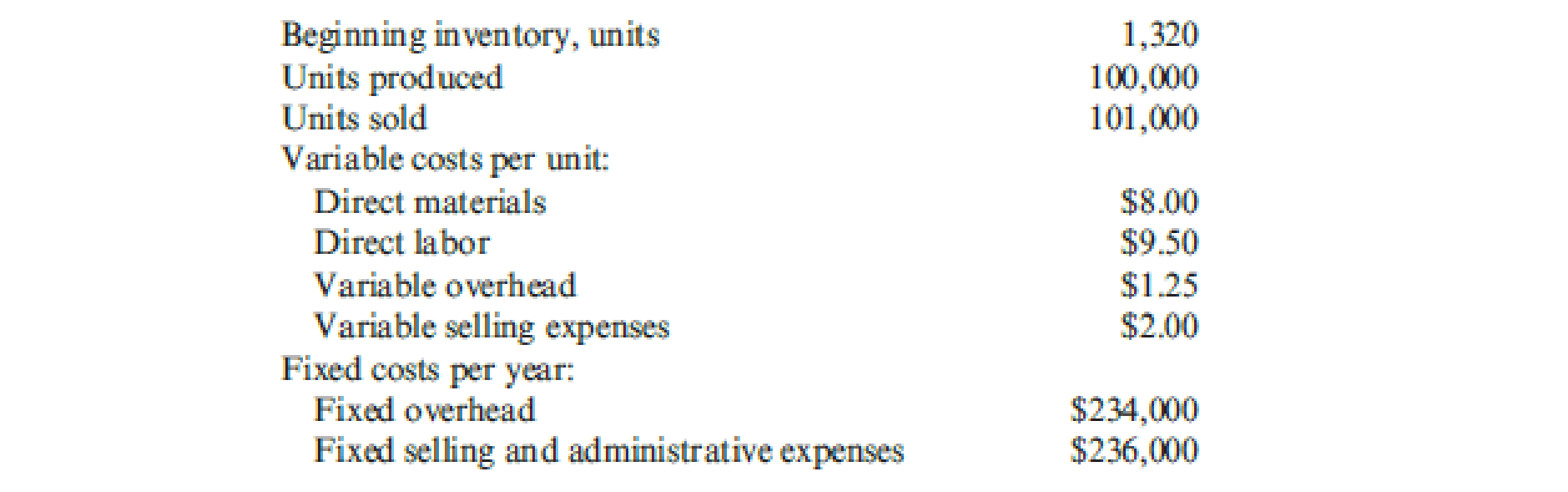

The following information pertains to Vladamir, Inc., for last year:

There are no work-in-process inventories. Normal activity is 100,000 units. Expected and actual

Required:

- 1. How many units are in ending inventory?

- 2. Without preparing an income statement, indicate what the difference will be between variable-costing income and absorption-costing income.

- 3. Assume the selling price per unit is $29. Prepare an income statement using (a) variable costing and (b) absorption costing.

1.

Determine the units of ending inventory.

Explanation of Solution

Determine the units of ending inventory:

| Particulars | Units |

| Beginning inventory | 1,320 |

| Add: Units produced | 100,000 |

| 101,320 | |

| Less: Units sold | (101,000) |

| Ending inventory | 320 |

Table (1)

Thus, the ending inventory is 320 units.

2.

Determine the difference between variable costing income and absorption costing income without preparing income statement.

Explanation of Solution

Variable Costing: The variable costing is the method of costing in which only the variable production costs such as the direct material, direct cost, and variable overhead costs are included in that time period in which they are incurred.

Absorption Costing: Absorption costing is a method for calculating the full cost or total cost of a single product in production process. It includes the total cost assigned to products.

Determine the difference between variable costing income and absorption costing income:

Thus, the difference between variable costing income and absorption costing income is ($2,340).

Working note 1: Calculate the fixed overhead rate:

3 (a).

Prepare an income statement using variable costing.

Explanation of Solution

Variable costing income statement: It is one of the important types of income statement, in which the entire variable costs are deducted from the revenue and the company’s contribution margin would be determined. Deducting all the fixed expenses from the contribution margin would result in company’s net income.

Prepare an income statement using variable costing:

| Incorporation V | |

| Variable Costing income statement | |

| For last year | |

| Particulars | Amount |

| Sales | $2,929,000 |

| Less: Variable expenses: | |

| Variable cost of goods sold | ($1,893,750) |

| Variable selling expenses | ($202,000) |

| Contribution margin | $833,250 |

| Less: Fixed expenses: | |

| Fixed overhead | ($234,000) |

| Fixed selling and administrative expenses | ($236,000) |

| Operating income | $363,250 |

Table (2)

Therefore, the operating income under variable costing is $363,250.

Working note 2: Determine the total cost of goods sold per unit:

3 (b).

Prepare an income statement using absorption costing.

Explanation of Solution

Absorption costing income statement: It is one of the important types of income statement, in which the cost of goods sold are deducted from the revenue, company’s contribution margin will get. Net income can be calculated by deducting total selling and administrative expenses from the contribution margin of the company.

Prepare and income statement using absorption costing:

| Incorporation V | |

| Absorption Costing income statement | |

| For last year | |

| Particulars | Amount |

| Sales | $2,929,000 |

| Less: Cost of goods sold | ($2,130,090) |

| Gross profit | $798,910 |

| Less: Selling and administrative expenses (4) | ($438,000) |

| Operating income | $360,910 |

Table (3)

Hence, the operating income under absorption costing is $360,910.

Working note 3: Determine the total cost of goods sold per unit:

Working note 4: Determine the total selling and administrative expenses:

Want to see more full solutions like this?

Chapter 18 Solutions

EBK CORNERSTONES OF COST MANAGEMENT

- Department A had 4,700 units in work in process that were 75% completed as to labor and overhead at the beginning of the period, 32,600 units of direct materials were added during the period, 35,100 units were completed during the period, and 2,200 units were 26% completed as to labor and overhead at the end of the period. All materials are added at the beginning of the process. The first-in, first-out method is used to cost inventories.The number of equivalent units of production for material costs for the period was a. 35,100 b. 37,300 c. 30,400 d. 32,600arrow_forwardWhat is the gross profit margin?arrow_forwardPlease give me true answer this financial accounting questionarrow_forward

- Marvin Company is a subsidiary of Hughes Corp. The controller believes that the yearly allowance for doubtful accounts for Marvin should be 8% of gross accounts receivable. Given the recession and the high interest rate environment, the president, nervous that the parent company might expect the subsidiary company to sustain its 10% growth rate, suggests that the controller increase the allowance for doubtful accounts to 9%. The president thinks that the lower net income, which reflects a 6% growth rate, will be a more sustainable rate for Marvin Company. On the basis of the case above: In a recessionary environment with tight credit and high interest rates, What steps Marvin Company might consider to improve the accounts receivable situation? Evaluate each step identified in terms of the risks and costs involved. Should the controller be concerned with Marvin Company's growth rate in estimating the allowance? Does the president's request pose an ethical dilemma for the controller?…arrow_forwardPlease provide answer this financial accounting questionarrow_forwardFinancial Accountingarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegePrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegePrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning