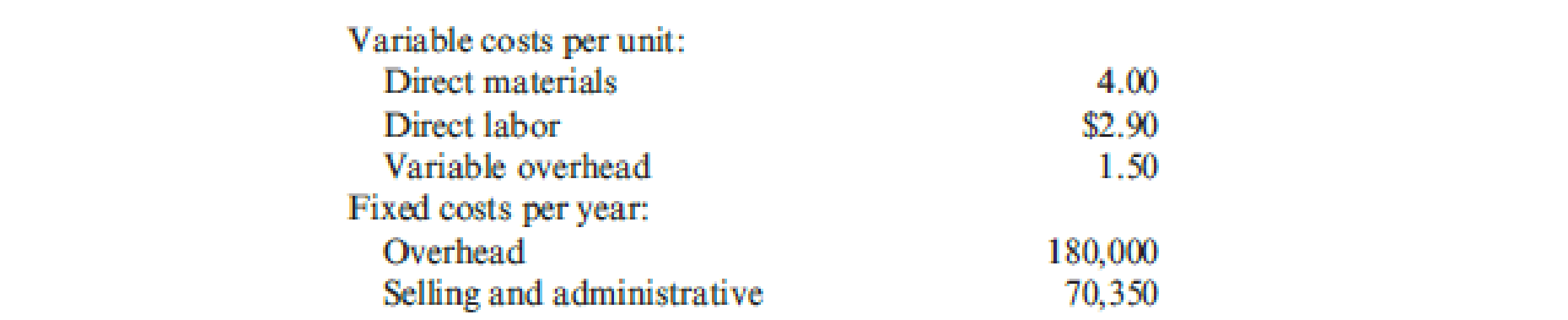

Jellison Company had the following operating data for its first two years of operations:

Jellison produced 90,000 units in the first year and sold 80,000. In the second year, it produced 80,000 units and sold 90,000 units. The selling price per unit each year was $12. Jellison uses an actual costing system for product costing.

Required:

- 1. Prepare income statements for both years using absorption costing. Has firm performance, as measured by income, improved or declined from Year 1 to Year 2?

- 2. Prepare income statements for both years using variable costing. Has firm performance, as measured by income, improved or declined from Year 1 to Year 2?

- 3. Which method do you think most accurately measures firm performance? Why?

1.

Prepare income statement for both years using absorption costing and explain whether the firm performance has improved or declined.

Explanation of Solution

Absorption costing income statement: It is one of the important types of income statement, in which the cost of goods sold are deducted from the revenue, company’s contribution margin will get. Net income can be calculated by deducting total selling and administrative expenses from the contribution margin of the company.

Prepare and income statement using absorption costing for Year 1 ad Year 2:

| Company J | ||

| Absorption Costing income statement | ||

| For Year 1 and Year 2 | ||

| Particulars | Year 1 | Year 2 |

| Sales | $960,000 | $1,080,000 |

| Less: Cost of goods sold (3) | ($832,000) | ($956,000) |

| Gross profit | $128,000 | $124,000 |

| Less: Selling and administrative expenses | ($70,350) | ($70,350) |

| Operating income | $57,650 | $53,650 |

Table (1)

Note: The units sold in Year 1 and Year 2 is 80,000 and 90,000 respectively.

From table (1), the operating income for Year 1 and Year 2 is $57,650 and $53,650 respectively. Hence, the firm performance has declined in Year 2 from Year 1.

Working note 1: Determine the cost of goods manufactured for Year 1 and Year 2:

| Computation of cost of goods manufactured | ||

| Particulars | Year 1 | Year 2 |

| Units produced (A) | 90,000 | 80,000 |

| Direct materials | $4.00 | $4.00 |

| Direct labor | $2.90 | $2.90 |

| Variable overhead | $1.50 | $1.50 |

| Fixed overhead | $2.00 | $2.25 |

| Total cost (B) | $10.40 | $10.65 |

| Cost of goods manufactured | $936,000 | $852,000 |

Table (2)

Working note 2: Calculate the ending inventory for Year 1:

Working note 3: Determine the total cost of goods sold for Year 1 and Year 2:

| Computation of cost of goods sold | ||

| Particulars | Year 1 | Year 2 |

| Beginning inventory | $0 | $104,000 |

| Add: Cost of goods manufactured (1) | $936,000 | $852,000 |

| Goods available for sale | $936,000 | $956,000 |

| Less: Ending inventory (2) | ($104,000) | $0 |

| Cost of goods sold | $832,000 | $956,000 |

Table (3)

2.

Prepare income statement for both years using variable costing and explain whether the firm performance has improved or declined.

Explanation of Solution

Variable costing income statement: It is one of the important types of income statement, in which the entire variable costs are deducted from the revenue and the company’s contribution margin would be determined. Deducting all the fixed expenses from the contribution margin would result in company’s net income.

Prepare an income statement using variable costing:

| Company J | ||

| Variable Costing income statement | ||

| For Year 1 and Year 2 | ||

| Particulars | Year 1 | Year 2 |

| Sales | $960,000 | $1,080,000 |

| Less: Variable cost of goods sold (6) | ($672,000) | ($756,000) |

| Contribution margin | $288,000 | $324,000 |

| Less: | ||

| Fixed overhead | ($180,000) | ($180,000) |

| Fixed selling and administrative expenses | ($70,350) | ($70,350) |

| Operating income | $37,650 | $73,650 |

Table (4)

Note: The units sold in Year 1 and Year 2 is 80,000 and 90,000 respectively.

From table (4), the operating income for Year 1 and Year 2 is $37,650 and $73,650 respectively. Hence, the firm performance has improved in Year 2 from Year 1.

Working note 4: Determine the variable cost of goods manufactured for Year 1 and Year 2:

| Computation of variable cost of goods manufactured | ||

| Particulars | Year 1 | Year 2 |

| Units produced (A) | 90,000 | 80,000 |

| Direct materials | $4.00 | $4.00 |

| Direct labor | $2.90 | $2.90 |

| Variable overhead | $1.50 | $1.50 |

| Total cost (B) | $8.40 | $8.40 |

| Cost of goods manufactured | $756,000 | $672,000 |

Table (5)

Working note 5: Calculate the ending inventory for Year 1:

Working note 6: Determine the variable cost of goods sold for Year 1 and Year 2:

| Computation of cost of goods sold | ||

| Particulars | Year 1 | Year 2 |

| Beginning inventory | $0 | $84,000 |

| Add: Variable cost of goods manufactured (4) | $756,000 | $672,000 |

| Goods available for sale | $756,000 | $756,000 |

| Less: Ending inventory (5) | ($84,000) | $0 |

| Variable Cost of goods sold | $672,000 | $756,000 |

Table (6)

3.

Identify the method that evaluates the performances accurately and explain the same.

Explanation of Solution

The costs remaining the same, the sales have also increased. The operating income has increased under variable costing due to the absence of fixed costs in ending inventory cost. On the other hand, the operating income has decreased under absorption costing as the fixed costs in ending inventory cost have been included. Therefore, variable costing is better and evaluates the performances accurately reflecting the economic performance

Want to see more full solutions like this?

Chapter 18 Solutions

Bundle: Cornerstones of Cost Management, Loose-Leaf Version, 4th + CengageNOWv2, 1 term Printed Access Card

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub