Concept explainers

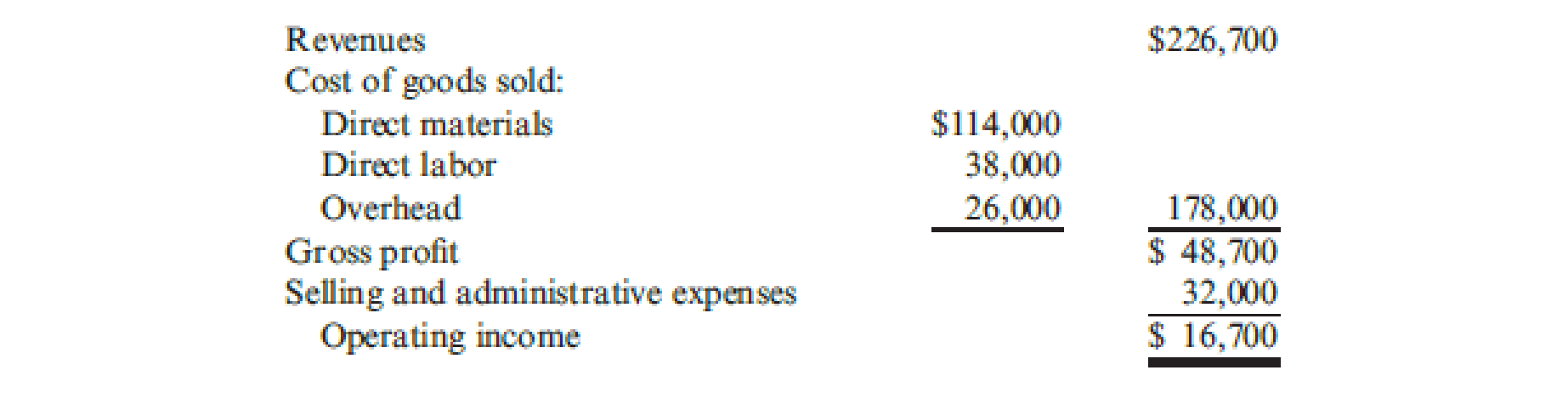

Ventana Window and Wall Treatments Company provides draperies, shades, and various window treatments. Ventana works with the customer to design the appropriate window treatment, places the order, and installs the finished product. Direct materials and direct labor costs are easy to trace to the jobs. Ventana’s income statement for last year is as follows:

Ventana wants to find a markup on cost of goods sold that will allow them to earn about the same amount of profit on each job as was earned last year.

Required:

- 1. What is the markup on cost of goods sold (COGS) that will maintain the same profit as last year? (Round the percentage to two significant digits.)

- 2. A customer orders draperies and shades for a remodeling job. The job will have the following costs:

What is the price that Ventana will quote given the markup percentage calculated in Requirement 1? (Round the price to the nearest dollar.)

- 3. What if Ventana wants to calculate a markup on direct materials cost, since it is the largest cost of doing business? What is the markup on direct materials cost that will maintain the same profit as last year? (Round the percentage to two significant digits.) What is the bid price Ventana will use for the job given in Requirement 2 if the markup percentage is calculated on the basis of direct materials cost? (Round to the nearest dollar.)

Trending nowThis is a popular solution!

Chapter 18 Solutions

Bundle: Cornerstones of Cost Management, Loose-Leaf Version, 4th + CengageNOWv2, 1 term Printed Access Card

- Determine the direct materials purchasesarrow_forwardThe Refining Department of Sunny Syrup, Inc. had 85,000 tons of syrup to account for in August. Of the 85,000 tons, 55,000 tons were completed and transferred to the Bottling Department, and the remaining 30,000 tons were 60% complete. The materials required for production are added at the beginning of the process. Conversion costs are added equally throughout the refining process. Calculate the total equivalent units of production for direct materials.arrow_forwardTata company uses predetermined overhead ratearrow_forward

- A company applies overhead to products based on standard direct labor hours allowed for actual output. The following data is provided: • Total budgeted fixed overhead cost for the year = $500,000 • Actual fixed overhead cost for the year = $495,000 • Budgeted standard direct labor hours (denominator level of activity) = 60,000 • Actual direct labor hours = 62,000 • Standard direct labor hours allowed for actual output = 58,000 A. Compute the fixed portion of the predetermined overhead rate. B. Compute the fixed overhead budget and volume variances.arrow_forwardWhat is the activity variance for fuel costs?arrow_forwardi need correct optionarrow_forward

- Provide correct answer general accounting questionarrow_forwardRichardson Industries has budgeted total factory overhead for the year at $710,000, divided into two departments: Cutting ($500,000) and Finishing ($210,000). Richardson manufactures two products: dining tables and chairs. Each dining table requires 4 direct labor hours in Cutting and 2 direct labor hours in Finishing. Each chair requires 3 direct labor hours in Cutting and 4 direct labor hours in Finishing. Each product is budgeted for 3,500 units of production for the year. Determine the total number of budgeted direct labor hours for the year in the Finishing Department.arrow_forwardA company applies overhead based on standard direct labor hours. The following data is available: 1. Total budgeted fixed overhead cost for the year = $450,000 2. Actual fixed overhead cost for the year = $460,000 3. Budgeted standard direct labor hours (denominator level of activity) = 55,000 4. Actual direct labor hours = 57,000 5. Standard direct labor hours allowed for actual output = 52,000 Required: A. Compute the fixed portion of the predetermined overhead rate. B. Compute the fixed overhead budget and volume variances.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning